1. Why are broad-based shares a good idea?

advertisement

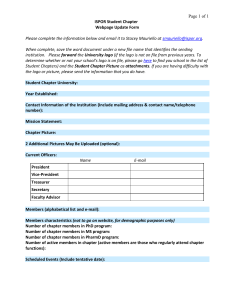

The Citizen’s Share Joseph Blasi, J. Robert Beyster Professor, Rutgers University School of Management and Labor Relations, NBER, IZA Richard B. Freeman, Herbert Ascherman Professor, Harvard, NBER, IZA, Centre for Economic Performance, LSE Your company logo here. Go to Master Slide to edit A Global Equity Historical Story Your company logo here. Go to Master Slide to edit Him, too? Yes! Your company logo here. Go to Master Slide to edit And him : the First U.S. Secretary of the Treasury Alexander Hamilton -Wrote glowingly of the share program -Supervised the Customs Officers confirming ships’ share programs Your company logo here. Go to Master Slide to edit Evidence on Broad-Based Shares, from the first days of US Republic “They were generally found the most attentive when their dependence was on a share of what they caught.” -Leading Philadelphia shipper Joseph Anthony, 1790 Your company logo here. Go to Master Slide to edit The British failed to develop a state-owned whaling industry without shares -Jealous of the U.S. whaling industry, Britain tried to create their own state-owned not based on shares. It failed even though Britannia Rules the Waves Your company logo here. Go to Master Slide to edit Our Talk Today: Three Points 1 Why broad-based shares are a good idea? 2 What does the U.S. example tell us about how broad-based shares work in reality? 3 Can shares expand in the EU and help the EU recover from current woes? Your company logo here. Go to Master Slide to edit 1. Why are broad-based shares a good idea? Your company logo here. Go to Master Slide to edit Diverse evidence using many data sets and methodologies from many countries shows that linking ownership and profit-sharing leads to better performance when there is a supportive corporate culture. Our employee & establishment studies, reviews of literature, including metastatistics, case studies, before-after studies –all give similar picture. But many managements have failed: -to use the scientific evidence to persuade their boards and shareholders to introduce or expand ownership plans. -to encourage inside researchers and academics to experiment with ways to develop share systems that best fit them. -to make the case to institutional investors (who often have their own employee share plans). Your company logo here. Go to Master Slide to edit A SOCIETAL PERSPECTIVE The Founders of the U.S. had a political-economy view of why expanded ownership of productive capital was important. They believed that democracy could not exist without broad-based ownership of business, initially land, craft shops, & shipping. The alternative was feudalistic rule by aristocrats or populist threats to property rights. Your company logo here. Go to Master Slide to edit They enacted government policies to make it easy to distribute property among heirs and to acquire shares: -outlawed primogeniture -favored low prices for land -implemented repeated share plans to allow more citizens to own key productive asset land: the Louisiana Purchase and the Homestead Act Your company logo here. Go to Master Slide to edit The Principles of the U.S. Founders -Every citizen should own part of the economy and receive income from this share to be economically and politically independent. -Citizens who shared fully in ownership and profits create a more productive economy. -This independence produced a society with small government, low taxes, less corruption, and a healthier civil society. Your company logo here. Go to Master Slide to edit Their message resonates today with rising inequality and huge economic problems recovering from Great Recession -Shares are not only about company incentive programs but about assuring democratic success against a march towards plutocratic feudalism or populist disorder. Your company logo here. Go to Master Slide to edit 2 What we’ve learned in the U.S. post the Old Fellows with wigs on US currency. First, society must go beyond land ownership, which is limited, to allow many citizens to acquire ownership of corporate assets. Second, government policies can affect the spread of ownership. So too can company policies independent of government programs. Your company logo here. Go to Master Slide to edit Generous U.S. Policies toward individual incentives *Employee Stock Purchase Plans – for Broad-Based plans workers can buy up to $25,000 of stock a year and hold it for two years and pay ordinary income tax on the gain up to the discount and lower capital gains after (but no corporate deductions) *Employee Stock Options –Unlimited tax deduction on spread between the grant price and exercise price for the corporation and worker. Further increase taxed at lower capital gains rates. *Restricted Stock –Unlimited corporate tax deductions of the value of stock grant on which worker pays ordinary income tax. Your company logo here. Go to Master Slide to edit Collective Employee Stock Ownership Plans (ESOPs) – for Broad-based Plans corporate tax deductions of the principal and interest on loans when the company purchases shares to be granted to workers and of dividends paid to the workers on the stock PLUS no capital gains taxes for sellers of more than a third of a company to the workers PLUS lower ordinary income tax rates for the worker since the plans generally pay out at retirement when tax rates are lower. VERY important for SMEs. Your company logo here. Go to Master Slide to edit -ESOPs, invented by Louis Kelso, allows worker trusts to buy large stakes of firms in a single transaction using loans the firm guarantees and pays for. Employees are not liable for the loans. They get grants. ESOP firms get tax breaks. -ESOPs are in 10,000 mostly closely-held firms with 11 million workers, about 3000 of which are majority or completely worker-owned. -ESOPs are main component of US broad-based equity system with associations of firms active in policy debate. Your company logo here. Go to Master Slide to edit Out Of a Labor Force of 107 million workers, 18% own company shares. 9% have options. In addition, profit-sharing or gainsharing plans cover even more workers so that in total 47% of US workers have a financial stake in their firm, mostly with a modest share of their income and wealth. Your company logo here. Go to Master Slide to edit 3. Can increased share ownership expand in the EU and help the EU in its economic crisis? Yes. -There are some ways to massively expand EU shares. -A new EU share-based ownership system can spur to macro-expansion that would give hope to countries facing years of austerity-driven joblessness. By increasing market demand for exports in EU troubled economies, it could also staunch the spread of the double/ triple dip Great Recession to the rest of Europe. Your company logo here. Go to Master Slide to edit A Huge Gap In Shares Between Europe and the U.S. -In principle employee financial participation is part of the European Social Model. -But 3.3% of workers in Europe have shares compared to 18% of workers in the U.S. Much of this difference is because few workers in SMEs have shares in the EU whereas over half of U.S. workers with shares are in SMEs. Your company logo here. Go to Master Slide to edit Shares in Europe expand slowly despite the financial crisis: % of employees in share plans increased from 9.1% to 13.5 % for profit sharing and 2.3% to 3.3% for employee owners, 2005-2010 (EU Parliament, 2012) Your company logo here. Go to Master Slide to edit One Proposal: The Lowitsch 28th Regime Idea -A new EU regulation would define a European Financial Participation Plan that companies could use EU-wide -Because it is optional it would not require compromise among EU member nations and companies could use the EU or the national model. -It would allow full portability for employees across all the EU countries. -Countries would retain sovereignty over tax legislation but make available Easy online tax software to deal with tax issues. -The goal is to make shares easier for large national and multinational firms. Your company logo here. Go to Master Slide to edit A Second Proposal: Encourage National Laws on ESOPs EU-Wide -Shares can be a major phenomenon in Europe if SMEs have a simple legal, tax, and regulatory regime for current owners to sell to an ESOP. -The business succession problem is the major problem of these firms. -ESOPs, invented by Louis Kelso, allow worker/manager groups to buy major stakes in one transaction using bank-approved loans paid back by the firm -National laws need to create a trust to purchase and hold the shares. -Supportive tax legislation for ESOPs requires workers to be exempt from income tax when the ESOP acquires shares. -ESOPs would receive a tax exemption on both interest and principal payments on a loan used to acquire shares from a seller -Owners of SMEs to be excluded from capital gains taxes on sales to ESOPs. Your company logo here. Go to Master Slide to edit A Third Proposal To Help Resolve The Current EU Economic Crisis? Jobs, GDP, sovereign debt crisis, divergence among economies with Euro. Rising inequality, increased numbers of working poor, danger of double-dip recession even in economies that have weathered the storm best, such as Germany and Sweden (which thanks Odin every night that citizens rejected its elite`s plan to join the Euro). HELP! My kingdom for an alternative. Your company logo here. Go to Master Slide to edit Example of troubled EU economy: Portugal – “Austerity‘s poster child“ -Has no policy tools to grow its GDP -Is locked into Euro so cannot depreciate -Deals with EU, IMF, ECB troika so no fiscal policy -No monetary policy -Weak labor institutions so no strong labor policies Your company logo here. Go to Master Slide to edit The Dilemma But ``alternativlos’ (no alternatives save for austerity) is the word on high. Suck it up, citizens. The elite knows, Troika leaches are the medicine of the day. Tell it to the Portuguese, the Spanish, the Greeks, whomever is going to be the next victim of the crisis, Tell it to the citizens throughout the EU who have lost faith in the European project. Alternativlos has it upside down. There no road to prosperity through years of low growth/declining GDP, mass joblessness, increased poverty, and economic misery. Your company logo here. Go to Master Slide to edit What you do when there is nothing you can do –June 1 Your company logo here. Go to Master Slide to edit Current lack of vision/absence of private sector and social partners in EU debate -With austerity policy failing,the EU has to find an alternative. -Troika loans to pay back banks (and reward speculators who own bonds?) do not grow an economy. -Equity or loans for productive investment grows an economy. -Idea is an EU citizens Marshall Plan for EU countries in trouble with investments in real economy not in bank balance sheets. Your company logo here. Go to Master Slide to edit A Plan to funnel savings into investment that creates goods and jobs and spreads share ownership. 1. EU financial organizations – private pension funds (Netherlands, UK, German Riester pensions, the Norwegian Sovereign Wealth Fund?) -- invest into a European Crisis Private Equity Fund that makes investments in firms which adopt some form of shared equity and undertake real investment projects in troubled EU. 2. To increase profitability, workers in those firms may take wage cuts for shares to obtain guaranteed equity or profit-sharing as the economy improves. 3. To involve SMEs, each country should adopt ESOP legislation to Your companyit logoeasier here. make for retiring owners to sell to workers/managers. Go to Master Slide to edit Government Encouragement -Could incentivize investors into the European Crisis Private Equity Fund: -Could provide some insurance/tax breaks for individuals who invest in the Fund (add-ons to what they do for mandated private pension schemes). -Could give tax benefits to returns from the Fund. -Lots of details for the devil, but private sector takes initiative outside politics and bank system to get money into viable projects instead of into bank balance sheets. Your company logo here. Go to Master Slide to edit Examples Historically some ESOPs form as part of concession bargaining in firms in trouble and succeed in saving jobs and firm. Some fail as well. US bailout of auto industry in Great Recession succeeded with govt moneys, Chapter 11 bankruptcy and large union cost concessions. Detroit Worker Bonuses Approach Records on Rising Profits (Bloomberg, Feb 2013). Ford’s $8,300 Chrysler $2,250. GM expected to exceed $7,325. For new Ford hires, who are paid about half what senior workers make, $8,300 adds 23 percent to their annual compensation of $36,000. Your company logo here. Go to Master Slide to edit Virtues By investing in share-owned firms, the EU could shift employment to more stable jobs. Citizens benefit on both sides of the transaction: those in prosperous countries get ownership stake in firms (Peter Drucker‘s famous analysis of pension fund ownership of shares, 1976); those in economic trouble get stake in own firm. Both benefit from recovery. Policy holds even if a troubled economy leaves Euro or if austerity keeps squeezing public sector. Your company logo here. Go to Master Slide to edit Who develops and leads this reform? Companies/social partners, not government. This is private sector response to disaster to real economy that is orthogonal to battles over austerity and Euro A Way to Start Private sector establishes commission to assess all three proposals, recommend national legal changes of share systems, advance “the 28th Regime” for large firms and ESOPs to encourage SMEs to follow the shared ownership route, and examine ways to establish the European Private Equity Crisis Fund. Your company logo here. Go to Master Slide to edit CONCLUSION ‘They’ cannot think of an alternative to austerity. So the door is open for chaos, collapse of European economy. But door is also open for reforming the EU economy and expanding shares. In English, equity has two meanings: fairness and ownership. Broad-based share ownership fulfills both meanings. Easier regulations for share plans EU-wide and equity investment from EU countries that weathered crisis best into firms with worker share ownership in troubled economies offers private sector alternative to escape economic disaster. Equity for all, YES! Your company logo here. Go to Master Slide to edit Sources: 1)The Capital Manifesto. Louis O. Kelso and Mortimer J. Adler. New York: Random House, 1958. Downloadable at: http://www.kelsoinstitute.org/download.html 2)The Citizen’s Share. Joseph Blasi, Richard Freeman, and Douglas Kruse. London: Yale University Press, 2013. 3)Jens Lowitzsch, Iraj Hashi et al. , Employee Financial Participation (EFP) in Companies’ Proceeds” Study for the European Parliament, Sept 2012. 4)Financial Participation of Employees in the European Union: Much Ado About Nothing? Christian Welz and Enrique FernandezMacias. European Journal of Industrial Relations, Volume 14, Number 4, 2008, 479-497. Report of the 2005 European Working Conditions Survey, European Foundation for the Improvement of Living and Working Conditions. 5)The Political Economy of Labor-Capital Income Imbalances: European Solutions. Ognian N. Hishow, German Institute for International and Security Affairs. Berlin, Germany, 2012. 6)The Evolution of Economic Inequality: Different Time Perspectives and Dimensions. United Nations Conference on Trade and Development. Geneva: UNCTAD, 2012. 7)Wealth, Inequality & Taxation. Thomas Piketty, Paris School of Economics. Presentation to the International Monetary Fund, September 27, 2012. 8)) Income Inequality in the European Union. Kaja Nonesmo Frederiksen. Paris: OECD Economics Department Working Papers No. 952, April 16, 2012. We thank Arne Peder-Blix of Accurate Equity and Mike Pewton of Global Share Plans for assistance. Global Share Plans allowed us access to their web site reviewing EU policies on share plans. We alone are responsible for the views in this presentation. Your company logo here. Go to Master Slide to edit