Financial Ombudsman Service

advertisement

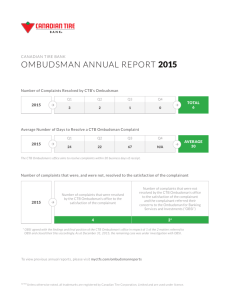

UK Financial Ombudsman Service independent external review David Thomas Lordand Hunt of Wirral corporateby director principal ombudsman 1 UK Insurance Ombudsman established by insurers voluntarily in 1981 in partnership with consumer bodies alternative to civil courts but redress beyond the law binding on provider, but not consumer 2 characteristics complain to provider first free to consumer flexible and informal processes mediation or investigation and decision specialist knowledge encouraging complaint resolution / prevention 3 other financial ombudsmen followed banks building societies (mutual mortgage banks) investment product providers investment intermediaries 4 Financial Services and Markets Act 2000 Financial Services Authority (the regulator) Financial Ombudsman Service (resolves on unresolved disputes) Financial Services Compensation Scheme 5 providers covered services provided in or from the UK by all: banks and building societies other lenders (mortgages and consumer credit) mortgage and loan intermediaries credit unions and electronic money institutions insurers and insurance intermediaries investment providers and intermediaries credit reference agencies and debt collectors 6 complainants covered individual business (< €1.5 million turnover) from UK and world-wide 7 any complaint not resolved by close of the following business day prompt written acknowledgement to consumer what the rules require providers to do keep consumer informed within 8 weeks: ‘final response’ with details of ombudsman 8 If complainant has not complained to provider we: send the provider details of the complaint, and remind it to issue a final response within 8 weeks send the complainant a pre-populated complaint form, to complete and return it if the complaint is not resolved within 8 weeks 9 customer contact division phone enquiries (341, 455) total enquiries (627,814) written enquiries (286,359) to casework enquiries converted to cases (94,392) figures are for ALL financial products in year ended 31 March 2007 10 case casework division early termination by adjudicator mediation by adjudicator non-binding decision by adjudicator final decision by ombudsman 11 early termination by adjudicator for example: no reasonable prospect of success fair settlement on offer more suitable for court legitimate commercial judgment [can ask for review by ombudsman] 12 mediation by adjudicator evaluative mediation by agreement 13 non-binding decision by adjudicator (paper) investigation legal power to compel evidence non-binding decision both sides can accept either side can ask for the case to go to an ombudsman (<10% do) 14 review by ombudsman (internal appeal) request by either side additional evidence/arguments possible hearing (rare) final decision if consumer accepts, both sides bound otherwise, neither is bound 15 basis of decision law requires us to decide what is ‘fair and reasonable in the circumstances’ rules require us to take account of: - relevant law - regulators’ rules and guidance - industry codes - good industry practice 16 redress we can require the provider to: pay compensation up to €150,000 * pay interest pay costs (rare) * we can make a non-binding recommendation for more 17 alternatively, or additionally we can direct the provider to take appropriate action in relation to the complainant – for example: put something right reconsider an application or claim apologise 18 insurance cases: year to 31 March 2007 4,230 motor 680 critical illness 3,734 life 520 commercial 1,951 buildings 445 legal expenses 1,832 loan protection 388 medical 1,670 travel 273 pets 1,238 contents 202 breakdown 891 income protection 713 extended warranty 177 personal accident 77 caravan 19 www.financial-ombudsman.org.uk independent external review by Lord Hunt of Wirral www.financial-ombudsman.org.uk/accessibility/polish/ twoje_zazalenie_a_rzecznik_praw_obywatelskich.htm 20