Practice Questions for the PA State Realtor Exam

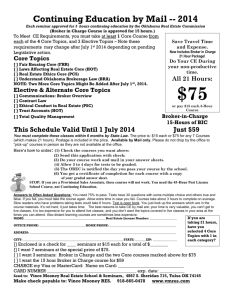

advertisement