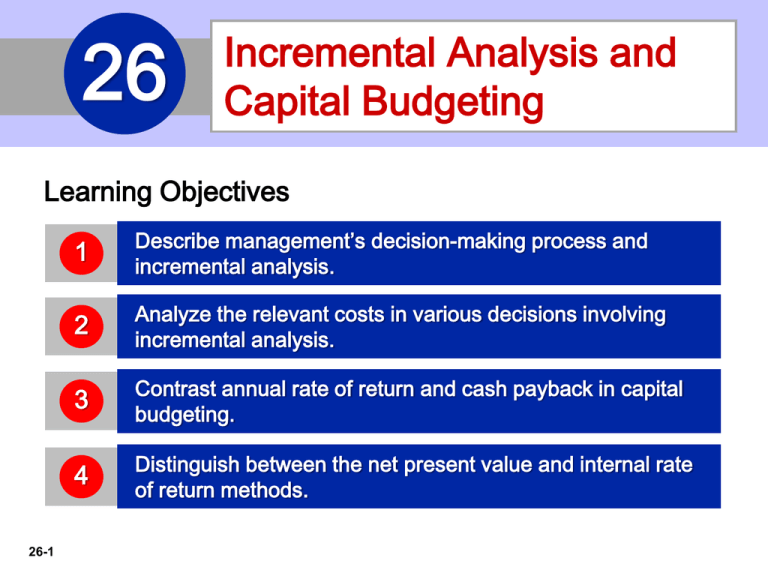

26

Incremental Analysis and

Capital Budgeting

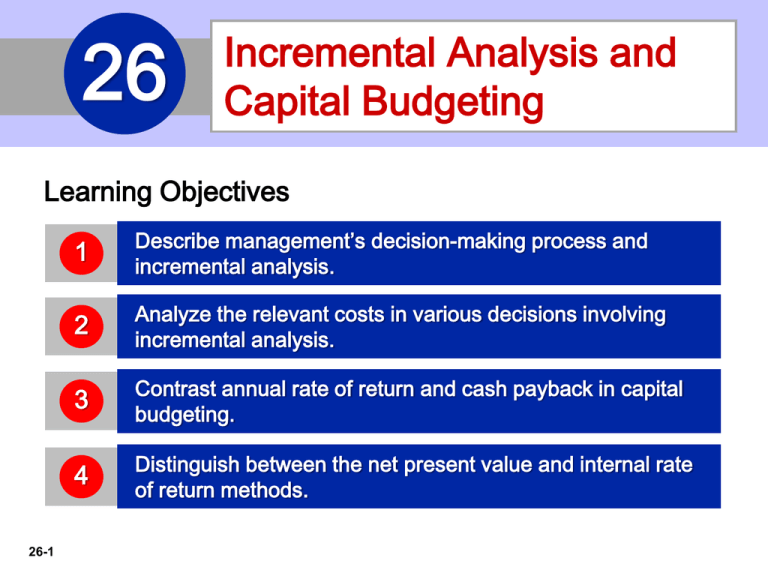

Learning Objectives

26-1

1

Describe management’s decision-making process and

incremental analysis.

2

Analyze the relevant costs in various decisions involving

incremental analysis.

3

Contrast annual rate of return and cash payback in capital

budgeting.

4

Distinguish between the net present value and internal rate

of return methods.

LEARNING

OBJECTIVE

1

Describe management’s decision-making process

and incremental analysis.

Making decisions is an important management function.

Does not always follow a set pattern.

Decisions vary in scope, urgency, and importance.

Steps usually involved in process include:

Illustration 26-1

Management’s decision-making process

26-2

LO 1

Decision-Making Process

In making business decisions,

Considers both financial and non-financial information.

Financial information

26-3

►

Revenues and costs, and

►

Effect on overall profitability.

Nonfinancial information

►

Effect on employee turnover

►

The environment

►

Overall company image.

LO 1

Incremental Analysis Approach

26-4

Decisions involve a choice among alternative actions.

Process used to identify the financial data that change

under alternative courses of action.

►

Both costs and revenues may vary or

►

Only revenues may vary or

►

Only costs may vary

LO 1

How Incremental Analysis Works

Illustration 26-2

Basic approach in incremental analysis

Alternative B

26-5

Incremental revenue is $15,000 less.

Incremental cost savings of $20,000 is realized.

Produces $5,000 more net income.

LO 1

How Incremental Analysis Works

Important concepts used in incremental analysis:

26-6

Relevant cost

Opportunity cost

Sunk cost

LO 1

How Incremental Analysis Works

26-7

Sometimes involves changes that seem contrary to

intuition.

Variable costs sometimes do not change under

alternatives.

Fixed costs sometimes change between alternatives.

LO 1

Service Company Insight

American Express

That Letter from AmEx Might Not Be a Bill

No doubt every one of you has received an invitation from a

credit card company to open a new account—some of you have

probably received three in one day. But how many of you have

received an offer of $300 to close out your credit card account?

American Express decided to offer some of its customers $300 if

they would give back their credit card. You could receive the

$300 even if you hadn’t paid off your balance yet, as long as you

agreed to give up your credit card.

Source: Aparajita Saha-Bubna and Lauren Pollock, “AmEx Offers Some

Holders $300 to Pay and Leave,” Wall Street Journal Online (February

23, 2009).

26-8

LO 1

Types of Incremental Analysis

Common types of decisions involving incremental analysis:

1. Accept an order at a special price.

2. Make or buy component parts or finished products.

3. Sell or process further them further.

4. Repair, retain, or replace equipment.

5. Eliminate an unprofitable business segment or product.

26-9

LO 1

Incremental Analysis

Question

Incremental analysis is the process of identifying the financial

data that

a. Do not change under alternative courses of action.

b. Change under alternative courses of action.

c. Are mixed under alternative courses of action.

d. None of the above.

26-10

LO 1

DO IT! 1

Incremental Analysis

Owen T Corporation is comparing two different options. The

company currently follows Option 1, with revenues of $80,000 per

year, maintenance expenses of $5,000 per year, and operating

expenses of $38,000 per year. Option 2 provides revenues of

$80,000 per year, maintenance expenses of $12,000 per year, and

operating expenses of $32,000 per year. Option 1 employs a piece

of equipment that was upgraded 2 years ago at a cost of $22,000. If

Option 2 is chosen, it will free up resources that will increase

revenues by $3,000.

Complete the following table to show the change in income from

choosing Option 2 versus Option 1. Designate any sunk costs with

an “S.”

26-11

LO 1

The company currently follows Option 1, with revenues of $80,000

per year, maintenance expenses of $5,000 per year, and operating

expenses of $38,000 per year. Option 2 provides revenues of

$80,000 per year, maintenance expenses of $12,000 per year, and

operating expenses of $32,000 per year. Option 1 employs a piece

of equipment that was upgraded 2 years ago at a cost of $22,000. If

Option 2 is chosen, it will free up resources that will increase

revenues by $3,000.

26-12

LO 1

LEARNING

OBJECTIVE

2

Analyze the relevant costs in various decisions

involving incremental analysis.

Special Price Order

26-13

Obtain additional business by making a major price

concession to a specific customer.

Assumes that sales of products in other markets are

not affected by special order.

Assumes that company is not operating at full capacity.

LO 2

Accept an Order at a Special Price

Illustration: Sunbelt Company produces 100,000 Smoothie

blenders per month, which is 80% of plant capacity. Variable

manufacturing costs are $8 per unit. Fixed manufacturing costs are

$400,000, or $4 per unit. The blenders are normally sold directly to

retailers at $20 each. Sunbelt has an offer from Kensington Co. (a

foreign wholesaler) to purchase an additional 2,000 blenders at

$11 per unit. Acceptance of the offer would not affect normal sales

of the product, and the additional units can be manufactured

without increasing plant capacity. What should management do?

26-14

LO 2

Accept an Order at a Special Price

Illustration 26-4

Incremental analysis—accepting

an order at a special price

Fixed costs do not change since within existing capacity – thus fixed

costs are not relevant.

Variable manufacturing costs and expected revenues change – thus

both are relevant to the decision.

26-15

LO 2

DO IT!

2a

Special Orders

Cobb Company incurs costs of $28 per unit ($18 variable and $10

fixed) to make a product that normally sells for $42. A foreign

wholesaler offers to buy 5,000 units at $25 each. Cobb will incur

additional shipping costs of $1 per unit. Compute the increase or

decrease in net income Cobb will realize by accepting the special

order, assuming Cobb has excess operating capacity. Should Cobb

Company accept the special order?

Accept

or

Reject?

26-16

LO 2

Make or Buy

Illustration: Baron Company incurs the following annual costs in

producing 25,000 ignition switches for motor scooters.

Illustration 26-5

Annual product

cost data

Instead of making its own switches, Baron Company might purchase

the ignition switches at a price of $8 per unit. If purchased, $10,000 of

the fixed costs will be eliminated. “What should management do?”

26-17

LO 2

Make or Buy

Illustration 26-6

Incremental analysis—

make or buy

Total manufacturing cost is $1 higher per unit than purchase price.

Must absorb at least $50,000 of fixed costs under either option.

26-18

LO 2

OPPORTUNITY COST

The potential benefit that

may be obtained from

following an alternative

course of action.

26-19

LO 2

OPPORTUNITY COST

Illustration: Assume that through buying the switches, Baron

Company can use the released productive capacity to generate

additional income of $38,000 from producing a different product.

This lost income is an additional cost of continuing to make the

switches in the make-or-buy decision.

26-20

Illustration 26-7

Incremental analysis—make or

buy, with opportunity cost

LO 2

Make or Buy

Question

In a make-or-buy decision, relevant costs are:

a. Manufacturing costs that will be saved.

b. The purchase price of the units.

c. Opportunity costs.

d. All of the above.

26-21

LO 2

Service Company Insight

Amazon.com

Giving Away the Store?

In an earlier chapter, we discussed Amazon.com’s incredible growth. However,

some analysts have questioned whether some of the methods that Amazon

uses to increase its sales make good business sense. For example, a few years

ago, Amazon initiated a “Prime” free-shipping subscription program. For a $79

fee per year, Amazon’s customers get free shipping on as many goods as they

want to buy. At the time, CEO Jeff Bezos promised that the program would be

costly in the short-term but benefit the company in the long-term. Six years later,

it was true that Amazon’s sales had grown considerably. It was also estimated

that its Prime customers buy two to three times as much as non-Prime

customers. But, its shipping costs rose from 2.8% of sales to 4% of sales, which

is remarkably similar to the drop in its gross margin from 24% to 22.3%.

Perhaps even less easy to justify is a proposal by Mr. Bezos to start providing a

free Internet movie-streaming service to Amazon’s Prime customers. Perhaps

some incremental analysis is in order?

Source: Martin Peers, “Amazon’s Prime Numbers,” Wall Street Journal Online (February

3, 2011).

26-22

LO 2

DO IT!

2b

Make or Buy

Juanita Company must decide whether to make or buy some of its

components for the appliances it produces. The costs of producing

166,000 electrical cords for its appliances are as follows.

Direct materials

Direct labor

$90,000

20,000

Variable overhead

Fixed overhead

$32,000

24,000

Instead of making the electrical cords at an average cost per unit of

$1.00 ($166,000 ÷ 166,000), the company has an opportunity to buy the

cords at $0.90 per unit. If the company purchases the cords, all variable

costs and one-fourth of the fixed costs will be eliminated.

(a) Prepare an incremental analysis showing whether the company

should make or buy the electrical cords. (b) Will your answer be different

if the released productive capacity will generate additional income of

$5,000?

26-23

LO 2

DO IT!

2b

Make or Buy

(a) Prepare an incremental analysis showing whether the company

should make or buy the electrical cords.

*$24,000 x .75

**166,000 units x $0.90

Juanita Company will incur $1,400 of additional costs if it buys the

electrical cords rather than making them.

26-24

LO 2

DO IT!

2b

Make or Buy

(b) Will your answer be different if the released productive capacity

will generate additional income of $5,000?

Yes, net income will be increased by $3,600 if Juanita Company

purchases the electrical cords rather than making them.

26-25

LO 2

Sell or Process Further

May have option to sell product at a given point in

production or to process further and sell at a higher

price.

Decision Rule:

Process further as long as the incremental revenue from

such processing exceeds the incremental processing

costs.

26-26

LO 2

Sell or Process Further

Illustration: Woodmasters Inc. makes tables. The cost to

manufacture an unfinished table is $35. The selling price per

unfinished unit is $50. Woodmasters has unused capacity that

can be used to finish the tables and sell them at $60 per unit. For

a finished table, direct materials will increase $2 and direct labor

costs will increase $4. Variable manufacturing overhead costs will

increase by $2.40 (60% of direct labor). No increase is

anticipated in fixed manufacturing overhead.

Illustration 26-8

Per unit cost of

unfinished table

26-27

LO 2

Sell or Process Further

The incremental analysis on a per unit basis is as follows.

Illustration 26-9

Incremental analysis—

sell or process further

26-28

Should Woodmasters sell or process further?

further.

LO 2

Sell or Process Further

Question

The decision rule in a sell-or-process-further decision is:

Process further as long as the incremental revenue from

processing exceeds:

a. Incremental processing costs.

b. Variable processing costs.

c. Fixed processing costs.

d. No correct answer is given.

26-29

LO 2

DO IT!

2c

Sell or Process Further

Easy Does It manufactures unpainted furniture for the do-it-yourself

(DIY) market. It currently sells a child’s rocking chair for $25. Production

costs are $12 variable and $8 fixed. Easy Does It is considering painting

the rocking chair and selling it for $35. Variable costs to paint each chair

are expected to be $9, and fixed costs are expected to be $2.Prepare an

analysis showing whether Easy Does It should sell unpainted or painted

chairs.

Solution

26-30

LO 2

Repair, Retain, or Replace Equipment

Illustration: Jeffcoat Company is considering replacing a factory

machine with a new machine. Jeffcoat Company has a factory

machine that originally cost $110,000. It has a balance in

Accumulated Depreciation of $70,000, so its book value is $40,000. It

has a remaining useful life of four years. The company is considering

replacing this machine with a new machine. A new machine is

available that costs $120,000. It is expected to have zero salvage

value at the end of its four-year useful life. If the new machine is

acquired, variable manufacturing costs are expected to decrease from

$160,000 to $125,000 and the old unit could be sold for $5,000. The

incremental analysis for the four-year period is as follows.

26-31

LO 2

Repair, Retain, or Replace Equipment

Prepare the incremental analysis for the four-year period.

Illustration 26-10

26-32

Retain or Replace?

LO 2

Repair, Retain, or Replace Equipment

Additional Considerations

26-33

The book value of old machine does not affect the decision.

►

Book value is a sunk cost.

►

Costs which cannot be changed by future decisions (sunk

cost) are not relevant in incremental analysis.

However, any trade-in allowance or cash disposal value of

the existing asset is relevant.

LO 2

DO IT!

2d

Repair or Replace Equipment

Rochester Roofing is faced with a decision. The company relies very

heavily on the use of its 60-foot extension lift for work on large homes

and commercial properties. Last year, the company spent $60,000

refurbishing the lift. It has just determined that another $40,000 of repair

work is required. Alternatively, Rochester Roofing has found a newer

used lift that is for sale for $170,000. The company estimates that both

the old and new lifts would have useful lives of 6 years. However, the lift

is more efficient and thus would reduce operating expenses by about

$20,000 per year. The company could also rent out the new lift for about

$2,000 per year. The old lift is not suitable for rental. The old lift could

currently be sold for $25,000 if the new lift is purchased.

Prepare an incremental analysis that shows whether the company

should repair or replace the equipment.

26-34

LO 2

DO IT!

2d

Repair or Replace Equipment

Solution

The analysis indicates that purchasing the new machine would

increase net income for the 6-year period by $27,000.

26-35

LO 2

Eliminate an Unprofitable Segment or

Product

26-36

Key: Focus on Relevant Costs.

Consider effect on related product lines.

Fixed costs allocated to the unprofitable segment must be

absorbed by the other segments.

Net income may decrease when an unprofitable segment

is eliminated.

Decision Rule: Retain the segment unless fixed costs

eliminated exceed contribution margin lost.

LO 2

Eliminate an Unprofitable Segment or

Product

Illustration: Venus Company manufactures three models of tennis

rackets:

Profitable lines: Pro and Master

Unprofitable line: Champ

Should Champ

be eliminated?

Illustration 26-11

Segment income data

26-37

LO 2

Eliminate an Unprofitable Segment or

Product

Prepare income data after eliminating Champ product line. Assume

fixed costs are allocated 2/3 to Pro and 1/3 to Master.

Illustration 26-12

Income data after eliminating

unprofitable product line

26-38

Total income is decreased by $10,000.

LO 2

Eliminate an Unprofitable Segment or

Product

Incremental analysis of Champ provided the same results:

Do Not Eliminate Champ

26-39

Illustration 26-13

Incremental analysis—eliminating unprofitable

segment with no reduction in fixed costs

LO 2

Unprofitable Segments

Question

If an unprofitable segment is eliminated:

a. Net income will always increase.

b. Variable expenses of the eliminated segment will have to

be absorbed by other segments.

c. Fixed expenses allocated to the eliminated segment will

have to be absorbed by other segments.

d. Net income will always decrease.

26-40

LO 2

DO IT!

2e

Unprofitable Segments

Lambert, Inc. manufactures several types of accessories. For the

year, the knit hats and scarves line had sales of $400,000, variable

expenses of $310,000, and fixed expenses of $120,000. Therefore,

the knit hats and scarves line had a net loss of $30,000. If Lambert

eliminates the knit hats and scarves line, $20,000 of fixed costs will

remain. Prepare an analysis showing whether the company should

eliminate the knit hats and scarves line.

26-41

LO 2

LEARNING

OBJECTIVE

3

Contrast annual rate of return and cash payback

in capital budgeting.

Capital Budgeting is the process of making capital

expenditure decisions in business.

Amount of possible capital expenditures usually exceeds

the funds available for such expenditures.

Involves choosing among various capital projects to find

the one(s) that will maximize a company’s return on

investment.

26-42

LO 3

Evaluation Process

Many companies follow a carefully prescribed process in

capital budgeting.

Illustration 26-14

Corporate capital budget

authorization process

26-43

LO 3

Evaluation Process

Providing management with relevant data for capital

budgeting decisions requires familiarity with quantitative

techniques.

Most common techniques are:

1. Annual Rate of Return

2. Cash Payback

3. Discounted Cash Flow

26-44

LO 3

Annual Rate of Return

Indicates the profitability of a capital expenditure by dividing

expected annual net income by the average investment.

Illustration 26-16

Annual rate of return formula

26-45

LO 3

Annual Rate of Return

Illustration: Reno Company is considering an investment of

$130,000 in new equipment. The new equipment is expected to

last 5 years. It will have zero salvage value at the end of its useful

life. Reno uses the straight-line method of depreciation for

accounting purposes. The expected annual revenues and costs of

the new product that will be produced from the investment are:

26-46

Illustration 26-16

Annual rate of return formula

LO 3

Annual Rate of Return

Computing Average Investment

130,000 + 0

2

Expected annual

rate of return

$13,000

$65,000

Illustration 26-20

Formula for computing

average investment

= $65,000

= 20%

A project is acceptable if its rate of return is greater than

management’s required rate of return.

26-47

LO 3

Annual Rate of Return

Principal advantages:

Simplicity of calculation.

Management’s familiarity with the accounting terms used in

the computation.

Major limitation:

Does not consider the

time value of money.

26-48

LO 3

DO IT!

3a

Annual Rate of Return

Watertown Paper Corporation is considering adding another machine for the

manufacture of corrugated cardboard. The machine would cost $900,000. It

would have an estimated life of 6 years and no salvage value. The company

estimates that annual revenue would increase by $400,000 and that annual

expenses excluding depreciation would increase by $190,000. It uses the

straight-line method to compute depreciation expense. Management has a

required rate of return of 9%. Compute the annual rate of return.

26-49

Advance slide in presentation mode to reveal answer.

LO 3

Cash Payback

Cash payback technique identifies the time period required to

recover the cost of the capital investment from the net annual

cash inflow produced by the investment.

Illustration 26-19

Computation of net annual

cash flow

Illustration 26-18

Cash payback formula

$130,000

26-50

÷

$39,000

=

3.3 years

LO 3

Cash Payback

The shorter the payback period, the more attractive the

investment.

In the case of uneven net annual cash flows, the company

determines the cash payback period when the cumulative net

cash flows from the investment equal the cost of the

investment.

26-51

LO 3

Cash Payback

Illustration: Chen Company proposes an investment in a new

website that is estimated to cost $300,000.

Illustration 26-20

Net annual cash flow

schedule

Cash payback should not be the only basis for capital budgeting

decision as it ignores expected profitability of the project.

26-52

LO 3

Management Insight

Verizon

Can You Hear Me—Better?

What’s better than 3G wireless service? 4G. But the question for

wireless service providers is whether customers will be willing to pay

extra for that improvement. Verizon has spent billions on upgrading

its networks in the past few years, so it now offers 4G LTE service to

97% of the nation. Verizon is hoping that its investment in 4G works

out better than its $23 billion investment in its FIOS fiber-wired

network for TV and ultrahigh-speed Internet. One analyst estimates

that the present value of each FIOS customer is $800 less than the

cost of the connection.

Sources: Martin Peers, “Investors: Beware Verizon’s Generation GAP,”

Wall Street Journal Online (January 26, 2010); and Chad Fraser, “What

Warren Buffett Sees in Verizon,” Investing Daily(May 30, 2014).

26-53

LO 3

DO IT!

3b

Cash Payback Period

Watertown Paper Corporation is considering adding another machine

for the manufacture of corrugated cardboard. The machine would

cost $900,000. It would have an estimated life of 6 years and no

salvage value. The company estimates that annual cash inflows

would increase by $400,000 and that annual cash outflows would

increase by $190,000. Compute the cash payback period.

26-54

LO 3

Cash Payback

Question

A $100,000 investment with a zero scrap value has an 8-year

life. Compute the payback period if straight-line depreciation

is used and net income is determined to be $20,000.

a. 8.00 years.

b. 3.08 years.

c. 5.00 years.

d. 13.33 years.

26-55

LO 3

LEARNING

OBJECTIVE

4

Distinguish between the net present value and

internal rate of return methods.

Discounted Cash Flow

Generally recognized as the best conceptual approach.

Considers both the estimated total net cash flows from

the investment and the time value of money.

26-56

Two methods:

►

Net present value.

►

Internal rate of return.

LO 4

Net Present Value Method

Net cash flows are discounted to their present value and

then compared with the capital outlay required by the

investment.

Interest rate used in discounting is the required minimum

rate of return.

26-57

Proposal is acceptable when NPV is zero or positive.

The higher the positive NPV, the more attractive the

investment.

LO 4

Net Present

Value Method

Illustration 26-21

Net present value

decision criteria

A proposal is

acceptable when net

present value is zero

or positive.

26-58

LO 4

Net Present Value Method

EQUAL NET ANNUAL CASH FLOWS

Illustration: Reno Company’s net annual cash flows are $39,000.

If we assume this amount is uniform over the asset’s useful life,

we can compute the present value of the net annual cash flows.

Illustration 26-22

Calculate the net present value.

26-59

LO 4

Net Present Value Method

EQUAL NET ANNUAL CASH FLOWS

Illustration: Calculate the net present value.

Illustration 26-23

The proposed capital expenditure is acceptable at a required rate of

return of 12% because the net present value is positive.

26-60

LO 4

Net Present Value Method

UNEQUAL NET ANNUAL CASH FLOWS

Illustration: Reno Company management expects the same

aggregate net annual cash flow ($195,000) over the life of the

investment. But because of a declining market demand for the

new product over the life of the equipment, the net annual cash

flows are higher in the early years and lower in the later years.

26-61

LO 4

Net Present Value Method

UNEQUAL NET ANNUAL CASH FLOWS

Illustration 26-24

Computing present value of

unequal annual cash flows

26-62

LO 4

Net Present Value Method

UNEQUAL NET ANNUAL CASH FLOWS

Illustration: Calculate the net present value.

Illustration 26-25

Analysis of proposal using net

present value method

The proposed capital expenditure is acceptable at a required rate of

return of 12% because the net present value is positive.

26-63

LO 4

Management Insight

Sharp

Wide-Screen Capacity

Building a new factory to produce 60-inch TV screens can cost $4

billion. But for more than 10 years, manufacturers of these screens

have continued to build new plants. By building so many plants, they

have expanded productive capacity at a rate that has exceeded the

demand for big-screen TVs. In fact, during one recent year, the

supply of big-screen TVs was estimated to exceed demand by 12%,

rising to 16% in the future. One state-of-the-art plant built by Sharp

was estimated to be operating at only 50% of capacity. Experts say

that the price of big-screen TVs will have to fall much further than

they already have before demand may eventually catch up with

productive capacity.

Source: James Simms, “Sharp’s Payoff Delayed,” Wall Street Journal

Online (September 14, 2010).

26-64

LO 4

Internal Rate of Return Method

26-65

IRR method finds the interest yield of the potential

investment.

IRR is the rate that will cause the PV of the proposed

capital expenditure to equal the PV of the expected

annual cash inflows.

Two steps in method:

►

Compute the internal rate of return factor.

►

Use the factor and the PV of an annuity of 1 table to find

the IRR.

LO 4

Internal Rate of Return Method

Step 1. Compute the internal rate of return factor.

Illustration 26-26

For Reno Company:

$130,000

26-66

÷

$39,000

=

3.3333

LO 4

Internal Rate of Return Method

Step 2. Use the factor and the present value of an annuity of 1

table to find the internal rate of return.

Assume a required rate of return for Reno of 10%.

Decision Rule: Accept the project when the IRR is equal to or

greater than the required rate of return.

26-67

LO 4

Internal Rate of Return Method

26-68

Illustration 26-27

Internal rate of return

decision criteria

LO 4

Comparing Discounted Cash Flow Method

Illustration 26-28

Comparison of discounted

cash flow methods

26-69

LO 4

Discounted Cash Flow

Question

A positive net present value means that the:

a. Project’s rate of return is less than the cutoff rate.

b. Project’s rate of return exceeds the required rate of

return.

c. Project’s rate of return equals the required rate of return.

d. Project is unacceptable.

26-70

LO 4

DO IT! 4

Discounted Cash Flow

Watertown Paper Corporation is considering adding another machine

for the manufacture of corrugated cardboard. The machine would cost

$900,000. It would have an estimated life of 6 years and no salvage

value. The company estimates that annual revenues would increase

by $400,000 and that annual expenses excluding depreciation would

increase by $190,000. Management has a required rate of return of

9%.

(a) Calculate the net present value on this project.

(b) Calculate the internal rate of return on this project, and discuss

whether it should be accepted.

26-71

LO 4

DO IT! 4

Discounted Cash Flow

(a) Calculate the net present value on this project.

Watertown should accept the project.

26-72

LO 4

DO IT! 4

Discounted Cash Flow

(b) Calculate the internal rate of return on this project, and discuss

whether it should be accepted.

$900,000 ÷ 210,000 = 4.285714.

Since the project has an internal rate that is greater than 10% and the

required rate of return is only 9%, Watertown should accept the project.

26-73

LO 4

Copyright

“Copyright © 2015 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Copyright Act without the

express written permission of the copyright owner is unlawful. Request

for further information should be addressed to the Permissions

Department, John Wiley & Sons, Inc. The purchaser may make backup copies for his/her own use only and not for distribution or resale.

The Publisher assumes no responsibility for errors, omissions, or

damages, caused by the use of these programs or from the use of the

information contained herein.”

26-74