Principles of Economic Growth

advertisement

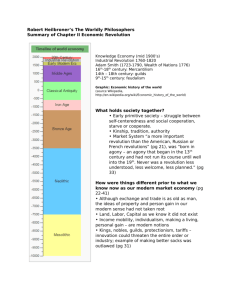

Chapter Two ROOTS AND BRANCHES Outline Chapter 2 Traces the history of economic growth theory Begins with Adam Smith who started it all Shows how Smith’s theory evolved, and culminated in the Harrod-Domar model Explains why Solow rebelled against classical growth theory … … and why and how endogenous-growth theory came about Roots and Branches The proximate causes of economic growth are the effort to economize, the accumulation of knowledge, and the accumulation of capital. ARTHUR LEWIS To change the rate of growth of real output per head you have to change the rate of technical progress. ROBERT SOLOW The first revolution: Adam Smith Saving and investment are by-products and precursors of domestic and foreign trade Theory of wealth creation, public policy, and economic growth size of the market division of labour efficiency The first revolution: Adam Smith Saving and investment stimulate growth direct effects through accumulation of capital indirect effects through labour productivity further indirect effects through interaction with exchange and trade, through foreign investment domestic market can take the place of foreign markets The first revolution: Adam Smith Smith’s reference to ‘private misconduct’ and the ‘publick extravagance of government’ Distinction between quantity and quality Mutual advantages of trade and growth, links to geography The first revolution: Adam Smith Benefits from division of labour If specialization increases efficiency and wealth and, thereby, economic growth, then ... ... just about anything that increases efficiency by the same amount, other things being equal, should be expected to have the same effect on growth. The first revolution: Adam Smith Benefits from division of labour So, if foreign trade enlarges the market and thus facilitates further division of labour à la Smith, thereby increasing wealth and growth, then ... ... all other equivalent means of increasing the efficiency or quality of labour, capital, and land should be expected to affect economic growth in the same way. The effort to economize Arthur Lewis The first revolution: Adam Smith Smith on education, efficiency, and growth Distinction between the quantity and quality of labour education, by increasing labour productivity, increases also efficiency and growth Smith feared the economic, political, and social consequences of inferior education among the masses He favoured public support for education The first revolution: Adam Smith - Summing up Economic growth = increase in the quantity and quality of the three main factors of production: labour, capital, and land Growth accounting is based on this classification Two shortcomings: quantity of land increase in the labour force does not really count as a source of economic growth Adam Smith’s followers Thomas Malthus Question of population David Ricardo Distribution of wealth and foreign trade Adam Smith’s followers John Stuart Mill rejected Malthus’s prediction that population would outgrow productive capacity more and better education would restrain population growth distribution a different matter than production but can be changed through policy Adam Smith’s followers Karl Marx Economic mechanisms driving production and distribution are closely related The limits to growth observed by Malthus are inescapable ‘technological unemployment’ Adam Smith’s followers Alfred Marshall organization as a fourth factor of production made explicit the connection between education and growth distribution of income and wealth matters for efficiency and growth ‘Knowledge is our most powerful engine of production ... Organization aids knowledge’ Adam Smith’s followers Joseph Schumpeter technology through invention, innovation, and entrepreneurship rent-seekers motivated by monopoly profits perfectly competitive markets … may not be very conducive to economic growth No rent to capture under perfect competition Static efficiency does not go along with dynamic efficiency, but ... Adam Smith’s followers John Maynard Keynes Accumulation of capital ‘Science and technical inventions’ ‘I draw the conclusion that, assuming no important wars and no important increase in population, the economic problem may be solved, or be at least within sight of solution, within a hundred years.’ Enter mathematics: Harrod and Domar Paul Samuelson’s Foundations of Economic Analysis (1948) laid the basis for mathematical economics, including the modelling of ... ... dynamic interactions among macroeconomic variables New lines of thought Enter mathematics: Harrod and Domar Net investment equals the increase in the capital stock … net of depreciation due to physical or economic wear and tear High level of investment entails an increasing level of the capital stock High levels of saving and investment are good for growth even if they are stationary, that is, not increasing By continuously augmenting the capital stock ... … even stationary levels of saving and investment relative to output drive output higher and higher, thus generating economic growth Enter mathematics: Harrod and Domar Efficiency is crucial for growth High level of efficiency stimulates growth by ... … amplifying the effects of a given level of saving and investment on the rate of growth of output All that is required is a steady accumulation of capital through saving and investment A given level of efficiency, including the state of technology will, then translate the capital accumulation into economic growth Enter mathematics: Harrod and Domar ... neatly formalized, simplified, and summarized the essence of almost 200 years’ theorizing about economic growth Harrod and Domar expressed the dynamic relationship between saving, efficiency, and growth in a simple equation which ... The Harrod-Domar model The Harrod-Domar model Economic growth depends on three factors: A. the saving rate B. the capital/output ratio C. the depreciation rate So, it is essentially all here, from Adam Smith onwards, in a single, simple equation: Growth depends on saving and efficiency, including depreciation The Harrod-Domar model Shortcomings: Neither theory nor empirical evidence seemed to provide much support for the capital/output ratio as an exogenous behavioural parameter in the model Proved fatal to the HarrodDomar model, as Solow was to show in 1956, or so it seemed a more elaborate formulation of the link between capital and output was called for The model did not leave much room for the other crucial factor of production, labour population or labour-force growth is absent from the formula, which explains output growth solely by saving and efficiency The second revolution: The neoclassical model Since population growth is basically a demographic phenomenon and, hence, exogenous from an economic point of view, it must follow that economic growth is also exogenous According to Solow, saving behaviour was no longer relevant for long-run growth, nor was efficiency in a broad sense, except insofar as it mattered for technology Economic growth was considered immune to economic policy, good or bad Even so, saving and efficiency play an important role for growth over long periods, that is, the medium term The second revolution: The neoclassical model Solow showed how the capital/output ratio, rather than being exogenously fixed as in the Harrod-Domar model, … is better viewed as an endogenous variable, which moves over time and ultimately reaches long-run equilibrium Once attained, the long-run equilibrium is consistent with not only a constant capital/output ratio … but also with a constant rate of growth of output per capita, a constant rate of interest, and a constant distribution of national income between labour and capital, all of which seemed to apply to the real world The second revolution: The neoclassical model The capital/output ratio is exogenous … possible to view growth as an endogenous variable: growth adjusts to the exogenously given capital/output ratio Solow reversed the roles of the rate of growth and the capital/output ratio He treated the capital/output ratio as an endogenous variable that adjusts over time to the exogenously given growth rate of output Growth is exogenous because its two main determinants, population growth and technological progress, are exogenous The third revolution: Endogenous growth The neoclassical growth model seemed unable to answer some burning questions about economic growth Is technological change exogenous from an economic point of view? Do economists really have nothing to say about economic growth in the long run? If output per capita grows at a rate that depends solely on - in fact, is equal to - the rate of technological progress, then why is it that the growth performance of different countries differs so radically over long periods? What does the neoclassical model tell us about relative growth performance anyway? The third revolution: Endogenous growth Do poor countries grow more rapidly than rich countries? What is the empirical evidence? Called for new thinking about economic growth The third revolution: Endogenous growth Key idea Technology is probably not exogenous More probably Technology depends on economic factors: the amount of capital available to workers - the capital/labour ratio The capital/output ratio turns out to be a constant after all The third revolution: Endogenous growth Economic growth free to respond to changes in saving and efficiency, and depreciation, even in the long run The Harrod-Domar model has thus been restored Endogenous technology makes economic growth also endogenous Throws all windows wide open The third revolution: Endogenous growth and development Arthur Lewis The effort to economize Accumulation of knowledge Accumulation of capital Economic growth responds to economic policy Economic growth obeys the same laws as economic development The third revolution: Endogenous growth - Summary Growth theory and the origins of economics Classical economists: viewed economic growth as endogenous The classical view was neatly summarized in a simple equation by Harrod and Domar Solow: economic growth depends on technology, and is exogenous in the long run Economic theorists went back to their drawing boards, and re-endogenized growth Questions for review 1. Suppose foreign trade stimulates economic growth as argued by Adam Smith, other things being equal. Does it follow that large countries with limited trade with the rest of the world should be expected to grow less rapidly than small countries with extensive foreign trade? Why not? 2. ‘A high saving rate ensures rapid economic growth.’ Is this statement true or false? Discuss. Questions for review 3. Explain how more and better education affects (a) the level of per capita GNP in the long run and (b) its long-run rate of growth according to I. the Harrod-Domar model; II. the Solow model; III. the endogenous-growth model. 4. Why does increased depreciation of capital reduce economic growth, other things being equal? Does it matter whether the depreciation is physical or economic? - i.e. whether it results from physical wear and tear or from low-quality investment decisions in the past. Classroom discussion