PowerPoint Slides for Chapter 5

advertisement

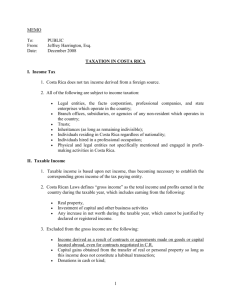

Overview of Taxable Income and Tax Liability Individuals Gross Income $XX Less: Above-the-line Deductions XX AGI $XX Less: Greater of Standard or Itemized Deductions XX Less: Exemptions XX Taxable Income $XX C Corporations Gross Income Less: Deductions Taxable Income $XX XX $XX Tax Liability Rate schedule applied to Taxable Income Less: Credits Regular Tax Liability$XX Pay greater of Regular Tax Liability or AMT 5-1 $XX XX Gross Income Defined • General Definition. Gross income means all income from whatever source unless excluded by law. Gross income includes income realized in any form, whether in money, property, or services. Income may be realized, therefore, in the form of services, meals, accommodations, stock, or other property, as well as in cash. [Source: Reg. Sec. 1.61-1(a)] 5-2 Examples of Taxable Gross Income • Which of the following would be included in gross income? – – – – – – 5-3 Wages, salaries, tips, bonuses Income from the sale of goods or services Income from illegal activities Interest, dividends, rent and royalty income Income from annuities and conduit activities Gains from the sale of investments assets Non-Cash Income • Receipt of property as compensation for services results in income equal to the fair market value of the property received – FMV = Arm’s-length price – Issue: How do we determine value? • Example: Shares of stock in a public company versus a closely-held company • Discharge of Indebtedness results in income to the debtor (unless insolvent) 5-4 Sales and Exchanges • Gross income includes Gain (Loss) realized on a sale or exchange of property, to the extent that the amount realized exceeds (is less than) the taxpayer’s basis in the property – A sale occurs when the amount realized is cash – In an exchange of property for non-cash consideration, the amount realized equals the fair market value of the asset received – Basis, generally equals the taxpayer’s investment in the property 5-5 Exclusions from Gross Income - Business Related Items • Nontaxable returns of capital – Basis of assets sold or exchanged – Principal payments received on loans • Many employee fringe benefits • Life insurance proceeds • State and municipal bond interest 5-6 Business Deductions • All the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business – Ordinary means common or customary for that type of business – Necessary means helpful and appropriate to the production of business revenues – Must also be reasonable in amount 5-7 Limits on Deductibility • Public policy considerations – Fines, bribes not deductible – Political contributions, lobbying expenditures not deductible – Federal income taxes not deductible • Expenses to generate tax exempt income are not deductible – Premiums paid on key-man life insurance – Expenses of investing in tax exempt bonds 5-8 Limits on Deductibility continued • Meals and Entertainment - must be either: – ‘Directly related’ to conduct of trade or business • Incurred in a business setting with expected business benefit – ‘Associated with’ conduct of trade or business • Clear business purpose – For entertainment, must directly precede or follow a bona fide business discussion – For meals, there must be a bona fide business discussion during, immediately proceeding or following the meal – Only 50% of cost is deductible 5-9 Limits on Deductibility continued • Travel Expenses: – Transportation costs are fully deductible, if business is ‘primary purpose’ of trip – Lodging, cab fares, etc. during business portion of trip are fully deductible – Meals during business portion of trip subject to 50% limit on deductibility • No deduction for club dues (business, social, athletic, golf, etc.) 5-10 Business Bad Debts • Under GAAP, many companies recognize bad debt expense using the reserve method, expensing the annual addition to the reserve (contra-asset) and reducing the reserve for actual write-offs – Annual addition based on estimate of accounts that will be uncollectible • Business bad debts may be deducted for tax purposes only when receivable is determined to be worthlessness and written off the books 5-11 Timing Issues • Taxable year – What types of taxpayers general use a calendar year? – What types of taxpayers are allowed to use another fiscal year? How is such fiscal year selected? • Timing also depends on – Realization versus recognition – Taxpayer’s method(s) of accounting 5-12 Realization Criteria • Realization occurs when the earnings process is complete - requires an external transaction involving a change in the form or substance of the taxpayer’s property or property rights • Under GAAP, income is typically recorded when realized • For tax purposes, income is typically recognized (included in taxable income) when realized, but there are many exceptions! 5-13 Methods of Accounting • General rules: – taxable income is computed using the overall method of accounting adopted for financial accounting purposes – method of accounting must ‘clearly reflect income’ • What types of taxpayers generally use the cash method for tax purposes? • What types of taxpayers generally use the accrual method? • What taxpayers are required to use the accrual method? 5-14 Methods of Accounting continued • Hybrid method: accrual method for inventory, cash method for all else • Special methods for specific transactions – Examples: • Inventory methods (FIFO, LIFO, LCM) • Installment method • Completed contract versus percentage-ofcompletion method for long-term contracts – Some special methods are elective, others are required if transaction meets qualifications 5-15 Accounting Methods and Income Issues • Cash-basis taxpayers must recognize income in year in which they have ‘constructive receipt’ – Occurs when no substantial barrier exists to the taxpayer’s control and possession of income • Accrual-basis taxpayers must recognize prepaid income in year in which cash is received, regardless of when earned 5-16 Accounting Methods and Deductibility Issues • Expense prepayments by cash-basis taxpayers must be amortized over useful life if create an asset which will not be consumed by the close of the next taxable year – Examples: Prepaid rent, bulk purchases of offices supplies – Prepaid interest deductible only in year due 5-17 Deductibility Issues continued • Accrued expenses must meet the all events test to be currently deductible – For routine accruals, all events must have occurred to establish the fact of the taxpayer’s liability and the amount must be reasonably determinable – For nonrecurring or extraordinary accruals, economic performance must occur before a deduction is allowed - generally occurs when services or property are actually provided to or by the taxpayer 5-18 Deductibility Issues continued – Economic performance not required if: • economic performance occurs within the shorter of 8 1/2 months or a reasonable period after the close of the tax year and • the expense is recurring and the taxpayer is consistent in treatment of the accrual and • the item is not material or accrual results in a more proper matching of income and expense and • the item does not arise from a tort, breach of contract, violation of law, or claim under workman’s compensation and • the all events test is met 5-19 Example: Economic Performance • Big Oil Co. enters into an offshore oil drilling lease in 2001. In 2002, Big installs a platform and commences drilling. The lease obligates Big to remove its platform and well fixtures upon abandonment of the well or termination of the lease. Based on past experience, Big estimates that the well will be productive for 10 years, at which time it will cost $2 million for removal. When can Big deduct these costs for financial accounting purposes? For tax purposes? 5-20 Deductibility of Losses • Losses on sales or exchanges of assets – Generally, losses related to tangible assets used in the conduct of a trade or business are fully deductible as ordinary losses – Losses related to intangible assets or assets held for investment purposes are capital losses whose deductibility is subject to special limits – Losses on sales to related parties generally not deductible – Much more coverage of these topics later 5-21 Deductibility of Losses continued • Net Operating Loss - excess of allowable business deductions over business gross income – Carried back as a deduction against any taxable income reported in 2 preceding years • Results in immediate refund of taxes previously paid • Taxpayer may elect to forego carry back – Any excess may be carried forward for 20 years 5-22 Book/Tax Differences • Temporary (timing) differences – Occur when an item of income (expense) is taxable (deductible) in a different year than when included in income for book purposes – Will ‘reverse’ over several years - eventually the item is included in both book and taxable income • Permanent differences 5-23 – Occur when an item of income (expense) included in book income will never be taxable (deductible) or vice versa – Never reverse List of Book/Tax Differences Permanent Differences Temporary Differences • Municipal bond interest • Prepaid income • Life insurance proceeds and related premiums • Bad debt reserves • Non-deductible fines, penalties, political contributions and lobbying expenditures • Federal income taxes • 50% of meals and entertainment 5-24 • Accrued expenses subject to economic performance rules