Disbursement Guidelines - The Texas A&M University System

advertisement

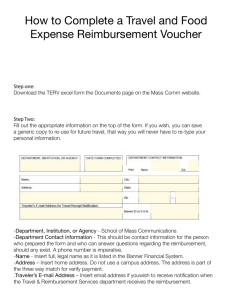

The Texas A&M University System Office of Budgets & Accounting Employee Travel Training February 25, 2009 Presenters: Tracy Crowley & Jennifer Montgomery Class Objectives Learn where to find the information regarding travel rules and regulations Learn how to use the Texas Comptroller of Public Accounts (CPA) online travel resource, Textravel Learn how to complete request for travel reimbursement form Agenda Agency and employee responsibilities State Travel Management Program (STMP) STMP Travel Contracts Travel Planning Travel Rates and Requirements State of Texas Web Resource, Textravel Travel Reimbursement Process Timeline Travel Reimbursement Form Demonstration Q&A Agency and Employee Responsibilities Agencies must properly train employees on travel regulations and keep them informed of any changes in travel rules. Agencies must ensure that all travel reimbursements are examined prior to payment to ensure compliance with all applicable regulations and limitations. Employees must ensure that their travel complies with applicable laws and rules and must not seek reimbursement for travel expenses that the employee should reasonably know are not reimbursable. The Comptroller is required by law to properly audit all claims submitted for payment. Therefore, all payment transactions are subject to audit regardless of amount or materiality. Source: Textravel https://fmx.cpa.state.tx.us/fmx/travel/textravel/index.php State Travel Management Program (STMP) The Texas Procurement and Support Services (TPASS) is a division of the Texas Comptroller of Public Accounts that awards and manages statewide contracts. TPASS has a wide variety of functional areas to assist vendors with how to do business with the state and to support other state agencies and cooperative purchasing members in procuring goods and services. The program area for travel is the State Travel Management Program (STMP). http://www.window.state.tx.us/procurement/prog/stmp/ STMP Travel Contracts TPASS has negotiated the following travel contracts: ◦ Airlines ◦ Corporate Charge Card ◦ Hotels ◦ Rental Car ◦ Travel Agency State agencies must use contract travel services whenever those services provide the most efficient travel resulting in the total lowest cost Exceptions are detailed on the travel reimbursement form Report problems with contract vendors to STMP STMP Travel Contracts Contract Exceptions: ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ Lower Cost to the State Unavailability of Contract Travel Services Special Needs Custodians of Persons In Travel Status Group Program Emergency Response Legally Required Attendance STMP Travel Contracts Airlines Contract Term: June 1, 2008 – March 31, 2009 ◦ American Airlines ◦ JetBlue Airways Provide maximum flexibility, but are not always the lowest cost Designed for last minute and/or fully refundable travel requirements Utilize 14-day advance or other lower cost airline fares for planned travel requirements to obtain the lowest possible cost to the state Mandatory form of payment is a state issued-JPMorgan Chase corporate travel charge card account STMP Travel Contracts Hotels Contract Term: Fiscal year September 1 – August 31 In order to be awarded a contract with the State of Texas, hotels must offer a 20-25 % discount off their standard rack rates for single room. STMP web site offers searchable contract hotel listing ◦ http://portal.cpa.state.tx.us/hotel/hotel_directory/index.cfm State contract rates are available based on the hotel's available inventory State contract rates may not be available during holidays or special events STMP Travel Contracts Rental Car Contract Term: March 31, 2004 through March 31, 2009 ◦ Avis Rental Car System, Inc. ◦ Enterprise Rent-A-Car When making a reservation, provide the name of the state entity of which you're employed and the state entity contract rate identifier number (For System employees, Avis F999710 or Enterprise TX710) Verify the rental is booked on the State of Texas (SOT) contract rate to insure the contract provisions are included: ◦ SOT daily contract rate includes both LDW (loss damage/waiver or comprehensive) and liability coverage. Some exceptions for specific Avis locations. ◦ Additional or secondary driver fees waived for SOT contract STMP Travel Contracts Corporate Charge Card ◦ Contract term: June 13, 2003 through August 31, 2009 ◦ JPMorgan Chase (JPMC) MasterCard JPMC Individually Billed Accounts (IBA) Eligibility criteria: take, or be expected to take, three (3) or more trips per fiscal year, or spend at least $500.00 per fiscal year for official state business travel. Applications available on SOBA web site Individual corporate travel charge cards issued through the State of Texas are to be used for official state business travel expenses only. Cardholder is responsible for paying the balance and seeking reimbursement Typically, travelers use this card for meals, lodging, incidentals. IBA’s, continued Benefits of the State-Issued IBA: ◦ Credit limits and payment information are not reported to the credit reporting bureaus, thus affecting personal credit history, unless the JPMC account is charged off. ◦ No Account Fees ◦ Travel Accident Insurance ◦ Lost Luggage Insurance State Designated Limitations: ◦ $200 limit per billing cycle on non-travel (retail) charges (In some instances, charges for travel-related expenses such as parking, taxis, and gasoline may be coded by the merchant as "retail." ) JPMC Central Billed Accounts JPMC Central Bill Account (CBA) ◦ SOBA works with each department to establish a CBA for their specific travel needs ◦ Bills directly to department ◦ Monthly billing cycle ends on the 10th ◦ For air, rail, and bus charges only In some cases, may include lodging also For hotel CBA: No State Taxes Allowed No Meals Allowed Travel Planning Avoid making plans through online travel services (Priceline,Travelocity, Orbitz, etc.) ◦ Lack of sufficient documentation ◦ Difficulty in getting itemized receipts ◦ In-State Taxes charged in error, very difficult to reverse For in-state hotel stays, present Texas Hotel Tax Exemption Certificate at check-in ◦ Review receipt at check-out to confirm State Tax was not charged. (City/Local Taxes are reimbursable.) For registration fees, charge to departmental purchasing card or submit a request for payment. Employee reimbursements cannot be reimbursed until event occurs. Textravel, the new State of Texas Travel Resource The Texas Comptroller of Public Accounts created Textravel to provide information on state travel laws and rules to state agencies and institutions of higher education. Textravel is based on Texas Government Code Chapter 660, General Appropriations Act, Article IX, Part 5 , and Texas Administrative Code,Title 34, Part 1, Chapter 5, Subchapter C, Section 5.22. This Web resource is designed to be an easy reference for state agencies and their employees. Links to applicable laws and rules are included. Source: https://fmx.cpa.state.tx.us/fmx/travel/textravel/index.php Agency Travel Rules State agencies have the authority to establish more restrictive rules but not less restrictive rules. For more information regarding System Offices rules, please refer to the Disbursement of Funds Guidelines located on our website at: http://www.tamus.edu/offices/budgetsacct/acct/general/index.html Travel Reimbursements Request for Travel Reimbursements must be completed and signed by the traveler. Departmental contact information should also be provided. The form is on our website: http://www.tamus.edu/offices/budgetsacct/acct/centralsvc/index.html In-state Travel Reimbursement Rates New mileage rate effective January 1, 2009 $0.550/mile Meal rate - $36/day Meal reimbursement amount based on actual meal expenses incurred not to exceed the maximum reimbursement rate. No meal reimbursement unless it is an overnight stay. Lodging reimbursement rate - $85/day Out-of-State Travel Employees traveling Out-of-State receive up to a maximum flat rate for meals and lodging based on federal regulations. The current Out-ofstate Meal and Lodging Rates schedule is available at: Out-of-State Meal and Lodging Rates - FPP S.003 Documentation for Travel Reimbursements Where applicable, the following information should be included with the request for travel reimbursement form: • Receipts for lodging costs, showing a zero balance Please do not use “express check-out” at the hotels. The wording “will be charged to XXXX” and “effective balance of $0” on a hotel bill is not a zero balance receipt. • Meal cost breakdown per day • Receipts to support claims for reimbursement of public transportation, airfare, registration fees etc. • Point to point mileage breakdown When claiming mileage that is different from the State Comptroller’s Mileage Guide, you must include beginning and ending odometer readings. • Requests for reimbursement of local mileage should be submitted at least monthly. Receipts Original lodging receipt required. It must be complete and show that payment has been made. Present the hotel occupancy tax exemption certificate when checking into the hotel. This is available on our website at: http://www.tamus.edu/offices/budgetsacct/documents/texas-hotel-occupancyexemption.pdf Receipts for meals are not required. However, employees are encouraged to keep a record of meal expenses incurred since they will be reimbursed only for actual expenses incurred, up to the maximum rate allowed. Airline Ticket The original airline ticket receipt should be attached to the payment request. An itinerary alone is unacceptable. If the ticket is in the form of an E ticket, the passenger itinerary or receipt must be attached to the payment request. The name of the employee and airline, the ticket number, the class of transportation, the fare basis code, the travel dates, the amount of the airfare, and the origin and destination of each flight must be included on the receipt. Parking Receipts Receipts are not required for parking. Charges must be itemized on a daily basis and must include information on where the parking expense was incurred and the date. Original receipt must be attached when requesting reimbursement for a rental car. The receipt must separately itemize all charges, including the starting and ending dates of the rental, the name of the renter and any other charges. Combining State and Personal Business If a traveler combines personal travel with official state business travel, the traveler is only allowed reimbursement up to the rate published by Textravel. Any meal, lodging or car rental expenses that were incurred on personal days cannot be reimbursed. Foreign Travel Appropriated funds may not be used to pay or reimburse a state employee for travel expenses incurred while traveling to or from a duty point in a foreign country other than Canada and Mexico, unless the Chancellor has approved the travel before departure. A request for Foreign travel must be completed and submitted to the Chancellor no later than 30 days prior to travel. There is the link to the form on our website: http://www.tamus.edu/offices/budgetsacct/acct/travel/index.html Washington, D.C. Travel Starting with fiscal year 2006, only travelers who intend to confer on legislative or appropriations issues with U.S. Congressmen, or other Federal Government Staff or Officials should submit travel information to the Office of State -Federal Relations (OSFR). Notification can be made online. The link to the form can be found on our website at: http://www.tamus.edu/offices/budgetsacct/acct/travel/travel_DC.html Common Issues Benefit to the State Requirement The traveler must provide a statement explaining how their travel benefited the state of Texas. Providing this statement ensures the travel expenses were incurred while conducting state business. “Part of job duties” is not sufficient. Common Issues cont. “Accompanied By” Requirement Section 660.030 of the Texas Government Code pertains to the examination of vouchers and reimbursement forms for travel expenses. In order to comply with this code, the traveler is required to provide information regarding who else from the department traveled to the same duty point and why it was necessary for more than one person to travel. Common Issues cont. 4 Per Car Rule Direct from Textravel: When employees from the same agency travel on the same dates with the same itinerary, they must coordinate travel. When four or fewer employees travel on the same itinerary, only one may be reimbursed for mileage. When more than four employees travel on the same itinerary, only one out of every four may be reimbursed for mileage. Travel Vouchers Most Common Problems • Missing signature by the traveler • Amounts do not match • Exceptions not checked when non-contracted hotel/airfare/rental cars used • Lack of description on second page • Benefit to the state statement not sufficient • Missing receipts Timeline for Travel Reimbursement Requests Traveler makes travel arrangements and is careful to make arrangements based on the System Office guidelines. After traveling to their duty point where state business is conducted, the traveler returns to headquarters. Traveler goes through receipts, then completes and signs the travel reimbursement form. Timeline for Travel Reimbursement Requests cont. The completed reimbursement form, along with the required receipts, is submitted to the bookkeeper. The bookkeeper audits the form and the receipts, then processes an online document to prepare the request for payment. After receiving departmental approval, the bookkeeper submits the form and receipts to Accounts Payable for processing. Timeline for Travel Reimbursement Requests cont. Accounts Payable’s goal is to process vouchers within five business days. The reimbursement request is audited by Accounts Payable. If information is missing, the bookkeeper is notified so the situation can be resolved. The five day turnaround starts over when the missing information is received. Around the time of the holidays, we will announce a submission date that guarantees reimbursement before the holiday break. Any requests received after that date are not guaranteed to be processed before the holiday break Timeline of Travel Reimbursement Requests cont. Payment Request is processed and traveler receives travel reimbursement. Direct Deposit, or ACH, is the preferred method of payment. The link to the Employee Direct Deposit Form is on our website at: http://www.tamus.edu/offices/budgetsacct/acct/general/index.html Questions?