Monitoring of issues identified in the s.31 assessment report

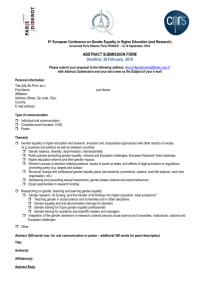

advertisement