Economics

advertisement

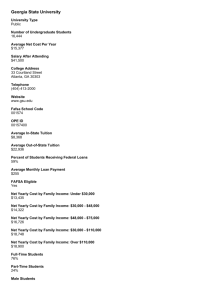

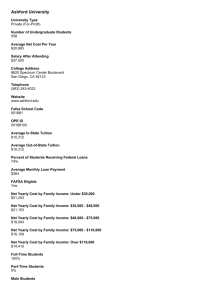

Economics Economic Evaluation of the direct iron reduction Midrex plant will help determine if plant design should continue. Various factors must be considered in this analysis. Total capital investment will be determined in order to find the startup cost of the plant. Yearly expenses will be compared to the total revenue to determine the profit margin of the plant. These factors will determine the payback period, the Net-Present value, and ultimately allow one to decide if the plant is worth building. Total capital investment The capital investment for the plant has many factors to be considered. The largest of these factors being the equipment needed for the plant. The main equipment pieces needed for this process are the primary Midrex reformer, the oxygen fuel booster, shaft furnace, and CO2 removal system. Consideration must also be taken for storage sites and loading and unloading facilities. Minor pieces of equipment include the top gas particulate scrubber, heat exchangers, compressor, and main air blower. An installed plant cost for a previous Midrex plant was used to determine a rough total installed cost for this plant using a typical scale up equation known as the six-tenths rule. This equation is as follows: C2 = C1(S2/S1)n(cost index for this year/cost index for year of known value) Where C1 = cost of equipment of capacity S1 C2 = cost of equipment of capacity S2 N = exponent that may vary between 0.4 to 1.2 depending on equipment type A 1.4 million ton capacity plant built in 2008 was valued at $375 million. Using the six-tenths rule to scale to a 1.86 million ton capacity and adjusted for year an installed plant cost was found to be $463 million. Then accounting for storage at $12 million installed, and rail lines and loading at $18 million installed a total installed plant cost was found to be $493 million. The storage and rail installed cost were found from project quotes for similar size operations and scaled via the six-tenths rule. Equipment costs where then determined based off this total installed plant cost. It was informed to us by a contact at Midrex that the primary Midrex reformer accounted for a bit over one third the total cost, the shaft furnace accounted for a bit less than one third the total cost, and that all the other equipment fell in the remaining amount. From here information from chapter 6 of Plant Design and Economics for Chemical Engineers, a handout given by prof. Perl, was used to determine equipment cost. A value of 4.36 was used to estimate equipment cost from total installed equipment cost. This value was used to account for such things as delivery, piping, electrical, buildings, service facilities, construction, and contractor’s fees. These values for equipment cost and installed cost can be found in appendix 7. Plant Staffing There will be 7 operators on site at all times. There will be four 8hr shifts. This gives a total of 28 operators per day each working eight hours. There are 4 shifts to account for overlap and shift changes. On a given day 224 man hours will be worked by operators. There will also be 5 engineers shared between three plants totaling 13.3 man hours per day. One complex manager for the entire complex at 8/9 man hours per day. 20 administrative staff is estimated to be employed by the entire complex giving 160/9 man hours per day worked. 3 safety personnel for the complex will be valued at 24/9 hours per day. 4 medical personnel for the complex at 32/9 man hours per day. One maintenance personnel for the complex at 8/9 man hours per day. And 4 supervisors for this plant at 24 man hours per day. This brings the total man hours worked a day to 292. A value of $100/hour was for salary and fringes estimate. This gives a yearly estimate for salaries and fringes at around 11 million. Yearly Revenue There is one major product being produced, that is the direct reduced iron (DRI), and one minor product, the CO2, the CO2 however is being traded within the complex and no transfer costs are being assumed. The DRI will be produced at about 5100 tons/day. DRI can be sold from last year’s figures between $400 to $450 per ton this price is subject to market values and has to potential to change drastically. A value of $425 was used to estimate the yearly revenue valued at $790 million. Yearly Expenses There are various expenses that were accounted for when evaluating the total plant expenses on a yearly basis. These include Depreciation, Electrical, Natural gas cost, Oxygen cost, Transportation, Salaries and Fringes, Maintenance, and Feed Ore. Depreciation was a value determined from subtracting the salvage value from the project cost and diving by the project life. This came out to be $3 million. Electrical cost is assumed to be traded within the complex and have no cost to the plant, however based of energy requirements from Midrex to produce one ton of DRI electrical cost were estimated at $20 million. This number was not used due to the assumption of no transfer cost between plants within the complex. Natural gas and oxygen cost fall under this same assumption but are dependent on market values and tendency to fluctuate. Transportation costs where based upon the following. • • • • • • • Basis of 1.86 mm ton produced 5,100 (ton/day) Average rail car holds 80 tons. With a maximum load per train of approximately 15,000 ton and 150 cars Plant will need a train every 2 days of approximately 130 cars. Average cost to ship by rail 0.03($/ton mile) Assuming a discounted rate of 25% for large volume of material transported. Using northeast Minnesota for iron oxide source and northwest Indiana for product shipment. Cost to ship 23.00($/ton) to ship product 12.00($/ton) import raw material. Total cost for transportation of material was estimated at $72 million per year. Salaries and Fringes are explained above and valued at $11 million per year. Maintenance costs are based off of 3% of the capital investment and come to $15 million. The Feed ore price per ton is about $150 and 2.7million tons of feed ore is required to produce 1.86 million tons of DRI. The feed ore is the largest expense and is subject to market conditions. The yearly cost for the feed ore is estimated to be $406 million. This ultimately gives a total yearly expense of $500 million. Sensitivity Analysis A sensitivity analysis of the plant will incorporate the variation in pricing for feed stock supplies and product. .32MM tons/year of natural gas and 3050 tons/year of oxygen are used in this process. These feeds are transferred to this plant from within the complex and have no cost. However if this plant did pay for these feeds their expenses would be greatly influenced by market prices which have a tendency to fluctuate drastically. Natural Gas however has seen a roughly stead decline due to the ability to obtain the gas from shale deposits and an increasing supply. The major expense of the feed ore is also subject to fluctuation in the market and will have substantial influence on the profitability of the plant. Along with this comes the sensitivity to fluctuation in the sale price of the plants DRI product. This product is of superior quality and should obtain a premium but is none the less subject to fluctuations in the market. Overall Evaluation With the yearly revenue and expenses calculated for the plant, the profit margin per year can be determined. Taking the yearly revenue and subtracting the expenses gives the total profit before taxes. Taxes are assumed to be 40% of the total profit per year. The yearly income will be $174 million. This will yield a payback period of around 4 years. The net present value of the plant is $1.254 billion with an internal rate of return of 38.57%. as the numbers show the iron reduction plant is profitable. It is recommended that further more accurate economic evaluations be done moving forward into the second stage gate to more accurately describe the plant’s profit and worth.