CIMA Professional Development Record Form

advertisement

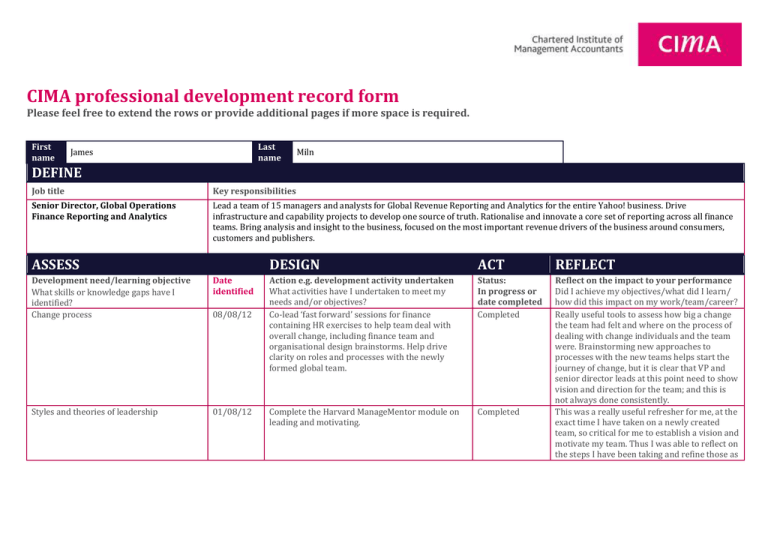

CIMA professional development record form Please feel free to extend the rows or provide additional pages if more space is required. First name Last name James Miln DEFINE Job title Key responsibilities Senior Director, Global Operations Finance Reporting and Analytics Lead a team of 15 managers and analysts for Global Revenue Reporting and Analytics for the entire Yahoo! business. Drive infrastructure and capability projects to develop one source of truth. Rationalise and innovate a core set of reporting across all finance teams. Bring analysis and insight to the business, focused on the most important revenue drivers of the business around consumers, customers and publishers. ASSESS Development need/learning objective What skills or knowledge gaps have I identified? Change process Date identified Styles and theories of leadership 01/08/12 08/08/12 DESIGN ACT REFLECT Action e.g. development activity undertaken What activities have I undertaken to meet my needs and/or objectives? Co-lead ‘fast forward’ sessions for finance containing HR exercises to help team deal with overall change, including finance team and organisational design brainstorms. Help drive clarity on roles and processes with the newly formed global team. Status: In progress or date completed Completed Complete the Harvard ManageMentor module on leading and motivating. Completed Reflect on the impact to your performance Did I achieve my objectives/what did I learn/ how did this impact on my work/team/career? Really useful tools to assess how big a change the team had felt and where on the process of dealing with change individuals and the team were. Brainstorming new approaches to processes with the new teams helps start the journey of change, but it is clear that VP and senior director leads at this point need to show vision and direction for the team; and this is not always done consistently. This was a really useful refresher for me, at the exact time I have taken on a newly created team, so critical for me to establish a vision and motivate my team. Thus I was able to reflect on the steps I have been taking and refine those as Developments in the profession 19/11/12 Read the Corporate Executive Board article – ‘A new era of finance transformation’. Completed Finance challenger 20/11/12 Completed Technology management 20/11/12 Attend the finance challenger boot camp. This was about how finance teams need to go beyond the partnership role and create constructive tension. This tension requires teaching, learning, influencing and ultimately advising in a way that helps the business reframe the problem and arrive at better solutions. It was a good day of role play and tools based on best practices from real companies. Attend CEB session: drafting the finance technology blueprint - delivering technology to support return, by focusing on data standardisation, end-user education and alignment with business goals. Completed I go into the final quarter of the year. I think the description of leadership styles is a great framework for me to gather feedback on myself and my managers. The concept of holding environment is new to me, but highly relevant to helping my team deal with the stress of change – both through high expectations we set ourselves, as well as managing new customers and partners across the company. This was a great overview of the important argument that finance needs to move beyond back office to strategic, from slow to fast, from rules to judgment; while real barriers in competency, skill and behaviour remain. I am very familiar with these arguments and believe I have demonstrated them strongly in my career, but there was good material here to use with my own team and organisation to continue to present that message strongly. A great overview of drivers and skills to be not just a finance partner but challenger. More than for myself, this arms me with material to help my team to: enhance their critical thinking skills; learn to operate strategically; communicate and influence effectively; and apply finance skills to business problems. A good framework of governance and technology to help think through guiding best technology return. Practical approach to get superior returns through 1) data standardisation; 2) end user education; 3) alignment with tangible strategic business goals. Benchmarking and performance indicators 01/08/12 Read the Project Management Journal’s Dec 2010 article ‘Measuring portfolio strategic performance using key performance indicators’. Completed Performance management tools including balanced scorecard and all its variations 01/08/12 Read FM’s Jul/Aug 2010 article ‘Technical matters: strategic management’. Completed Alternative approaches to measuring performance including both quantitative and non-quantitative approaches and covering all stakeholders. 01/08/12 Read Accountancy Review’s May 2010 article ‘Which performance measures do investors around the world value the most and why?’ Completed Finance clearly focuses on the quantifiable measures of a project and portfolio, but in times of change, internal or external, it can be difficult to model. Often business leads lead about how ‘strategic’ a project is, but this can be loose. The structure here of key benefits and objectives linked to strategy is a framework to apply to strategic criteria used in our business across portfolios of projects. Very interesting application of costing to the BSC model, to get at a more strategic assessment of resource allocation. The detail of activities tracked (350) and the need to get to time allocation requires strong management, and I can use this example to add to my own experience in this area for future applications. This is a thorough piece of analysis on the linkage of financial measures to stock returns, and I don’t think it surprising that no single performance measure dominates and that it is more important that the underlying attribute ties to operational cash flows. I thought it a bit surprising that sales were a comparative poor indicator. And more surprising that the smoother, more predictable and more persistent the measure, the less useful – but they do not seem to offer any reason why that should be the case. It just confirms to me that we should always strive to have financial accounting measures as transparent as possible, and that they allow stakeholders to ask the right questions. Alternative approaches to measuring performance including both quantitative and non-quantitative approaches and covering all stakeholders. 01/08/12 Read ‘Return on equity: a popular, but flawed measure of corporate financial performance’. Completed Alternative approaches to measuring performance including both quantitative and non-quantitative approaches and covering all stakeholders. 01/08/12 Read ‘Does measuring intangibles for management purposes improve performance?’ Completed I was not surprised that there is not a strong link over the short term, but was surprised at how weak the linkage seems to be, even over longer periods of time. It goes to show that we must value a company from the inside and the outside using a combination of financial and non-financial measures. The financial ratio route is a very valuable tool and framework, but the real world is a long way from the theory of the classroom, where limited variables change in business scenarios. It did make me laugh though when it confirmed history is not a good indicator of performance, but future expectations are. Seemed an obvious point to me. I absolutely believe that long term performance of a company is significantly impacted by many tangible factors – strategy, people, systems, processes. This can be at its most extreme in silicon valley. I also think that this paper shows what is probably to be expected, that it’s very hard to measure the connection to performance. The company specific studies seem to be the most convincing area of linking the two. Despite the lack of hard evidence, I think it demonstrates clearly enough the importance of strategic alignment in a company, from executives through the ranks. Finance skills sets 20/11/12 Performance management tools including balanced scorecard and all its variations 01/08/12 CEB session: between governance and guidance: building the right finance skill set for your company. Developing skilled financial analysts who not only govern the business but guide it, through recruitment, coaching and performance management. Read Harvard Business Review’s Jan/Feb 2010 article ‘Managing alliances with the balanced scorecard’. Completed Very good framing of the importance of business partnering and decision support to use with my teams, and very useful real case approaches to recruitment, coaching and performance management to develop a team with the right balance of competencies. Completed I thought this a very powerful example of the balanced scorecard approach, because it is about two independent parties working together on a common set of goals and measures. The really powerful action is where this allows the parties to ‘talk candidly about difficulties, resolve disputes and share information’. EVALUATE I verify that this record is a true reflection of my development needs identified through the CPD cycle and undertaken over the past 12 months. I confirm that I will take forward any relevant outstanding development needs to the next CPD cycle.