Lesson 10-3

advertisement

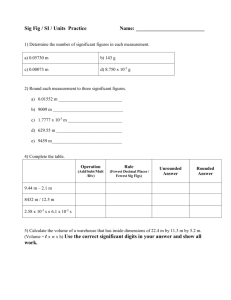

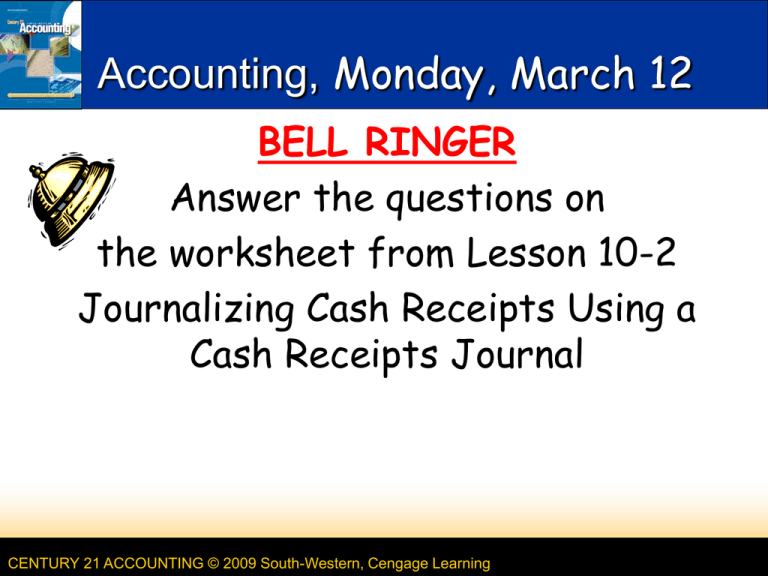

Accounting, Monday, March 12 BELL RINGER Answer the questions on the worksheet from Lesson 10-2 Journalizing Cash Receipts Using a Cash Receipts Journal CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning Tuesday, March 6 AGENDA Return Test Chapter 9 Finish Application Problem 10-2: Journalizing cash receipts; proving and ruling cash receipts journal Lesson 10-3: Recording Transactions Using a General Ledger CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning Assignment Monday, March 12 1. Bell Ringer Lesson 10-2 2. Aplia: On Your Own 10-2 Appl. Problem 10-2 3. Lesson 10-3: Read pgs.285-86 Define the three terms from Lesson 10-3 4. Complete Work Together 10-3, pg. 287 5. Aplia: On Your Own 10-3 Appl. Problem 10-3 CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 10-3 Recording Transactions Using a General Journal CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 5 TERMS REVIEW page 287 sales return sales allowance credit memorandum CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 10-3 6 CREDIT MEMORANDUM FOR SALES RETURNS AND ALLOWANCES CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning page 285 LESSON 10-3 7 JOURNALIZING SALES RETURNS AND ALLOWANCES page 286 March 11. Granted credit to Village Crafts for merchandise returned, $58.50, plus sales tax, $3.51, from S160; total, $62.01. Credit Memorandum No. 41. 2 4 1 3 5 7 1. Write the date. 2. Write Sales Returns and Allowances. 3. Write CM and the credit memorandum number. 4. Write the amount of the sales return. 5. Write Sales Tax Payable. 8 6 9 6. Write the sales tax amount. 7. Write the accounts to be credited. 8. Draw a diagonal line in the Post. Ref. column. 9. Write the total accounts receivable amount. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 10-3