MONEY - Session5

advertisement

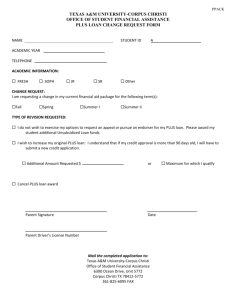

MONEY MATTERS LESSON 5: DO'S AND DON'TS OF CREDIT A man wanted to borrow some money on credit from the Hodja 1. The Hodja told him: "I have no money; but I can give you credit. How much do you want?" I. Literacy Objective: The students will be able to explain the advantages and disadvantages to using credit cards and write personal resolutions for their use. II. Materials for Lesson: "Credit Card Tips" - handout "Basic Do's and Don'ts of Credit" - handout by Sylvia Porter III. Suggested Readings: Be Credit - Wise: A Guide to Credit by Elsa Bruton A Janus Money Matters Guide Miles River Press Alexandria, VA 22314 Using Credit by Sharon Bywater New Readers Press Box 131 Syracuse, NY 13210 IV. Additional Activities: "Dear Abby" - optional handout V. Notes to Instructor: Bring in copies of credit applications if you can for practice in filling them out. Consider contacting your local Consumer Affairs Office to identify debt counselors to come and speak to the class. You might also arrange a field trip to a local bank or financial institution. 1Nasreddin Hodja (Turkish: 1208 - 1284) is one of the most loved and celebrated personalities of the Middle East. He was reputed to be very clever and cunning, as well as humorous. He seemed to have an answer for every situation that was not only comical but also had a note of encouragement. Collections of his jokes are in print. MM p. 1 Project FORWARD Curricula / Texas Education Agency & El Paso Community College Journal Entry: Is it important to establish a good credit history? Why or why not? Review: Ask the students to discuss their family members' ideas of what it means to be "credit-wise". INITIAL INQUIRY Develop a discussion with the students on credit cards using the following questions: 1. What does the term "plastic money" mean? 2. Do you have a different attitude toward credit cards than your parents did? Than your children do? 3. Do credit cards make it easy to "overspend"? Why or why not? 4. What do you do if a credit card is lost or stolen? Record student responses on the chalkboard or overhead projector. LEARNING ACTIVITY Credit cards are a common form of credit. They are issued by banks, financial service companies, and many retail stores. They can be used just about everywhere including stores, gas stations, restaurants, hotels, and even some food stores. VISA and MasterCard alone are accepted by over four million businesses in the U.S. Discuss with the class advantages to credit cards: 1. 1. 2. 3. 4. 5. They are convenient. You can buy something now and pay for it later You don't have to carry around a lot of cash. You can purchase things over the telephone. The bill is record of your purchases. They are a way to pay for something in an emergency. Discuss the disadvantages to using credit cards. 1. 2. 3. 4. You may buy more than you can afford since you don't need cash to do it. You have to pay interest on the unpaid balance you owe on the account. You may have to pay an annual fee which is usually between $15 and $40. You might be tempted to buy things impulsively or buy unnecessary things. MM p. 2 Project FORWARD Curricula / Texas Education Agency & El Paso Community College Applying For a Credit Card You can get applications for credit cards at banks or stores that offer the card. Applications generally ask for : Social Security Number Date of Birth Present Address Length of Time at Present Address Previous Address (if current address is less than 3 years) Indication of whether or not you have checking and/or savings accounts Employer Time with present employer Position Annual Salary Other annual income Monthly housing payment Total monthly credit payments Other credit cards Co-applicants' name, date of birth, social security number, and annual salary After you fill out the application, the bank or store that issues the card has to approve the application. Some cards are for one purpose such as buying gasoline or charging phone calls. Others are for a specific store, such as Sears or J.C. Penneys. Others are for many purposes, such as VISA, MasterCard, or American Express. You can use the card in place of cash at any place that accepts your card. You can also usually get cash from an ATM or bank using your card. If you have copies of credit applications, discuss the applications and practice filling them out. Correcting a Bad Credit Rating If you are turned down for a credit card or loan, you can change it by: 1. Paying every one of your bills. 2. Using collateral to get an installment loan. Then pay the loan in full, making payments on time. 3. Getting an account at a department store. Charge only a small amount and pay it off promptly. Read and discuss the Credit Card Tips handout published by the U.S. Department of Consumer Affairs. Paying on Credit Cards After a purchase on a credit card, the cost of the purchase is itemized on the next monthly bill from the credit card company. The credit card owner then has two options: * pay less than what you owe and pay interest on the remaining amount that you owe, or * pay all of the amount that you owe. Most credit card companies will not charge you interest if you pay your bill in full every month. MM p. 3 Project FORWARD Curricula / Texas Education Agency & El Paso Community College Many credit card users do not pay off their credit card bill every month which results in them paying interest on the amount owed. Credit statements state: * Your previous balance * The monthly finance charge * New purchases * Your last payment amount * The minimum payment you can make * The due date * Your new balance Comparing Charging to Saving When you buy an item on credit, you pay more for it if you have to pay interest. Suppose you pay 21% interest on your credit card on $650 worth of charges. Your interest for the month is $11.38 Now imagine that you save $650 to buy what you needed. You kept the money in a savings account that paid 5.25%. You earned $2.84 in simple interest and you did not pay $11.38 in interest by charging. ($14.22 = amount saved) The longer you leave savings in an account, the more you earn on your deposit. You also earn interest on the interest your deposit earns. It can be figured once a year (annual), twice a year (semi-annual), every three months (quarterly), or every day (daily). Self-paced Activities Activity 1: Ask these students to explain in writing the purpose of a credit card statement. Activity 2: Ask these students to explain what they would do if they found a discrepancy on their credit card statement. Activity 3: Ask these students to write their opinion on whether or not credit cards should be sent to teen-agers. MM p. 4 Project FORWARD Curricula / Texas Education Agency & El Paso Community College LANGUAGE EXPERIENCE Read this situation to the class: Beverly wants to buy a 2 head VCR with a remote control. An ad for a local rent club store states that she can "rent-to-own" by paying only $30.85 for 15 months. (The rentto-own agreement states that she will acquire ownership of the VCR when she pays the required number of payments for ownership.) The ad also indicates that this is quite a bargain because similar stores charge $43.81 for 18 months for the same VCR model. Beverly sees a similar model 2 head VCR with remote for sale at SEARS for $139. However, her credit history is not good and she doubts that can get a credit card or installment loan. She must save the money in order to purchase the VCR. Divide the class into 2 groups. One is to write the advantages to the "rent-to-own" option for purchasing the VCR, the other is to write the advantages to saving the money to purchase the VCR. Each group should also list the disadvantages to the other form of payment. Each group should present their case for the best method of payment to the class. Self-paced Activities Activity 1: Ask these students to write advice to Ralph who is 18 years old. He is $8000 in debt. He makes $18,000 a year at his job. He bought a car on credit. Then he furnished his apartment on credit. He buys most of his clothes on credit. Now he needs help. Activity 2: Ask these students to discuss in writing the "warning signs" of getting into financial trouble by using too much credit. Activity 3: Ask these students to write suggestions for using credit wisely. READING IN CONTEXT Read and discuss The Do's and Don'ts of Credit by Sylvia Porter. Comprehension Questions: 1. Which of the ideas were most meaningful to you personally? 2. Were there any ideas you disagreed with? 3. Are there any of the ideas you wish you had known earlier in your life? 4. Do you know of any personal stories where others could have used the information? 5. Which ideas are important to teach your children? MM p. 5 Project FORWARD Curricula / Texas Education Agency & El Paso Community College Ask the students to write their personal resolutions about credit cards. Sentences could begin with: "I am resolved that I will...." or "I promise myself that I will not..." PERSONAL DICTIONARY You might wish to review the following words: 1. ANNUAL--each year 2. BALANCE--the amount you owe after payment; amount left 3. CO-APPLICANT--second person agreeing to credit terms; also co-signer, or co-borrower 4. CONDITIONS--terms; special circumstances 5. CONTRACT--legal agreement 6. CONSENT--agree to; give permission 7. CONSUMER--buyer or borrower 8. CREDIT--ability to buy or borrow and pay at a later date 9. CREDIT TERMS--how you are to pay for a credit purchase or repay a loan 10. CREDITOR--person or business giving you credit; lender; seller 11. DEBTS--bills you owe; obligations 12. DEFAULT--nonpayment; failure to pay as agreed 13. DELINQUENT--late 14. DISCLOSURE--to make known; to state in writing; a written statement of the terms of a loan or credit agreement 15. DOWN PAYMENT--money paid in advance on credit purchase 16. ENTITLE--give the right to; permit; allow 17. FINANCE CHARGE--cost of having credit; monthly charge on credit agreement, usually used on charge card agreements 18. INSTALLMENT--monthly payment 19. INTEREST--cost of credit, usually used in loan agreements 20. LANDLORD--person who owns and rents out a house, apartment, or building 21. LEASE--a rent agreement 22. LIABILITY--legal responsibility 23. LIEN--a legal claim on your property for nonpayment of a debt 24. OPTION--choice 25. PERCENTAGE RATE--interest or finance charges stated as a percent of what you owe 26. RETAILER--seller or merchant; person or business giving credit 27. SUE--take to court 28. TENANT--person renting an apartment, a house, or a building 29. TITLE--legal document proving ownership 30. VIOLATE--fail to keep an agreement MM p. 6 Project FORWARD Curricula / Texas Education Agency & El Paso Community College HOME ACTIVITY Ask the students to bring in credit applications and find out the interest rates on credit accounts at stores and banks in your area. ADDITIONAL ACTIVITIES 1. Nancy wants to buy a car. She will have to borrow money to do it. Her aunt tells her that if she makes a big down payment, the loan will cost less. Ask the students to write an explanation of why this is so. 2. An advertisement for a new car in the paper says: $142.88 per month for 60 months Tax and license $598.56 Annual Percentage Rate (APR)2 12.74% Down payment $2000 A. How much does the car cost? ANSWER: $142.88 x 60 = $8572.80 (total payments) + $598.56 (tax and license) + $2000 (down payment) = $11,171.36 B. How much of the total cost is interest? Note that the 12.74% APR has already been figured into the monthly terms and down payment. To find out the cost of the loan (the interest), find the cost of the car without the added tax and license fee, then multiply by the APR. ANSWER: $8572.80 + $2000 = $10,572.80 x .1274 = $1346.97 interest 3. Read and discuss Dear Abby. 2 Annual Percentage Rate (APR) is the percent-per-year rate that is charged for using credit. The U.S. Truth-in-Lending law says that the person who gives credit must tell the borrower what the rate is. MM p. 7 Project FORWARD Curricula / Texas Education Agency & El Paso Community College CREDIT CARDS TIPS The following suggestions can help you when selecting a credit card company or using credit cards. 1. Keep in a safe place a list of your credit card numbers, expiration dates, and the phone number of each card issuer. 2, Credit card issuers offer a wide variety of terms (annual percentage rate, methods of calculating the balance subject to the finance charge, minimum monthly payments, and actual membership fees). When selecting a card, compare the terms offered by several card issuers to find the card that best suits your needs. 3. When you use your credit card, watch your card after giving it to the clerk. Promptly take back the card after the clerk is finished with it and make sure it is yours. 4. Tear up the carbons when you take your credit card receipt. 5. Never sign a blank receipt; draw a line through any blank spaces above the total when you sign receipts. 6. Save your purchase receipts until the credit card bill arrives. Then, open the bill promptly and compare it with your receipts to check for possible unauthorized charges and billing errors. 7. Write the card issuer promptly to report any questionable charges. Telephoning the card issuer to discuss the billing problem does not preserve your rights. Do not include written inquiries with your payment. Instead, check the billing statement for the correct address for billing questions. The inquiry must be in writing and must be sent within 60 days to guarantee your rights under the Fair Credit Billing Act. MM p. 8 Project FORWARD Curricula / Texas Education Agency & El Paso Community College 8. Never give your credit card number over the phone unless you made the call or have an account with the company calling. Never put your card number on a post card or on the outside of an envelope. 9. Sign new cards as soon as they arrive. Cut up and throw away expired cards. 10. If any of your credit cards are missing or stolen, report the loss as soon as possible to the card issuer. Check your credit card statement for a telephone number for reporting stolen cards. Follow up your phone call with a letter to each card issuer. The letter should contain your card number, the date the card was missing, and the date you called in the loss. 11. If you report the loss before a credit card is used, the issuer cannot hold you responsible for any unauthorized charges. If a thief uses your card before you report it missing, the most you will owe is $50 on each card. A special note of warning: If an automatic teller machine (ATM) card is lost or stolen, the consumer could lose as much as $500 if the card issuer is not notified within two business days after learning of the loss. 12. When writing checks for retail purchases and to protect yourself against fraud, you may refuse to allow a merchant to write your credit card number. However, if you refuse, the merchant might legally refuse to sell you the product. There is probably no harm in allowing a merchant to verify that you hold a major credit card and to note the issuer and the expiration date on the check. 13 If a merchant indicates he or she is using credit cards as back-ups for bounced checks, or refuses your sale because you refuse to provide personal information (including your phone number) on the bankcard sales slip, report the store to the credit card company. The merchant might be violating his or her agreement with the credit card companies. In your letter to the credit card company, provide the name and location of the merchant. Source: Consumer's Resource Handbook. U.S. Department of Consumer Affairs, Washington, D.C. MM p. 9 Project FORWARD Curricula / Texas Education Agency & El Paso Community College BASIC DO'S AND DON'TS OF CREDIT Excerpt from Sylvia Porter's Money Book No matter where you go for credit and no matter how many different types of loans you take out in the years to come, the basic do's and don'ts of credit will remain the same. Below you'll find them in the form of a simple check list to which you can refer again and again to make sure you are obeying the most fundamental of all credit rules. 1. DO'S Do always keep in mind that credit costs money. When you borrow you are renting money. 2. Do shop for credit as you shop for any other important purchase and buy your credit on terms that are best for you. 3. Do check with care the maximum amount of credit you can soundly and safely carry. 4. Do ask lots of questions about the credit deal you are being offered. Insist on a written statement showing all charges before you decide to buy. 5. Do ask yourself: would you buy the item for this amount of money in cash if you had the cash in your wallet right now? Would you buy as expensive an item as the one you are considering if you had the cash right now? 6. Do study your installment contract carefully and be sure you understand it before you sign it. When you sign, get a copy of the contract and keep it in a safe place. 7. Do keep receipts of your payment in a safe place. 8. Do pay off one major installment debt obligation before you take on another. Stagger your debts; don't pile them one on top of another. 9. Do make sure that in the installment plan that you sign, all your monthly payments are roughly equal and make sure this applies particularly to your last payment. Avoid the danger that you'll be faced with a very big final installment ("balloon" payment). 10. Do have the courage to say NO!! to an installment deal if any of the above warning signals are flying - any of them. 11. Do continue saving regularly as you buy on credit, even if you can save only a small amount each week. MM p. 10 Project FORWARD Curricula / Texas Education Agency & El Paso Community College 1. DON'TS Don't buy any item or service from any seller unless you have checked his/her reputation and have confidence that he is responsible. Use your common sense and make sure you are dealing with a reputable businessperson that you can come back to if your purchase turns out to be a lemon. 2. Don't buy anything you don't need or want - certainly not for credit. Learn how to handle highpressure selling. 3. Don't carry several charge accounts which are seldom or never paid up. Pay off each account periodically or you will be permanently in debt. 4. Don't use your debts to establish your budgeting "system". 5. Don't ever buy anything on credit unless you consult with your spouse or other person with whom you share financial responsibility. Make sure that both of you think the purchase is worthwhile. 6. Don't be in a hurry to sign any installment contract or agreement. 7. Don't make the mistake of thinking you can get out of an installment debt simply by returning the merchandise you bought from the seller. You probably signed two contracts: one was for the actual purchase and the second was for the money to finance the purchase. In most cases, your loan contract will be sold by the retailer at once to a bank or finance company and it is to this bank or finance company that you will have to continue making your payments in full - even though your TV set may not show a picture, or your dishwasher may not wash a dish, or your car may not move a mile. 8. Don't rely on verbal warranties or pledges of the salesperson or his/her boss. Get the warranties and pledges in writing. 9. Don't buy any item on credit which does not have a value that will outlast the installment payments. The key word is "value". 10. Don't buy anything on credit of which you will tire before you finish the installment payments. 11. Don't ever borrow money from a loan shark - even if you are desperate for cash. In fact, the more desperate you are for the money, the more insane it is for you to commit yourself to pay back interest rates ranging to 1,000 per cent a year and more for the money. This way lies financial disaster. 12. Don't sign any loan contract which contains blank spaces that could be filled in to your disadvantage. 13. Don't co-sign a loan for anyone unless you have complete faith in that person's ability and willingness to repay the loan. For, if the borrower whose note you co-sign defaults on the loan, you are responsible for paying off the entire indebtedness. MM p. 11 Project FORWARD Curricula / Texas Education Agency & El Paso Community College DEAR ABBY1 Dear Abby, The following incident just happened, and it occurred to me you could publicize it to warn others. One recent afternoon, a man phoned and asked if I was "Mrs. G." living at (my address). I verified the facts. Then he said he handles my account at the bank and asked me if I would be so kind as to get my Visa and MasterCard so he could check the numbers and expiration dates, as the bank is issuing new cards and he wanted the information to be correct. I laughed and told him he must be out of his mind to think I would give that kind of information over the telephone. Then I hung up. I called the police department and reported the incident, and I was transferred to the bunco squad, who happily took all the information and said I was a "smart lady" because, since the caller already had my name, address and telephone number, all he needed were my credit card numbers to make purchases by phone. Abby, please let people know that if they ever get a telephone call (supposedly from a bank employee) asking to "verify" their credit card numbers, they should get the person's name and call the bank to verify it. June G. in Del Mar, CA Dear June G., You are, indeed, a "smart lady" - and thanks for a valuable tip! You deserve a lot of credit. Do you know of other "scams"? Write an example here. 1 Abigail Van Buren is the most widely read advice columnist in the world. This column is dated Feb. 10, 1990. MM p. 12 Project FORWARD Curricula / Texas Education Agency & El Paso Community College