Employee Fee Waiver Presentation

advertisement

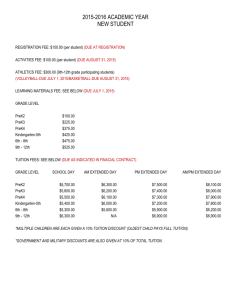

November 3, 2015 1 2 Agenda Fee Waiver Basics Eligibility Program Benefits Exclusions Dependent Transfer Procedures Forms 3 Agenda Admissions Financial Aid Registration Tuition & Fees 4 Program Benefits Tuition is waived for two courses or 6 units per semester, whichever is greater If the unit/course limitation is exceeded, the employee must pay the difference in fees Fees are reduced Only state-funded courses & the Summer Arts Program are eligible Extended Education courses are excluded Release time to attend one course subject to management approval 5 Eligibility Full-time or part-time permanent staff employees Full-time probationary employees Full-time managers Tenured, probationary, and temporary faculty with a 3-year appointment FERP participants are eligible for fee waiver only during the semesters when they are actively employed Coaches with at least 6 consecutive years of full-time equivalent service 6 Eligibility Must maintain at least a 2.0 G.P.A. each semester 7 Transfer of Benefit Spouse or registered domestic partner Dependent child (subject to age restrictions) Your child or stepchild under age 25 who has never been married A child, under age 25 living with you in a parent-child relationship who is economically dependent upon you and has never been married Your child or stepchild age 25 or above who is incapable of self-support due to a disability which existed prior to age 25 For SUPA (Unit 8), the age limit for dependent children is under age 23 using the same definitions above Must be matriculated toward a degree or attainment of a teaching credential If both parents are eligible employees, their dependent may enroll in up to four (4) courses or 12 units, whichever is greater Only one person at a time Refer to collective bargaining agreements for details 8 Employee Pathways Job Related Career Development Update knowledge, skills, and Employees apply and are abilities, improve work performance or be ready for upcoming changes in job duties Employees are not matriculated students and not working towards a degree admitted as matriculated students working toward a degree 9 Career Development Plan The course of study will be established by the employee and assisted by an advisor of choice selected by the employee. Subject to approval by the appropriate administrator Updated every semester 10 Tuition & Fees Application Fee – only one campus fee is waived or reimbursed regardless of the number of applications submitted The full tuition is waived if an employee takes only two courses, even if they exceed 6.0 units Tuition & Fee Table 11 CSU Doctorate of Education (Ed.D) The Doctorate Tuition Fee will be charged in lieu of the Tuition Fee. Eligible employees or dependents that enroll in the Doctoral program are required to take specified coursework (e.g., one, two or three courses) per term. The Doctorate Tuition Fee is a flat fee; there is no parttime rate. As a result, the full Doctorate Tuition Fee is waived. 12 Taxes All graduate level tuition fees waived for an employee’s spouse or dependent child are considered taxable income. Undergraduate and graduate fees waived for an employee’s domestic partner is considered taxable income. The Payroll Department reports fee waiver-related imputed taxable income to the IRS. 13 Forms & Procedures Non-Matriculated employees (not seeking a degree) – complete the following forms & submit to HR: Employee Fee Waiver Application form Non-Matriculated Application form Employees seeking a degree (career development path) – complete the CSU Admission Application and submit to Admissions; complete the following forms after being accepted to the university: Employee Fee Waiver Application form Career Development Plan Employees transferring benefits to dependents – submit form & unofficial transcript (if not attending CSUMB) to HR: Dependent Fee Waiver Transfer Application 14 Forms & Procedures A new Fee Waiver Application must be submitted to HR for approval for each semester to continue participation in the program Proof of good academic standing required (CMS unofficial transcript) Approved forms are routed by HR to: Fee Waiver Coordinator at appropriate campus of attendance ; or CSUMB’s Registrar and STAR Forms & info are available online 15 Tips and Traps Career development students must apply to and be accepted by the university A fee waiver application does NOT guarantee admission to the university Lab classes with a different catalog number than the lecture class that goes with it will be counted as a separate class The dependent fee waiver applies only to certain fees incurred by California residents Spouses, domestic partners and dependent children who do not meet established in-state residency requirements will be responsible for paying non-resident tuition charges based upon the total number of units in which they are enrolled. 16 An eligible employee who is on an approved leave of absence may enroll for more than 6 units in accordance with the following schedule: Percentage of leave Maximum semester or quarter units One-fourth but less than one-half 9 One-half but less than three-fourths 12 Three-fourths but less than full 15 Full Not limited 17 18 19 20 21 To avoid the $25.00 late registration fee, matriculated students must register prior to the 1st day of the term Students are responsible for staying informed about registration and tuition/fee payment deadlines 22 The Finish Line with Monty 23 • • • Terri Giroux – CSUMB Fee Waiver Coordinator – x4426 or tgiroux@csumb.edu Jennifer Jennings – CSUMB STAR Technician – x4728 or jjenings@csumb.edu Cynthia Olvera – CSUMB Records & Registration Coordinator – x4228 or colvera@csumb.edu 24