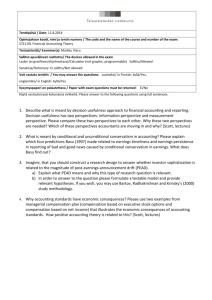

3. Models to measure the use of conservatism

advertisement