Properties of Interest Rates

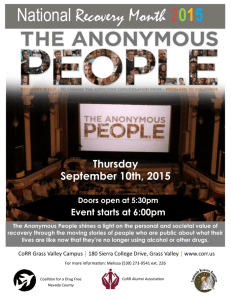

advertisement

Interest Rates Empirical Properties The Nominal Interest Rate Suppose you take out a $1000 loan today. You agree to repay the loan with a $1050 payment in one year. Interest = Payment (Face Value) – Principal (Price) Interest = $1,050 - $1,000 = $50 Interest Rate = (Interest/Principal) Interest Rate = ($50)/($1,000) = .05 (5%) Per Year This is the one year spot rate INTEREST RATES ALWAYS HAVE A TIME PERIOD ASSOCIATED WITH THEM!!! Annualizing Suppose that you invest $1 at a quarterly interest rate of 2%. What is your annual return? $1 $1.02 X (1.02) X (1.02) $1.04 X (1.02) $1.06 $1.082 X (1.02) (1.02)(1.02)(1.02)(1.02) = 1.082 = 8.2% Note: It is generally a safe approximation to multiply by 4 Annualizing Suppose you earn a cumulative interest rate of 5% over a 4 year period. What is your annualized return? $1 $?? X (1+i) $?? X (1+i) $?? X (1+i) $1.05 X (1+i) (1+i)(1+i)(1+i)(1+i) = 1.05 (1+i) = (1.05)^(.25) = 1.012 = 1.2% Note: Its generally a safe approximation to just divide by 4 The Yield Curve 6 4 2 0 1 yr 2 yr 5yr 10 yr 20yr Spot Rates are interest rates charged for loans contracted today: S(1), S(2), S(3), etc… The Yield curve is a listing of current spot rates for different maturities (on an annualized basis) Forward Rates Forward rates are interest rates for contracts to be written in the future. (F) F(1,1) = Interest rate on 1 year loans contracted 1 year from now F(1,2) = Interest rate on 2 yr loans contracted 1 year from now F(2,1) = interest rate on 1 year loans contracted 2 years from now S(1) = F(0,1) Forward rates are not explicitly stated, but are implied through observed spot rates Calculating Forward Rates The current annual yield on a 1 yr Treasury is 2.0% while a 2 yr Treasury pays an annual rate of 2.6% $1(1.02) = $1.02 ($1 invested for 1 year) $1(1.026)(1.026) = $1.053 (invested for two years) ($1.02)(1+F(1,1)) = $1.053 Therefore, the implied return from the 1st year to the second is $1.053/$1.02 = 1.032 = F(1,1) = 3.2% Calculating Forward Rates The current annual yield on a 2 yr Treasury is 2.6% while a 3 yr Treasury pays an annual rate of 2.9% $1(1.026)(1.026) = $1.053 (invested for two years) $1(1.029)(1.029)(1.029) = $1.09 (invested for 3 years) ($1.053)(1+F(2,1)) = $1.09 Therefore, the implied return from the 2nd year to the third is $1.09/$1.053 = 1.035 = F(2,1) = 3.5% Spot Rates & Bond Prices Zero Coupon (Discount) Bonds are convenient because they only involve one payment. Maturity date (Term) Face Value (Assume $100) A 90 Day T-Bill is currently selling for $99.70 Yield (Yield to Maturity) = ($100 - $99.70)/$99.70 = .003 (.3%) Annualized YTM = (1.003)^(365/90) = 1.012 (1.2%) Spot Rates & Bond Prices STRIPS (Separately Traded Registered Interest and Principal) were created by the Treasury department in 1985. Maturity date (Term) Face Value (Assume $100) A 10 Yr. STRIP is selling for $63.69 YTM = ($100 - $63.69)/$63.69 = .5701 (57.01%) Annual YTM = (1.5701)^(.1) = 1.0461 (4.61%) Forward Rates and Bond Prices STRIP prices also imply forward rates… An August 2015 STRIP is currently selling for $63.55 while an August 2014 STRIP is selling for $68.07. F(9,1) = $68.07/$63.55 = 1.07 = 7% Interest Rates & Bond Prices Consider a 1 year, $100 Now, consider the same 1 discount bond with a price year, $100 discount bond of $98.00 with a price of $94.00 i = ($100 – $98.00) *100 =2% i = ($100 – $94.00) *100 = 6.4% $98.00 $94.00 Higher bond prices are associated with Lower Returns!! Interest Rates & Bond Prices What’s the difference between a bond price and an interest rate? They are both relative prices Interest Rate = Price of a current $ in terms of foregone future dollars. Bond Price = Price of a Future $ in terms of foregone current dollars Interest Rates in the US (1984 – 2004) 14 12 10 8 6 4 2 0 1/1/84 1/1/89 1/1/94 1 YR TBILL 1/1/99 1/1/04 1 Year Treasury Rate 18 16 14 12 10 8 6 4 2 0 1/1/59 1/1/64 1/1/69 1/1/74 1/1/79 1/1/84 1/1/89 1/1/94 1/1/99 1/1/04 Interest Rates in the US Term Federal Funds Mean 1Yr TBill 5 Yr. TBill 5.88 Std. Dev. 2.98 Corr (+1) .988 Corr (+2) .968 Corr (+3) .949 Corr (+4) .934 10 Yr. TBill Interest Rates in the US 16 14 12 10 8 6 4 2 0 1/1/84 1/1/89 1 YR 1/1/94 5 YR 10 YR 1/1/99 Fed Funds 1/1/04 Interest Rates in the US Term 1Yr 5 Yr. 10 Yr. Mean Federal Funds 5.80 5.88 6.49 6.69 Std. Dev. 3.39 2.98 2.75 2.68 Corr (+1) .986 .988 .992 .994 Corr (+2) .961 .968 .979 .985 Corr (+3) .937 .949 .968 .976 Corr (+4) .915 .934 .957 .969 Correlations 1YRTB 5YRTB 1YRTB 5YRTB 10YRTB 1 0.966104 0.934983 1 0.993211 FF 0.973375 0.914724 10YRTB 1 0.879391 FF 1 Interest Rates Mean reverting (stationary) Long term rates are less volatile than short term rates Long term rates show more persistence than short term rates High degree of persistence Highly correlated with one another (long rates less correlated with shorter rates) Interest Rates & Inflation 14 12 10 8 6 4 2 0 1/1/84 1/1/89 1/1/94 1/1/99 1/1/04 Interest Rates & Inflation 15 10 5 0 1/1/84 1/1/89 1/1/94 1/1/99 -5 -10 1 YR TBILL INFLATION 1/1/04 Interest Rates & Inflation MEAN (Inflation Rate) 3.90 STDEV (Inflation Rate) 3.6746435 Corr(FF) 0.5899089 Corr(1YRTB) 0.5552795 Corr(5YRTB) 0.4879992 Corr(10YRTB) 0.4666077 Inflation rates are highly correlated with interest rates (less so for longer term rates) Characteristics of Business Cycles All recessions/expansions “look similar”, that is, there seems to be consistent statistical relationships between GDP and the behavior of other economic variables. Correlation (procyclical, countercyclical) Timing (leading, coincident, lagging) Relative Volatility 4 3 18 2 1 14 0 -1 10 8 -3 -4 6 -5 -6 2 Annual Yield 1/ 1/ 00 1/ 1/ 95 12 1/ 1/ 90 -2 16 1/ 1/ 85 1/ 1/ 80 Annual Growth Interest Rates vs. GDP GDP 1YR TBILL 4 0 Nominal Interest Rates tend to be Procyclical and lagging Interest Rates vs. Money 5 14 4 12 1/1/2004 1/1/2002 1/1/2000 1/1/1998 1/1/1996 1/1/1994 -1 1/1/1992 6 1/1/1990 0 1/1/1988 8 1/1/1986 1 Annual Yield 10 2 1/1/1984 Annual Growth 3 M1 1YR TBILL 4 -2 -3 -4 2 0 Interest rates tend to be negatively correlated with changes in money (in the short run) Nominal vs. Real Interest Rates A $1000 investment at a 10% annual interest rate will pay out $1100 in one year. Nominal Return (i) = ($1100 - $1000)/$1000 = .10 (10%) or (1+i) = $1100/$1000 = 1.10 Nominal vs. Real Interest Rates A $1000 investment at a 10% annual interest rate will pay out $1100 in one year. To get a real (inflation adjusted) returns, we must divide by the price level (current and future) Real Return (r) = (($1100/P’) – ($1000/P))/($1000/P) or (1+r) = ($1100/$1000)/(P’/P) (1+r) = (1+i) / (1+ inflation rate) Nominal vs. Real Interest Rates A $1000 investment at a 10% annual interest rate will pay out $1100 in one year. To get a real (inflation adjusted), we must divide by the price level (current and future). Suppose that the inflation rate is equal to 5% annually Real Return (1+r ) = (1.10) / (1.05) = 1.048% An Easy Approximation We have the following: (1+i) = (1+r)(1+inflation) (1+i) = 1 + r + inflation + r*inflation i = r + inflation. + r*inflation ( usually r*inf is small) Ex) r = 10% - 5% = 5% Real Interest Rates: 1975-1985 20 15 10 1YR 5YR 10YR 5 0 1/1/1975 1/1/1977 1/1/1979 1/1/1981 1/1/1983 1/1/1985 -5 -10 Why would anyone accept a negative real rate of return? Ex Ante. Vs. Ex Post Ex Ante real interest rates are the rates investors expect based on anticipated inflation rates Ex Post real interest rates are the rates investors actually receive after the fact. The difference between the two depends on the accuracy of inflationary expectations 1/ 1/ -5 -10 1/ 1/ 7/ 1/ 1/ 1/ 7/ 1/ 1/ 1/ 7/ 1/ 1/ 1/ 7/ 1/ 1/ 1/ 7/ 1/ 1/ 1/ 7/ 1/ 1/ 1/ 7/ 1/ 19 85 19 84 19 84 19 83 19 83 19 82 19 82 19 81 19 81 19 80 19 80 19 79 19 79 19 78 19 78 Inflation Expectations 20 15 10 5 Expected Actual Real Rate 0 Inflation Expectations and Real Returns Inflation expectation tend to be quite persistent (i.e. investors don’t seem to update to new information). Therefore, real interest rates also have a high degree of persistence.