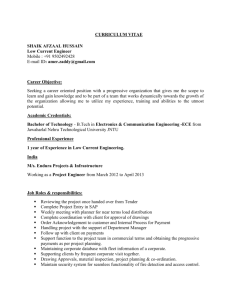

Merit Pay

advertisement

1 Chapter 12 Recognizing Employee Contributions with Pay After reading this chapter, you should be able to: Describe the fundamental pay programs for recognizing employees' contributions to the organization's success. List the advantages and disadvantages of the pay programs. List the major factors to consider in matching the pay strategy to the organization's strategy. Chapter 12 Recognizing Employee Contributions with Pay Explain the importance of process issues such as communication in compensation management. Describe how U.S. pay practices compare with those of other countries. Introduction Organizations have a relatively large degree of discretion in deciding how to pay. Differences in performance by an individual, group, organization, seniority, or skills determine the pay. Regardless of cost differences, different pay programs can have very different consequences for productivity and return on investment. How Does Pay Influence Individual Employees? Three different theories help explain compensation’s effects: Reinforcement Theory Expectancy Theory Agency Theory How Does Pay Influence Individual Employees? Reinforcement Theory - A response followed by a reward is more likely to recur in the future. Expectancy Theory - Motivation is a function of valence, instrumentality, and expectancy. Agency Theory -The interests of the principals (owners) and their agents (managers) may not converge. Types of agency costs include: perquisites attitudes towards risk decision-making horizons Agency Costs Agency costs may be minimized by the principal choosing a contracting scheme that helps align the interests of the agent with the interests of the principals. The type of contract depends partly on the following factors: risk aversion outcome uncertainty job programmability measurable job outcomes ability to pay tradition Programs for Recognizing Employee Contributions Programs differ by payment method, frequency of payout, and ways of measuring performance. Potential consequences of such programs are performance motivation of employees, attraction of employees, organization culture, and costs. Contingencies that may influence whether a pay program fits the situation are management style, and type of work. Merit Pay Incentive Pay Profit Sharing Skill-based Gain Sharing Ownership Merit Pay Merit pay programs link performanceappraisal ratings to annual pay increases. A merit increase grid combines an employee’s performance rating with the employee’s position in a pay range to determine the size and frequency of his or her pay increases. Some organizations provide guidelines regarding the percentage of employees who should fall into each performance category. Merit Pay Deming, who is a critic of merit pay, argues that it is unfair to rate individual performance because "apparent differences between people arise almost entirely from the system that they work in, not the people themselves.” Criticisms of merit pay include: the focus on merit pay discourages teamwork. The measurement of performance is done unfairly and inaccurately. Merit pay may not really exist. Individual Incentives Individual incentives reward individual performance, but payments are not rolled into base pay, and performance is usually measured as physical output rather than by subjective ratings. They are relatively rare because: Most jobs have no physical output measure. There are many potential administrative problems. Employees may do what they get paid for and nothing else. They typically do not fit in with the team approach. They may be inconsistent with organizational goals. Some incentive plans reward output at the expense of quality. Profit Sharing Under profit sharing, payments are based on a measure of organization performance (profits), and payments do not become a part of base pay. An advantage is that profit sharing may encourage employees to think more like owners. The drawback is that workers may perceive their performance has little to do with profit but is more related to top management decisions over which they have little control. Ownership Ownership encourages employees to focus on the success of the organization as a whole, but, like profit sharing, may not result in motivation for high individual performance. One method to achieve employee ownership is through stock options, which give employees the opportunity to buy company stock at a fixed price. Employee stock ownership plans (ESOPs) are employee ownership plans that give employers certain tax and financial advantages when stock is granted to employees. ESOPs can carry significant risk for employees. Gainsharing Gainsharing programs offer a means for sharing productivity gains with employees, and are based on group or plant performance that does not become part of the employee’s base salary. Conditions that should be in place for gainsharing to be effective include: management commitment the need to change or a process of continuous improvement management's acceptance and encouragement of employee input high levels of cooperation and interaction employment security information sharing on productivity and costs goal setting commitment and agreement of all parties standards that are understandable, fair, and related to objectives. Group Incentives and Team Awards Group incentives tend to measure performace in terms of physical output Team award plans may use a broader range of performance measures. Drawbacks are that individual competition may be replaced by competition between teams. Balanced Scorecard Some companies design plans that combine various elements of the above programs that are appropriate to the situation. The four categories of a balanced scorecard include: financial customer internal learning and growth Managerial and Executive Pay Top managers and executives are a strategically important group whose compensation warrants special attention. In some companies rewards for executives are high regardless of organizational performance. Executive pay can be linked to organizational performance (from agency theory). There has been increased attention to executive pay from regulators. The Securities and Exchange Commission (SEC) Process and Context Issues Three issues represent areas of significant company discretion and pose opportunities to compete effectively: Employee Participation in Decision Making Intertwined Effects of Pay and Process Communication Matching Pay Strategy and Organization Strategy Pay Strategy Dimensions Risk Sharing Time Orientation Pay Level (short-run Pay Level (long-run) Benefit Level Centralization of Pay Decisions Pay Unit of Analysis Organization Strategy Concentration Growth Low High Short-term Long-term Above Market Below Market Below Market Above Market Above Market Below Market Centralized Decentralized Job Skills