Corporate reform in East Asia

advertisement

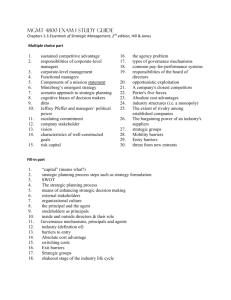

Corporate reform in East Asia Prof. Stephen Y.L. Cheung Department of Economics & Finance City University of Hong Kong Priorities in promoting corporate governance in East Asia (I) Board Increase the number of independent directors Transparent board structure Heighten fiduciary duty of BoD Criterion of the board of directors Priorities in promoting corporate governance in East Asia (II) Law and regulations Stringent regulation to cope with corruption Enforce legal framework Strengthen capital market regulation Priorities in promoting corporate governance in East Asia (III) Disclosure Timely and sufficient financial disclosure Adopt an international standard accounting Non-financial disclosure Corporate governance/ ethical/ social issues Better risk management Priorities in promoting corporate governance in East Asia (IV) Shareholders Strengthen minority shareholder protection Educate the public shareholders Exercise their rights Encourage participation of institutional and shareholders in monitoring performance Comparison of corporate governance in East Asian Economies (I) Criterion of the board members Hong Kong Japan Malaysia Very general guideline. e.g. level-headed, relevant management experience and knowledge, etc. Singapore South Korea Thailand Age, background, qualification Comparison of corporate governance in East Asian Economies (II) Separation of chairman and CEO Hong Kong Not discussed Japan Dual roles are allowed with explanation Malaysia Singapore Dual roles are NOT allowed South Korea Not discussed Thailand Not discussed Comparison of corporate governance in East Asian Economies (III) Board size Hong Kong Not discussed Japan No maximum/ minimum is set. The size should be decided by the Board. Malaysia Singapore South Korea Thailand No less than 5 Comparison of corporate governance in East Asian Economies (IV) Independent directors (IDs) Hong Kong Japan Malaysia Singapore South Korea Thailand No max. / min. is set At least 1/3 of the board Max. of 1/3 or 2 IDs At least 3 IDs Listed co.: at least 1/4 FIs: at least 1/2 At least 2 IDs Comparison of corporate governance in East Asian Economies (V) Remuneration review Hong Kong Not discussed Japan Remuneration committee Malaysia Executive directors’ links with corporate/ individual performance IDs’ reflects level of responsibilities Fair evaluation Singapore South Korea Thailand In accordance with Articles of Association Comparison of corporate governance in East Asian Economies (VI) Assessment of board performance Hong Kong Not discussed directly Japan Malaysia Nominating committee Singapore South Korea Fair evaluation Thailand Not discussed Comparison of corporate governance in East Asian Economies (VII) Communication with institutional and retail investors, and information disclosure (I) Hong Kong - Disseminate price-sensitive information in a timely manner - Clarify any unusual price movement or rumours Japan -BoD and management are responsible for providing accurate, substantive, practical and reliable information. - Fund managers, analysts and major shareholders receive privileged information - Adopt the international standard accounts - Introduce the quarterly reports Malaysia -Encourage direct contact and monitoring by institutional investors Comparison of corporate governance in East Asian Economies (VIII) Communication with institutional and retail investors, and information disclosure (II) Singapore - Communicate with shareholders effectively and fairly - All the material information should be fully disclosed to the public before disseminating to others. South Korea Monitoring corporate performance by institutional investors is encouraged Thailand - All the financial and corporate information should be disclosed. - All the connected transactions are disclosed. Comparison of corporate governance in East Asian Economies (IX) Board meetings (I) Hong Kong Full board meeting: - No less than every 6 months - Involve matters with conflict of interest Japan Not discussed Malaysia - Meet regularly and prepare minutes - Disclose number of meetings held per year and details of attendance Singapore - Meet regularly Comparison of corporate governance in East Asian Economies (X) Board meetings (II) South Korea -At least once every 3 months -Follow the Board Operating Regulation -Independent directors: - collect and review all related information - listen to the opinion of the shareholders Thailand Company secretary is appointed: - ensure compliance with the relevant laws and regulations - prepare the minutes Comparison of corporate governance in East Asian Economies (XI) Disclosure on directors’ remuneration Hong Kong Disclosed in full Japan -Decided by the board -Disclosed as business statements and evaluated by shareholders Malaysia - Disclose a formal and transparent policy - Report in detail Singapore -Disclose a clear remuneration policy -Disclose the remuneration of all directors and top 5 earning executives in detail South Korea - Disclosed in full - Fair evaluation Thailand Disclosed in full Comparison of corporate governance in East Asian Economies (XII) Corporate governance disclosure (I) Hong Kong A statement of compliance with the Code of Best Practice from 31st December, 1995 onwards Japan Wide disclosure, e.g. policy statements, environment-related reports Malaysia - Comply with the Best Practice - Performance is reviewed by nominating committee - Disclose the board structure and advisers, details of the board meetings and audit committee meetings Comparison of corporate governance in East Asian Economies (XIII) Corporate governance disclosure (II) Singapore -Chairman ensures compliance with company guidelines on corporate governance -Detail information of directors and board committee -Assessment of the board performance and effectiveness, and contribution of each directors South Korea -Disclose information of the nominated directors to the shareholders -Explanation for any deviation from the Code -Disclose detailed information on shareholding of controlling shareholders Thailand -Comply with Code of Corporate Conduct and Code of Ethics -Statement of the responsibilities of the directors Comparison of corporate governance in East Asian Economies (XIV) Accuracy of information disclosure (I) Hong Kong Every director is responsible for the accuracy of information disclosed Japan Not discussed Malaysia External auditors report independently according to statutory and professional requirements - covers financial/ operational/ compliance controls and risk management Comparison of corporate governance in East Asian Economies (XV) Accuracy of information disclosure (II) Singapore -Independent internal auditors -Meet the international standard -Audit committee reviews the evaluation of the internal controls by the internal/ external auditors South Korea Audit committee and auditors are responsible for the accuracy of financial reports Thailand Directors are responsible for the accuracy of financial reports, minutes and all document regarding to the board Comparison of corporate governance in East Asian Economies (XVI) Shareholders’ voting rights Hong Kong Not discussed Japan Election of directors Malaysia Election of directors Singapore Not discussed South Korea Election of directors Right of profit apportion/ attendance of board meeting/ Thailand A list of certain decisions made by the board require the shareholders’ approval, e.g. amendments to Memorandum of Association/ Articles of Association, capital changes, etc. Recent development of corporate governance in East Asian Economies (I) Hong Kong Amendments to Companies Ordinance Minority shareholders rights Voting rights Rules for company annual meetings and accessibility to corporate records by shareholders Recent development of corporate governance in East Asian Economies (II) Malaysia All directors and company advisers are responsible for violations of rules regarding to director liability, financial reporting, disclosure and investor protection from June 1, 2001. Disclose the responsibility of directors in internal controls in annual reports Transform from the rule-based to the disclosurebased regulatory framework Recent development of corporate governance in East Asian Economies (III) Singapore New Securities and Futures Act Listed companies will be charged for violation of disclosure regulations, in either civil or criminal penalty Publish the first corporate governance code in April 2001 Disclosure of executive and director remuneration Board composition (IDs: 1/3 of board) Audit committee (All IDs) Fair and Equitable information disclosure Include the corporate governance practices in annual reports from January 2003 Recent development of corporate governance in East Asian Economies (IV) China Proposed rules on pre-listing corporate restructuring and corporate governance structure Separation from parent companies on operations, assets, and structure From 2002, listed firms publish quarterly financial reports starting THE END