4464-chapter

advertisement

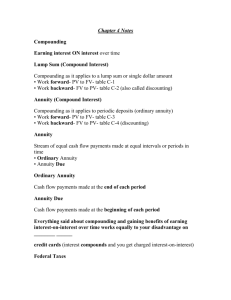

HFT 4464 Chapter 5 Time Value of Money 3/23/2016 1 Chapter 5 Introduction This chapter introduces the topic of financial mathematics also known as the time value of money. This is a foundation topic relevant to many finance decisions for a hospitality firm: Capital budgeting decisions Cost of capital estimation Pricing a bond issuance 5-2 Organization of Chapter Financial math will be presented in the context of personal finance. Later chapters will apply financial math to various finance applications for a hospitality firm. Financial math topics covered include: Computation of future values, present values, annuity payments, interest rates, etc. Perpetuities and non-constants cash flows Effective annual rates and compounding periods other than annual 5-3 Future Value of a Lump Sum The future value in 2 years of $1,000 earning 5% annually is an example of computing the future value of a lump sum. We can compute this in any one of three ways: Using a calculator programmed for financial math Solve the mathematical equation Using financial math tables (Table 5.1) p. 91 5-4 Solve for the Future Value The general equation for future value is: FVn = PV x (1+i)n Computing the future value in the example: FV2 = $1,000 x (1+5%)2 = $1,102.50 5-5 Present Value of a Lump Sum How much do you need to invest today so you can make a single payment of $30,000 in 18 years if the interest rate is 8%? This is an example of the present value of a lump sum. Again we can solve it using a programmed calculator, solving the math or using Table 5.2. p.93 5-6 Solve for the Present Value The general equation for present value is: FVn PV n 1 i Computing the present value in the example: $30,000 PV $7,507.47 18 1 8% 5-7 Annuities Two or more periodic payments All payments are equal in size. Periods between each payment are equal in length. 5-8 PV Versus FV of an Annuity The value of an annuity can be expressed as an equivalent lump sum value. The PV of an annuity is the lump sum value of an annuity at a point in time earlier than the payments. The FV of an annuity is the lump sum value of an annuity at a point in time later than the payments. 5-9 Ordinary Annuity Versus Annuity Due The PV of an ordinary annuity is located one period before the first annuity payment. (Paid at the end of each period) The PV of an annuity due is located on the same date as the first annuity payment. (Paid at the beginning of each period) The FV of an ordinary annuity is located on the same date as the last annuity payment. (Last annuity payment is at the end of the last period) The FV of an annuity due is located one period after the last annuity payment. ( Last annuity payment is at the beginning of the last period) 5-10 Future Value of an Annuity Suppose you plan to deposit $1,000 annually into an account at the end of each of the next 5 years. If the account pays 12% annually, what is the value of the account at the end of 5 years? This is a future value of an annuity example. We can solve this problem using a programmed calculator, solving the math, or using Table 5.4. (p. 96) 5-11 Solve for the Future Value of an Annuity The general equation for a FV of an annuity is: 1 i n 1 FVA n PMT x i The FV of the annuity in the example is: 1 12% 5 1 FVA 5 $1,000 x $6,352.85 12% 5-12 Present Value of an Annuity You plan to withdraw $1,000 annually from an account at the end of each of the next 5 years. If the account pays 12% annually, what must you deposit in the account today? This is an example of a present value of an annuity. We can solve this problem using a programmed calculator, solving the math, or using Table 5.5. ( p. 102) 5-13 Solve for the Present Value of an Annuity The general equation for PV of an annuity is: 1 1 - 1 i n PVA n PMT x i The PV of the annuity in the example is: 1 1 1 12%5 $3,604.78 PVA 5 $1,000 x 12% 5-14 Perpetuity—An Infinite Annuity A perpetuity is essentially an infinite annuity. An example is an investment which costs you $1,000 today and promises to return to you $100 at the end of each forever! What is your rate of return or the interest rate? PMT $100 i 10% PV $1,000 5-15 The Present Value of a Perpetuity Another investment pays $90 at the end of each year forever. If 10% is the relevant interest rate, what is the value of this investment to you today? We need to solve for the present value of the perpetuity. PMT $90 PV $900 i 10% 5-16 Present Value of a Deferred Annuity There are 3 different PV of annuity computations: The payments on an ordinary annuity begin one period after the PV. The payments on an annuity due begin on the same date as the PV. The payments on a deferred annuity begin 2 or more periods after the PV. Thus it is called a deferred annuity since the payments are deferred more than one period from the present. 5-17 Computing the PV of a Deferred Annuity An investment promises to pay $100 annually beginning at the end of 5 years and continuing until the end of 10 years. What is the value of this investment today at a 7% interest rate? Because the payments are deferred 5 years, this is a PV of deferred annuity problem. 1st step:Compute the PV of an ordinary annuity. 1 1 1 7% 6 $476.65 PVA $100 x 7% 5-18 Computing the PV of a Deferred Annuity 2nd step : Discount the PV of the ordinary annuity through deferral period. 1 1 - 1 7%6 1 x PV $100 x 4 7% 1 7% 1 PV $476.65 x $363.63 4 1 7% 5-19 General Formula for PV of a Deferred Annuity 1 1 1 i n PV PMT x i 1 x m 1 i PMT = $ amount of the perpetuity payment i = interest rate n = the number of perpetuity payments m = the deferral period minus 1 5-20 PV of a Series of Non-Constant Cash Flows The PV of a series of non-constant cash flows is just the sum of the individual PV equations for each cash flow. CF1 CF2 CFn PV ............. 1 2 1 i 1 i 1 i n Where the Cfi’s are a series of non-constant cash flows from year 1 to year n. 5-21 PV of a Series of Non-Constant Cash Flows Suppose some new kitchen equipment for your restaurant is expected to save you $1,000 in 1 year, $750 in 2 years, and $500 in 3 years. What is the PV of these cost savings today if 10% is the relevant interest rate? $1,000 $750 $500 PV $1,904.58 1 2 3 1 10% 1 10% 1 10% 5-22 Compounding Periods Other Than Annual Future value of a lump sum. i nom FVn PV x 1 m inom mx n = nominal annual interest rate m = number of compounding periods per year n = number of years 5-23 Compounding Periods Other Than Annual A $1,000 investment earns 6% annually compounded monthly for 2 years. 12 x 2 6% FV2 $1,000 x 1 12 FV2 $1,000 x 1 0.5% $1,127.16 24 5-24 Compounding Periods Other Than Annual PV of a lump sum uses a similar adjustment to the basic equation for non-annual compounding. PV FVn i nom 1 m mx n inom = nominal annual interest rate m = number of compounding periods per year n = number of years 5-25 Compounding Periods Other Than Annual Annuity computations require the annuity period and the compounding period to be the same. For example, suppose a car loan for $12,000 required 20 equal monthly payments and uses a 12% annual rate compounded monthly. The annuity payments and the compounding periods are both monthly. The interest rate needs to be expressed as a monthly rate: I = 12% / 12 = 1% 5-26 Compounding Periods Other Than Annual The car loan payment can be computed with the following equation: 1 1 1 1.00% 20 $12,000 PMT x 1.00% And the car loan payment = $664.98. 5-27 Effective Annual Rate An effective annual rate is an annual compounding rate. When compounding periods are not annual, the rate can still be expressed as an effective annual rate using the following: m i nom Effective Annual Rate 1 1 m inom = nominal annual rate m = number of compounding periods in 1 year 5-28 Effective Annual Rate A bank offers a certificate of deposit rate of 6% annually compounded monthly. What is the equivalent effective annual rate? 12 6% 12 1 1 1 0.5% - 1 6.17% 12 5-29 Amortized Loans Amortized loans are paid off in equal payments over a set period of time and can be viewed as the PV of an ordinary annuity. An amortization schedule follows for a $120,000 mortgage to be paid of with 360 monthly payments of $965.55 each over 30 years. The interest rate is 9% annually compounded monthly or 0.75% per month. 5-30 Loan Amortization Schedule Month Payment Interest Principal Balance 0 1 2 3 4 $965.55 965.55 965.55 965.55 $900.00 899.51 899.01 898.51 $65.55 66.04 66.53 67.03 $120,000.00 119,934.45 119,868.41 119,801.88 119,734.85 357 358 359 360 965.55 965.55 965.55 965.55 28.43 21.40 14.32 7.19 937.12 944.14 951.23 958.36 2,853.73 1,909.58 958.36 0.00 5-31 Loan Amortization Schedule A loan amortization schedule shows: The amount of each payment apportioned to pay interest. The amount paid towards interest declines since the principal balance is declining. The amount of each payment apportioned to pay principal balance. The amount paid towards principal balance increases as the interest amount declines. The remaining balance after each payment. 5-32 Summary FV (p. 91)& PV of a lump sum (p. 93) FV (p 96) & PV (p 102) of an annuity and PV of a perpetuity PV of a series of non-constant cash flows Compounding other than annual and effective annual rates Loan amortization schedule 5-33 Homework Problems 1,2,3,4,13 and Problem Sheet on the website 5-34