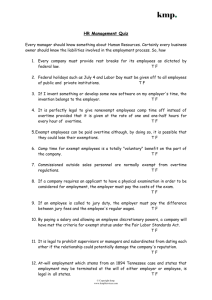

LO-1 - Cengage Learning

Payroll Accounting 2013

Bernard J. Bieg and Judith A. Toland

CHAPTER 2

CHAPTER 2

COMPUTING WAGES & SALARIES

Developed by Lisa Swallow, CPA CMA MS

Learning Objectives

•

•

•

•

•

Explain the major provisions of the Fair Labor Standards Act

Define hours worked

Describe the main types of records used to collect payroll data

Calculate regular and overtime pay

Identify distinctive compensation plans

What is Minimum Wage?

•

•

•

•

•

•

Includes all rates of pay including, but not limited to

Commissions

Nondiscretionary bonuses and severance pay

On-call or differential pay

Discretionary bonus (one which is not agreed upon or promised before hand) is not included in an employee’s regular rate of pay

•

•

•

•

Other types of compensation not included in regular rate of pay include

Gifts made as a reward for service

Payments for a bona fide profit-sharing plan

Vacation, holiday, sick day or jury duty pay

Vehicle, tool or uniform allowances

LO-1

Tipped Employees

•

•

•

•

•

“Tipped employee” regularly average more than $30/month in tips

Minimum tipped wages is $2.13/hour, therefore tip credit = $5.12/hour – but may be calculated differently based upon state law

Employee must make $7.25/hour when combining tips/wages ($7.25 x 40 = $290 minimum weekly gross)

Tip credit remains the same for overtime pay calculation purposes

•

•

Examples of tips received for 40-hour workweek

#1. Reported tips = $43

•

*40 hours x

$2.13/hour = $85.20

Is $85.20 (40 x $2.13 minimum tipped wage) + $43 > $290 (No - so employer must pay additional wages of $290 - $43 = $247)

#2. Reported tips = $1,189

• Is $85.20 + $1,189 > $290 - (Yes – so employer pays $85.20 wages)

Note: states’ tip credit percentages may differ from federal law

LO-1

Overtime Provisions & Exceptions

•

•

•

•

•

•

•

Workweek established by corporate policy

Must be seven consecutive 24-hour periods

For example 12:01 a.m. Saturday - 11:59 p.m. Friday

Some states require daily overtime (OT) over 8 hours (if state plan is more generous than FLSA, state law is followed)

FLSA sets OT pay at 1.5 times regular pay

Employer can require employees to work overtime

•

•

•

Exceptions to the above are as follows

Hospital employee, overtime for 80+ hours in 14 days or over 8 hours in a day (whichever is greatest)

Retail or service industry employees earning commission (special rules)

Employee receiving remedial education

LO-1

Exempt vs. Nonexempt Employees

“Exempt” means exempt from some, or all, of FLSA provisions

•

•

•

•

•

•

•

White-collar workers as outlined in Figure 2-2 (p. 2-10) are exempt

Executives, administrators, professionals

Business owners, highly compensated employees

Computer professionals and creative professionals

Outside salespeople

•

Test of exemption means employee must meet ‘primary duty’ requirements listed in Figure 2-2

Employee must be paid on salary basis at least $455/week

Blue collar workers are always entitled to overtime pay – includes police officers, EMTs, firefighters, paramedics and LPNs

Note: Putting someone on salary doesn’t mean he/she is exempt!!

LO-1

Determining Employee’s Work Time

•

•

•

•

•

•

•

•

•

•

Principal activities require exertion, and are required by the employer and for the employer’s benefit

Prep at work station is principal activity and in some situations changing in/out of protective gear may be part of workday

Travel (when part of principal workday) is compensable

Idle time and wait time (waiting to provide employer’s service)

Rest periods under 20 minutes are principal activities (can’t make employee

“check out”)

Meal periods are not compensable time unless employee must perform some tasks while eating – generally 30 minutes or longer

Work at home is principal activity for nonexempt employees

Sleep time is principal activity if required to be on duty < 24 hours

Training sessions (with certain caveats)

Waiting for doctor’s appointment on site

LO-2

Records Used for Timekeeping

•

•

•

•

FLSA requires certain time and pay records be kept

Time sheets indicate arrival/departure time of employee

Computerized time/attendance recording systems

•

•

Card-generated systems use computerized time cards

Badge systems employ badges in conjunction with electronic time clocks

•

•

Cardless and badgeless sytems require that an employee use their PIN number to process timekeeping

PC-based system allows employee to clock in via computer

Next generation technology includes touch-screen kiosks, web-based, biometrics and IVR (interactive voice response)

LO-3

Computing Wages/Salaries

Most common pay periods are as follows

•

•

•

• Biweekly (26) - 80 hours each pay period

Semi-monthly (24) - different hours each pay period

Monthly (12)- different hours each pay period

Weekly (52) - 40 hours each pay period

Employer may have different pay periods for different groups within same company!

LO-4

Calculating Overtime Pay

•

•

There are two methods

•

•

Most common method

Calculate gross pay (40 hours x employee’s regular rate)

OT rate then calculated by multiplying 1.5 x employee’s regular rate x hours in excess of 40

•

•

Other method

Calculate gross pay (all hours worked x employee’s regular rate)

•

Then calculate an overtime premium (hours in excess of 40 x overtime premium rate*)

Hourly rate x ½ = *overtime premium rate

These methods result in same total gross pay!

LO-4

Salaried Nonexempt Employees -

Fluctuating Workweek

•

•

•

•

•

Employee and employer may forge an agreement that a fluctuating schedule on a fixed salary is acceptable

Overtime is calculated by dividing normal salary by total hours worked

Then an extra .5 overtime premium is paid for all hours worked over 40 or

Can divide fixed salary by 40 hours – gives different pay rate each week

Then an extra .5 overtime premium is paid for all hours worked over 40

•

•

•

•

•

Alternative – BELO Plan

Appropriate for very irregular work schedule

Deductions cannot be made for non-disciplinary absences

Guaranteed compensation cannot be for more than 60 hours

Calculate salary as wage rate multiplied by maximum number of hours and then add 50% for overtime

LO-5

Piece Rate

•

• FLSA requires piecework earners to get paid for nonproductive time

Must equal minimum wage with OT calculated one of two ways

Method A

• Units produced x unit piece rate = regular earnings

•

•

• Regular earnings/total hours = hourly rate

Hourly rate x 1/2 = OT premium

Regular earnings + (OT premium x OT hours) = gross pay or

Method B

• (Units produced in 40 hours x piece rate) +

[(Units produced in OT) x (1.5 x piece rate)]

Note: two methods don’t give same results!!

LO-5

Special Incentive Plans

•

•

•

Special incentive plans are modifications of piece-rate plans

• Used to entice workers to produce more

Computation of payroll is based on differing rates for differing quantities of production

Example of incentive plan

•

•

• .18/unit for units inspected up to 2,000 units/week

.24/unit for units inspected between 2,001-3,500 units/week

.36/unit for units inspected over 3,500 units/week

LO-5