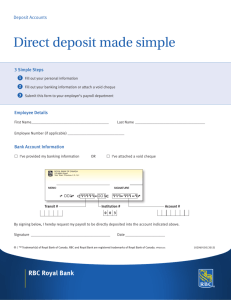

Bank - Note Khata

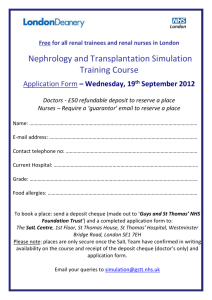

advertisement