Food, Beverage and Labor Cost Controls

advertisement

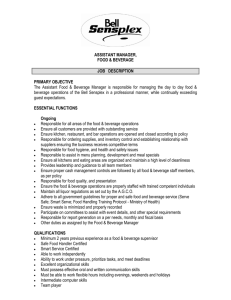

Chapter 1 Cost and Sales Concepts Principles of Food, Beverage, and Labour Cost Controls, Canadian Edition Learning Objectives • After reading this chapter, you should be able to: • 1.1 Define costs and provide an example of the following types of costs: fixed, variable, directly variable, semivariable, controllable, noncontrollable, unit, total, prime, historical, and planned. • 1.2 Define sales and provide several examples illustrating monetary and nonmonetary sales concepts. • 1.3 Describe the significance of cost-to-sales relationships and identify several cost-to-sales ratios and the formulas used to compute cost percent and sales price. • 1.4 Describe factors that cause industry-wide variations in cost percents. • 1.5 Explain the value of comparing current cost-to-sales ratios with those for previous periods. Important Concepts • Sales: the amount of dollars you take in. • Expenses: the costs of the items required to operate the business. • Profit: the amount of dollars that remain after all expenses have been paid. Sales - Expenses = Profit Cost Concepts • There are four costs a Food Service Manager must concern themselves with. • Food costs are the costs associated with actually producing the menu items. In most cases, food costs will make up the largest or second largest expense category you must learn to manage. Costs • Beverage costs are those related to the sale of alcoholic beverages. Costs of a non-alcoholic nature are considered an expense in the Food Costs category. Alcoholic beverages accounted for in the Beverage Costs category include beer, wine, and liquor. It may also include the costs of ingredients necessary to produce these drinks, such as cherries, lemons, olives, limes, mixers like carbonated beverages and juices, and other items commonly used in the production and service of alcoholic beverages. Costs • Labour costs include the cost of all employees necessary to run the business, including taxes and benefits. In most operations, labour costs are second only to food costs in total dollars spent. • Overhead costs include all expenses that are neither food, beverage nor labour, such as utilities, rent, linen, etc. • Good managers learn to understand, control, and manage their expenses. Numbers can be difficult to interpret due to inflation. Therefore, the industry uses percentage calculations. • Percentages are the most common standard used for evaluating costs in the foodservice industry. • Food Cost = Food Cost % • Food Sales • Beverage Cost = Beverage Cost % • Beverage Sales • Labour Costs = Labour Cost % • Total Sales • Percent (%) means “out of each hundred.” • There are three (3) ways to write a percent: • Common Form • In its common form, the "%" sign is used to express the percentage, as in 10%. • Fraction Form • In fraction form, the percent is expressed as the part, or a portion of 100, as in 10/100. • Decimal Form • The decimal form uses the (.) or decimal point to express the percent relationship, as in 0.10. • Fixed costs are those unaffected by changes in sales volume. • Variable costs are related to business volume, every increase or decrease in cost. • Semivariable costs have both fixed and variable elements. • Controllable costs are those that can be changed in the short term. Variable costs are normally controllable. • Noncontrollable costs are those that cannot normally be changed in the short term. These are usually fixed costs. • Unit costs may be food or beverage portions or units of work. • Total costs may be the total cost of labour for one period. • Prime cost is the sum of food costs, beverage costs, and labour costs (salaries and wages, plus employee benefits). • Historical costs can be found in business records, books of account, and other similar records. • Planned costs are projections of what costs will be or should be for a future period. • Monetary terms include total sales and may be given by category (such as total food sales or total beverage sales), by server, or by seat (total dollar sales for a given time period divided by the number of seats in the restaurant). • Other monetary terms include sales price, average sale, average cheque (the result of dividing total dollar sales by the number of sales or customers), and average sales per server. • Nonmonetary terms include total number sold (such as number of steaks sold in a given time period) and covers (one diner). Total covers refers to the total number of customers served in a given period. • Other nonmonetary terms include seat turnover (the number of seats occupied during a given period divided by the number of seats) and sales mix (a term that describes the relative quantity sold of any menu item compared to other items in the same category). • A simplified statement that details revenue, expenses and profit, for a given period of time, is called the Income Statement. It lists revenue, food and beverage cost, labour cost, other expense, and profit. • The income statement is important because it describes the efficiency and profitability of an operation. • Put in another format, the equation looks as follows: Revenue (100%) - Food & Beverage Cost % - Labour Cost % - Overhead Cost % = Profit % • The primary purpose of preparing an income statement is to identify revenue, expenses, and profits for a given time period. 1. Food and Beverage Cost Revenue = Food & Beverage Cost % 2. Labour Cost Revenue = Labour Cost % 3. Overhead Cost Revenue = Overhead Cost % 4. Profit Revenue = Profit % Simplified Profit and Loss • • • • • Sales Food Cost Labour Cost Overhead Profit 349,725 100% 33% 29% % 7% Key Terms • • • • • • • • • • • • • • • • • Average cheque, p. 18 Average number of covers, p. 20 Average sale, p. 18 Average sale per server, p. 19 Controllable costs, p. 13 Cost, p. 10 Cost per dollar of sale, p. 22 Cost percent, p. 20 Cover, p. 20 Directly variable costs, p. 12 Fixed costs, p. 11 Historical costs, p. 15 Labour costs, p. 12 Noncontrollable costs, p. 13 Overhead, p. 25 Planned costs, p. 15 Prime costs, p. 14 • • • • • • • • • • • • • Sales, p. 16 Sales mix, p. 21 Sales price, p. 17 Seat turnover, p. 20 Semivariable costs, p. 12 Total costs, p. 13 Total covers, p. 20 Total dollar sales by category, p. 16 Total number sold, p. 14 Total sales, p. 16 Total sales per seat, p. 17 Total sales per server, p. 16 Unit costs, p. 13 • Variable costs, p. 12 Chapter Web Links • Food Marketing Institute: www.fmi.org • Canadian Restaurant and Foodservices Association: www.crfa.com Copyright