Competitive Advantage

advertisement

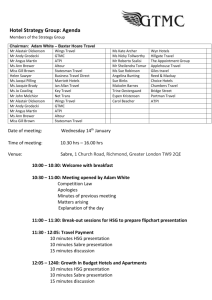

MIS 480 GROUP PRESENTATION Using Information Technology for Competitive Advantage Jolanta Zadlo & Gary Gray IT as a Competitive Weapon IT and Competitive Advantage Sustainability of Competitive Advantage Case Studies Sabre GE Conclusion Definition: Information Technology Information Technology (IT) is the amalgamation of hardware, software, data, people and procedures that enables or inhibits business objectives depending on management’s involvement in IT. Source: Why General Managers Need to Understand Information Technology, lecture notes, Lacity, 2002 How the information revolution affects competition Changes industry structure thereby altering the rules of competition Creates competitive advantage by giving new ways to outperform rivals Spawns whole new businesses Source: How information gives you competitive advantage, Porter and Millar, 1985 How IT creates a competitive advantage Differentiate a product or service Improve business processes (lower costs) Change a business structure Create new business Source: IS 480 lecture notes, Lacity, 2002 Competitive advantage comes from critical differentiators Critical Useful Critical Commodities Useful Commodities Critical Differentiators Eliminate/Migrate Commodity Source: IS 480 lecture notes, Lacity, 2002 Differentiator IT as a Competitive Weapon Sustainability Very few companies sustain their competitive edge over the long term Sustainability occurs when it is difficult or impossible for the competition to respond “IT as a Basis for Sustainable Competitive Advantage,” Feeny & Ives IT as a Competitive Weapon Sustainability IT Resources-Easily Duplicated • Capital for investment • Proprietary technology • Technical Skills “IT as a Basis for Sustainable Competitive Advantage,” Feeny & Ives IT as a Competitive Weapon Sustainability IT Resources-NOT Easily Duplicated Managerial IT Skills • Understanding business needs • Collaborating with colleagues • Managing market & technical risk of innovation “IT as a Basis for Sustainable Competitive Advantage,” Feeny & Ives IT as a Competitive Weapon Sustainability Sustainable Advantage 1. How long before a competitor responds? Supply Project2. Life-Which competitors Competitorcan/will respond? System cycle Analysis Analysis Analysis 3. Will the response be effective? Lead Time Competitive Asymmetry “IT as a Basis for Sustainable Competitive Advantage,” Feeny & Ives Pre-emption Potential IT as a Competitive Weapon Sustainability 3 Pillars Supporting Sustainable Advantage • Lead Time • Information leaks • Followers take short cuts • Followers implement better solutions • Competitor Analysis (Difficulty of competitor to respond or copy application) • Supply system analysis • Market capture • Switching costs Case studies selected: AmericanAirlines General Electric Company Sabre Holdings Corporation Current Company Background S&P Fortune 500 Company $2.1B in revenues in 2001 TSG – “The Sabre Group” Traded on the NYSE – 1996 Current Price – about $21 Headquarters – Dallas/Fort Worth, TX Source: www.sabre.com Sabre Holdings Corporation Current Company Background 7,000 employees in 45 countries Sabre connects more than 60,000 travel agency locations worldwide, providing content for 400 airlines (complete flight data, seat maps, etc) , 55,000 hotel properties (room availability, type, price), 52 car rental companies, nine cruise lines, 33 railroads and 229 tour operators. Source: www.sabre.com Sabre Holdings Corporation Financial Data Revenues in Billions Earnings in Millions $2.5 $350 $300 $2.0 $250 $1.5 $200 $150 $1.0 $100 $0.5 $50 $0.0 $0 1997 1998 1999 2000 2001 1997 1998 1999 2000 2001 Revenues from operations declined 19% in 2001 due to 9/11 events and lower US and worldwide travel volumes, but were more than compensated for by revenue from outsourcing to EDS, profits did not fare as well. Source: Sabre’s 2001 Summary Annual Report Sabre Holdings Corporation Financial Picture 2001 Revenues by Business GetThere 2% Airline Solutions 9% Travelocity 11% Travel Marketing & Distribution 78% Source: Sabre’s 2001 Summary Annual Report Sabre Holdings Corporation Information Technology Both Carol Kelly, Senior VP and CIO, and Craig Murphy, Senior VP and CTO report to the CEO Sabre outsourced its mainframe and data center to EDS. However, Sabre has retained a sizeable investment in IT. Source: Interview of Jim Menge, VP Technology Sales, Sabre What is Sabre SemiAutomatic Business Research Environment Source: Computerworld, Technology Takes Flight, Sep 2002 IT to Improve Business Processes: American Airlines developed Sabre to automate the process of reserving airline seats. Source: Computerworld, Technology Takes Flight, 9/02 American Airlines: improves a business process 1959 – American Airlines (AA) and IBM sign a contract for the joint development of a real-time reservation system that combines in a centralized electronic unit, 2 basic reservation records – the passenger name record (PNR) and the seat inventory. AA spends $150M on the development of the system. Sabre was based upon technology created by MIT for DOD. Source: Data Management, Sep 1981 & Computerworld Mar 1999 American Airlines: improves a business process AA’s reservation process used a system based on computer cards and teletypes and required the efforts of 12 people, at least 15 steps and up to 3 hours to record a roundtrip reservation. The error rate was 8%. Sabre reduced costs and the error rate. Source: www.sabre.com American Airlines: improves a business process 1960 – American Airlines (AA) installed the first Sabre system, a computer reservation system (CRS). Represented stateof-the-art technology and processed 84,000 calls per day. Research, development and installation cost $40 million with an investment of 400 man-years of effort. Source: www.sabre.com American Airlines: improves a business process 1964 – AA completes cutover to Sabre with a coast to coast network in the US. Sabre is the largest, private real-time data processing system. Source: www.sabre.com Competitive Edge Competitive advantage from process change Source: www.sabre.com Competitive Edge AA saved 30% of its investment in staff alone Sabre delivers an error rate of less than 1% Sabre creates a competitive edge that lasts for 5 to 7 years Source: www.sabre.com Competitive Edge Other CRS providers today: Apollo – rolled out by United in 1976 Worldspan – Delta, Northwest and TWA Amadeus – largest foreign owned CRS Sabre continues as the industry leader today Worldspan is the only airline owned CRS Source: www.sabre.com and BTMC records Sabre System History – 1970s 1972 – Sabre system upgraded to IBM 360s 1976 – Sabre system first installation in a travel agency – by year end 130 locations and captured about 86% of the market United Airlines introduces Apollo 1978 – Sabre stores 1M fares Source: www.sabre.com Sabre System History – 1980s 1981 – Sabre has a slight market share advantage over Apollo The competitive edge has all but disappeared 1981 – AA introduces the first airline frequent flyer program 1984 – Sabre introduces low-fare search engine – a service unmatched in the industry Sources: Business Week, Aug 1982, Direct Marketing, Jul 1983 and www.sabre.com Sabre System History – 1980s 1985 – AA allows travel agencies to use personal computers to tap into the Sabre system via computer online services to access airline, hotel and car rental reservations 1986 – AA/Sabre installs the industry’s first automated yield management system 1988 – Sabre system stores 36 million fares Source: www.sabre.com Sabre System History – 1980s 1987 – With airlines in their 8th year of deregulation, information and transaction processing has become more profitable than selling seats. AA’s Sabre System produced pretax margins of 30% vs. 5.2% percent from tickets. Source: Business Week, 1987 Sabre System History – 1980s 1988 – Sabre system stores 36 million fares 1989 – A computer foul-up shut down AA’s Sabre ticketing system for 12 hours, apparently the result of a glitch written into the system. The system failure left 14,000 travel agencies and a large part of AA without flight information. Lesson ? Sources: New York Times and Business Week, 1989 Sabre System History – 1990s 1995 – Sabre begins to prepare for Y2K – software is distributed to 40,000 travel agents in 1998. Y2K costs estimated at $78M. 1996 – Sabre names its first CIO Source: www.sabre.com & Computerworld, May 1996 and Computerworld, Mar 1998 The Web Threat Airlines begin to focus on the Web as a means to further reduce their distribution costs Source: www.sabre.com A New Way to Cut Costs 1995 – AA and all major US carriers reduce travel agency commissions on domestic flights. Commission is capped at $50. Additional reductions are made in 1997 (% decreased from 10% to 8%), 1998 (international commissions capped at $100), 1999 (% decreased to 5%), 2001 (domestic caps reduced to $20) and 2002 (commissions eliminated) Source: www.sabre.com and BTMC records Sabre System History – 1990s 1996 – Sabre becomes a separate subsidiary of AMR and AMR releases 18% to be publicly traded (total spin-off in 2000) Source: www.sabre.com Sabre System History – 1990s 1996 –– Travelocity.com, currently the industry’s leading online consumer travel website is launched. Source: www.sabre.com Sabre System History – 1990s By 1998 Sabre had evolved into a global distribution system (GDS) for travel reservations connecting more than 30,000 travel agents and 3 million online customers with 400 airlines, 50 car rental companies, 35,000 hotels and dozens of railways, tour companies and cruise lines. About 1% of all airline tickets are purchased on the web in early 1998. Source: Computerworld, Sep 2002 & Forbes, Apr 1998 Sabre System History – 1990s 1999 – Sabre®Virtually There™, a web based system that provides travelers itinerary and destination info via the internet Source: www.sabre.com The Web Threat 1995 – Sabre considers development of the first corporate online booking tool – BTS. The project is incubated for 2 to 3 years. 1997 – Development of the BTS begins. 1998 – BTMC agrees to beta test Sabre’s BTS for Boeing travelers. Source: interview and BTMC records Online Booking 1998 – Sabre is unable to expand BTS to be a multiCRS system. 1999 – BTMC terminates agreement with Sabre and signs with small startup firm – Internet Travel Network for a multi-CRS system. BTS is available today in a Spanish version which is still in use today. Source: BTMC interview and BTMC records Online Booking 2000 – Sabre acquires GetThere.com, formerly Internet Travel Network for $757M. GetThere’s online product is currently the leading provider of online booking solutions. Purchase completed to gain customer base and keep competitors from purchasing. Sources: www.sabre.com, interview & Computerworld, Aug 2000 The Web Threat Sabre’s recent response to the web which threatens its core business model - Sabre signs deals with Hotwire.com and Priceline.com to provide key technology – both companies are also competitors of Sabre’s Travelocity.com Source: Computerworld, Aug 2000 The Initial Outsourcing In August 1996, Sabre signed a 7 year outsourcing deal which transferred responsibility for its travel reservations network. A partnership of Paris-based airline network SITA and Atlanta-based Equant essentially purchased the network for $450M for 7 years. Sabre transferred 80% of its network engineers to SITA. Source: Computerworld, December 1997 Outsourcing a mature product In July 2001, Sabre signed a 10 year, $2.2B outsourcing contract with EDS. EDS purchased Sabre’s IT infrastructure assets and data centers and Sabre’s airline technology outsourcing business. Over 4,000 Sabre employees transferred to EDS. This transaction represented $600M in revenue to Sabre. Source: Computerworld July 2001 and interview The Future Sabre continues to develop and release new products on an ever increasing pace. Continued change required to maintain customer satisfaction. Revenues from the traditional CRS/GDS model must be replaced by new lines of business. Success with IT: Strategies 1980’s: Killer Application • AA/UA-Reservation Systems • American Hospital Supply-Online ordering system • Frito-Lay-Handheld devices for sales Early 1990’s: Re-engineering • Redesigning business processes around technology Mid 1990’s: Information Management • Knowledge Management • ERP • CRM http://www.cio.com/archive/050101/davenport_content.html Success with IT: Strategies Late 1990’s: e-Commerce Today • e-Commerce is not enough • IT investment in the business core (touches customer) • Business commitment • Commitment to change (continually re-invent and never rest) • Using multiple technologies and management approaches (not just one) • Company must excel in front office(e-commerce, CRM) , back office (ERP), and data warehousing, mining, and KM • Information focus (to make smart decisions) http://www.cio.com/archive/050101/davenport_content.html It’s All About “E” Overview Strategy e@GE Summary Case Study: General Electric • Company Overview • Digitization Strategy • Examples • Buy Side • Plastics • Appliances • Power Systems • Aircraft Engines • Sell Side • Make Side • Summary e-business Is Business Just Simpler, Faster, and Better General Electric: Company Overview • Formed in 1892 • Only company part of the Dow Jones's Industrial Index since the Index’s debut • 67,588 patents, 2 Nobel Prizes and numerous other honors • Operates in more than 100 countries and employs 313,000 people worldwide • GE is considered to be one of the largest and most diversified industrial corporations in the world www.ge.com General Electric: Company Overview • Short-cycle businesses contributed approximately 20% of GE's net earnings in 2001 • Consumer Products (Lighting & Appliances) • Plastics • Industrial Systems • NBC • Specialty Materials •Long-cycle businesses contributed approximately 40% of GE's net earnings in 2001 • Medical Systems • Power Systems • Transportation Systems • Aircraft Engines • Financial services contributed approximately 40% of GE's net earnings in 2001 GE – Digitization Strategy • Before 1999 - IT at GE was non existent •1999 - Jack Welch orders each business to “Destroy your business/ Grow your business” • Use information technology to “create a leaner, faster, more customer focused company, accelerate high margin, capital efficient growth.”, Jeff Immelt, CEO • 2001- GE Top e-business innovator (eweek) www.ge.com GE – Digitization Strategy IT Spending 2000 - $2.5 billion 2001 - $3.0 billion 2002 - $3.5 billion Gary Reiner, CIO "You won't see one ounce of slowdown in tech spending.” Jack Welch 1/2001 http://www.eweek.com/article2/0,3959,94717,00.asp GE – Digitization Strategy Buy Make Sell Productivity (“Workflow”) • Negotiate – e-Auctions – Deflation • Transact – Productivity – eTransactions – Control • Eliminate Intermediaries – Speed – Unit Cost Reduction – Streamline processes More Share/ Higher Margin • Make the Customer More Productive – Comparative Performance Data – Customized Service (Availability/Order Service) • Transaction Productivity GE Internal Presentation e-Business Value Customer Value Buy smarter Process more efficiently Sell more GE Value Buy smarter Process more efficiently Sell more e@GE Digitization provides ways to improve our customer interface and work on our own internal productivity at the same time. It is just beginning. Our investments in information technology will grow about 15% this year. It is really going to help us transform the cost base of GE. Its going to help us buy better. Its going to help us interface with customers better. But primarily its going to help us in terms of the inner workings of GE make us more efficient, leaner, and closer to the customer." -- Jeff Immelt, Chairman and CEO Customer City Swings, April 2001 e-Business Organizational Approach CEO Marketing Leader e-Business Leader BD Leader • • • • • • High Level Leader Knows the Business Track Record of Delivering Well Respected - Great Team Player/Influencer Understands Commercial & Operations Has or Can Play on Business Leader Staff CIO e-Business Steering Committee Buy Side e-Commerce Leader • • • • • Other e-Business Functional Leaders CEO e-Business Leader CIO Marketing Leader BD Leader DYB.com/GYB.com Leader Focus: Destroy Your Business/ Grow Your Business Cross Functional Team Marketing Sales Operations • • • • • External or Internal Internet Generation Creative, Entrepreneurial Start Up Experience Marketing/IT Background Chief Architect .Com Technical Team Technical Functionality • • • • CWC.com Leader Focus: Enhance & Build Your Customer Web Center Back End Infrastructure GE Internal Presentation External Hire e-Commerce Industry Experience Business Savvy Technical Expertise Cross Functional Team Marketing Sales Operations e@GE Statistics Sell 140 Dollars (billions) 120 100 On Line Revenue 80 Overall Revenue 60 Profit (overall) 40 20 0 2000 2001 Online Revenue as a percentage of total revenue 2002 % 1999 16 14 12 10 8 6 4 2 0 1999 2000 After a year of trying web sales, “it really hadn’t changed the world.” Gary Reiner, CIO GE, Forbes 4/30/2001 GE Annual Reports 2001 2002 e@GE - Sell Plastics-Overview Company • Leading global manufacturer and distributor of plastics resins and plastics, including polycarbonate, ABS, SAN, ASA, PPE, PC/ABS, PBT and PEI resins. • 10K employees • $5.3 Billion in sales Customers Automotive (i.e. Ford), computers (i.e. Dell), telecommunications, appliances, optical media, packaging, and building and construction www.geplastics.com e@GE - Sell Plastics-Overview • 1994 - 1,500 pages of corporate literature, product information, press announcements, photographs, and design guides on the Net • 1997 - First to sell resins on the web • Today • industry's leading e-Commerce Web site • speeding up and simplifying the whole range of customer services • Voted best of the web (Forbes 9/18/2002) • Full service portal • 200,000 registered users, 20K visits/week, 2,000 pages of online material e@GE - Sell Plastics-Overview gepolymerland.com • Web site designed to give an easy, super-fast way to manage a resin business • Provides information needed to stay on top of your business • Available 24 hours a day, seven days a week. “it's all about speed, efficiency and making every minute count” www.gepolymerland.com e@GE - Sell gepolymerland.com • Interact • Buy • Discussion groups • Real time orders online FAST • Chats • Shipping confirmation in minutes • Career center • Track and trace shipments • Calendar • MSDS and Certifications online • Yellow Pages • secure Company information • Research • Design Services • Material selection database • Part/toll design assistance • Computer-aided engineering services • Technical Tips and case studies • Problem solving guidelines • Design questions • Technical inquiries • Literature online “it's all about speed, efficiency and making every minute count” www.gepolymerland.com e@GE - Sell Plastics-Performance 9 7 6 14% growth primarily attributed to e-business initiatives Online Revenue 5 Overall Revenue 4 Profit (overall) 3 2 1 0 20 1995 1996 1997 1998 1999 2000 2001 2002 15 10 5 0 % Revenue $ (Billions) 8 -5 -10 1996 1997 1998 1999 2000 2001 % Revenue Growth % Profit Growth -15 -20 -25 -30 -35 2001 GE Annual Report & http://www.line56.com/articles/default.asp?ArticleID=4086&ml=3 e@GE - Sell Plastics-Summary • Information on the net helps customers operate more productively and save money • product information • warehouse inventory • shipment status • 24x7 convenience Chemical Week 5/10/2000 e@GE - Sell Plastics-Summary •Beyond transactions-long term value creation • Aim to draw in engineers, plant managers, and others •ColorXpress: allows customers to match and order color chips; • Vendor Managed Inventory (VMI): uses a proprietary online monitoring technology to monitor storage silos and stabilize order patterns for customers • Design Solution Center:offers a full range of online technical software tools to aid in application development. • Content encourages repeat visits • Customer support/technical assistance • Educational offerings (online seminars) • 500 events in 2001 • multilingual • reached 15,000 customers • Continually broadening its interactive base of knowledge www.geplastics.com e@GE - Sell Appliances-Overview Company • GEA is nearly a $6 billion business in North America, Europe, Asia and South America. • Each year GEA sells more than 15 million appliances in 150 world markets under the Monogram®, GE Profile™, GE®, and Hotpoint® brand names. www.geappliances.com e@GE - Sell Appliances-Overview Products • refrigerators • freezers • ranges • dishwashers • washing machines • dryers • microwave ovens • speed cooking ovens • room air conditioners • water filtration • softening and heating systems Customers Retailers Individuals e@GE - Sell Appliances-Overview Kiosk based virtual inventory model • Program allows customers to walk into a Home Depot or WalMart store, buy an appliance online at a kiosk, and select a delivery date/time • Web based systems at GE warehouses help coordinate fulfillment and promise deliveries within 15 minutes of customer specification • Manufacturer assumes all warehousing, delivery, and installation duties • Goal: Making channel partners more successful “direct ship is going to be the differentiating factor for competition in the future. There is too much redundancy in the way that business is conducted.” Larry Johnston, CEO GE Appliances Wolf, Alan, “GE’s Johnston: Why the Web is Imperative,” Twice 10/23/2000 e@GE - Sell Appliances-Performance 7 5 4 Overall Revenue 3 Profit (overall) 2 1 0 1995 1996 1997 1998 1999 2000 2001 15 10 5 0 % Dollars (billions) 6 % Revenue Growth 1996 -5 -10 -15 -20 GE Annual Reports 1997 1998 1999 2000 2001 % Profit Growth e@GE - Sell Appliances-Summary • Retail Win • No capital commitment by merchant • Registering sales of products that are not physically there • Elimination of inventory and delivery costs • Customer Win • Precision fulfillment system • GE Win • Increase revenue “Something as un-sexy as logistics has become the game changer.” GE Spokesperson Wolf, Alan, “Wal-mart Enters Majap Program with GE Appliance Pilot Program,” Twice 9/4/2000 e@GE - Sell Aircraft Engines • B2B web center that enables real-time transactions with 300 customers 24x7 • Catalog of 250,000 parts • Order entry • Inventory status • Order/shipping status • Account information • Value added services • Enhancing customer productivity • Saved parts list • Configuration histories • Advanced search tools • On-line troubleshooting using fiber optic video Competitors Pratt & Whitney or Rolls Royce have yet to develop anywhere near as effective a Web Strategy as GE. http://www.cio.com/sponsors/050100_ebiz_story2_side5.html & http://www.forbes.com/best/2000/0717/038s01.html e@GE - Sell Power Systems Turbine Optimizer • Web based tool • Compares turbine performance with same models across the world • Shows dollar value of improvement • Ability to schedule service call for improvement “It used to take 2 weeks to analyze a problem, now it only takes an hour.” http://www.forbes.com/best/2000/0717/038s01.html e@GE – Make Internal Processes Overview • Eliminate manual processes • Eliminate paper generating processes • Increases volume per sales rep • Reduce back office processes and increase front office face time with customer “Every process we can digitize will help reduce our costs and further increase our speed -- both key competitive advantages in today's marketplace.” GE Internal Presentation e@GE – Make Internal Processes Overview • Finance • HR • Employee Evaluations • Employee Applications • Sales • invoicing • reconciling e@GE – Make Internal Processes Overview • Travel • Booking • Expensing • 2001 savings: $200 million in improved efficiencies and reduced travel • Support Central • Education GE Internal Presentation e@GE – Make Internal Processes Stakeholders • Employees • Management • Stockholders • Customers e@GE – Make Internal Processes 2000 - $1.5 billion savings on streamlined internal processes Future - ~$10 billion in savings e-Make is about streamlining processes and reducing unit costs http://www.pcmag.com/article2/0,4149,33527,00.asp e@GE – Buy Stakeholders • Management • Stockholders e@GE – Buy Negotiate e-Auction “Everything” • real-time online purchasing auction for both incumbent and non-incumbent GE suppliers • reverse auction • allows GE purchasing managers to monitor competitive pricing and drive down total costs • $3 billion worth of goods and services on auction (2000) • businesses achieved 10-20% price deflation across the board GE Internal Presentation e@GE – Buy Transact Capture Digitally Capture All PO’s, Invoices, Payments • easier to obtain current data • fewer errors in purchase orders • quicker turnaround reconciling bills GE Internal Presentation e@GE – Buy Supplier Workflow e-P0 e-Inv e-Pay Date % Date % Date % NBC Jan-01 100% Dec-01 85% Sep-01 93% APPLIANCES Mar-01 100% May-01 100% Dec-01 100% LIGHTING May-01 95% Jun-01 90% Jun-01 100% AIRCRAFT Jun-01 100% Jun-01 100% Jun-01 100% TRANS Jun-01 100% Dec-01 100% Dec-01 100% PLASTICS Dec-01 100% Dec-01 100% Sep-01 100% INDUSTRIAL Dec-01 95% Dec-01 90% Dec-01 90% MEDICAL Dec-01 95% Dec-01 95% Dec-01 95% CAPITAL Dec-01 85% Dec-01 90% Dec-01 75% SUPPLY Dec-01 80% Dec-01 90% Oct-01 100% POWER Dec-01 65% Dec-01 80% Dec-01 70% GE Internal Presentation e@GE – Buy Constrict Usage – Implement Automated Workflow Approvals – 5% on $20B = $1B Contract Adherence – Establish One Data Source for Pre-Negotiated Contracts – 3% on $20B = $600M Productivity – Streamline Sourcing Process – 5% of 3000 people = $20M GE Internal Presentation e@GE – Buy Summary • Savings 2001: Anticipated $600 million in savings • Transactions 2000: $6 billion transactions 2001: $15 billion transactions Future: $30 billion transactions e-Buy is about buying smarter and processing more efficiently http://www.pcmag.com/article2/0,4149,33527,00.asp e-Business Value Customer Value Buy smarter Process more efficiently Sell more GE Value Buy smarter Process more efficiently Sell more Competitive Advantage through differentiation (value added customer services) and cost reduction e@GE e-Business strategy continues to build on the business model that has enabled the company to outpace S&P 500 earnings growth through every cycle http://www.ge.com e@GE Digitization mandate - Straight from the top IT – leveraged to cut costs and differentiate Differentiation • Online tools and services • Increased front office operations “Digitization is changing our relationship with our customer. At the customer for the customer (ACFC)-the way that we differentiate.” http://www.ge.com IT as a Competitive Weapon Sustainability Sustainable Advantage Do our case studies have sustainable advantage ? Project Lifecycle Analysis Competitor Analysis Sabre GE (Plastics, Appliances) Lead Time Competitive Asymmetry “IT as a Basis for Sustainable Competitive Advantage,” Feeny & Ives Supply System Analysis Pre-emption Potential Web Business Staying Power • Simplicity • Applying traditional business thinking to a new channel • Use web to improve business and create valuable services • Awareness of customer needs • e-Business is a constantly moving target • Need for sound relationships http://www.cio.com/archive/120101/power_content.html Davidson, Stephen, “B2B Exchaanges:Lessons from the Trading Pit,” Journal of Internet Law, 4/2002, v5 i10 p1(10) IT as a Competitive Weapon Summary IT can be used as a competitive weapon through cost reduction and differentiation Very few companies sustain competitive advantage using IT IT projects need to be evaluated for “sustainability’ in addition to traditional risk e-Business is a constantly moving target Future of IT Competitive Advantage? or Competitive Necessity?