Evaluating Expansion-PPT

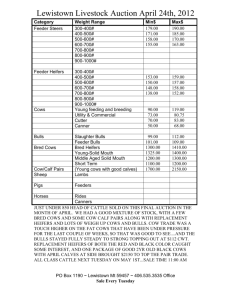

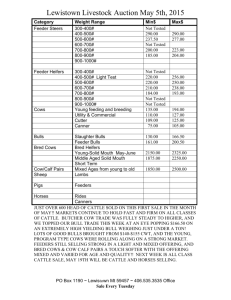

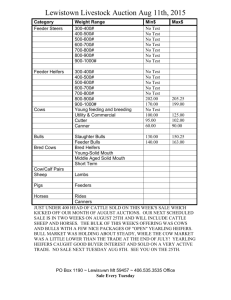

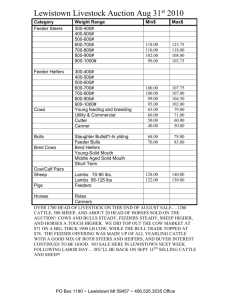

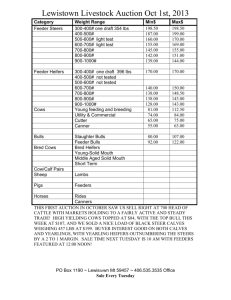

advertisement

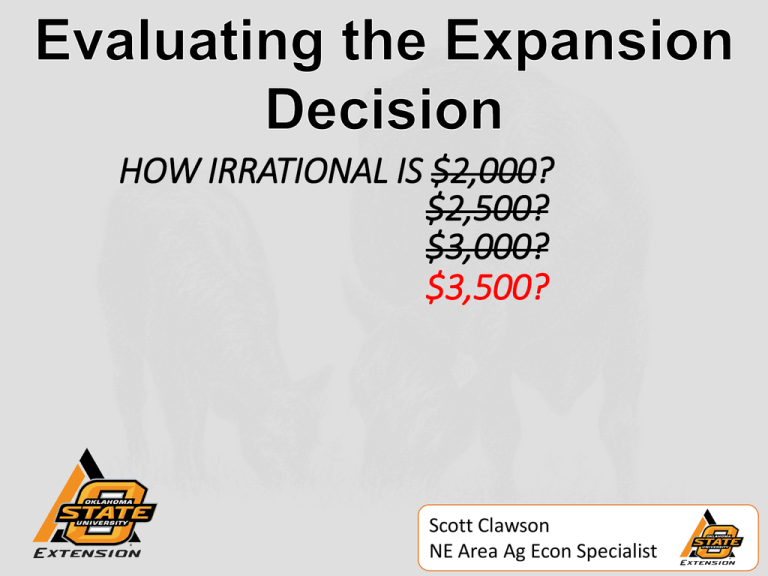

HOW IRRATIONAL IS $2,000? $2,500? $3,000? $3,500? Scott Clawson NE Area Ag Econ Specialist Contributing Factors • Not so surprising Supply issue • Surprising Demand issue Soapbox • WE HAVE TO REVISIT “RULES OF THUMB” AND OTHER MANAGEMENT DECISIONS AT THESE PRICE LEVELS! • We cant use $1.00/# management at $3.00/# price levels • Buy LOW sell HIGH Not so surprising SUPPLY issue… 35,000 34,000 US Beef Cow Inventory 33,000 33,543 33,697 2023 2024 32,630 31,837 32,000 30,992 31,000 30,000 33,031 33,245 29,741 29,631 29,042 28,922 28,991 2014 2015 2016 29,000 28,000 27,000 26,000 2013 2017 2018 2019 2020 2021 http://www.usda.gov/oce/commodity/projections/index.htm 2022 Somewhat surprising DEMAND response… Despite all else, the real market driver… Buying Replacements Bid Price Factors Buying Replacements • How do we determine how much we should pay?????? • Net Present Value Approach (NPV) • Puts a current value on that series of future cash flows • That current value then provides a benchmark for what you could pay for replacements and hit a targeted rate of return • Works with all types of investments, particularly for replacement purchases as we have a series of cash flows or calf sales to look at • Based on the concept that money in your hand right now is more “valuable” than money in the future Market conditions… • Set a scenario to work with • Expect heifers and steers to average 474 and 523 respectively with an average price of $2.68 for heifers and $2.84 for steers per OKC Report 10/13, slightly higher on 1/6/14 • Anticipating 8 calves in life cycle • Financing • 80% LTV • 6.5% interest • 5 year term • Vary the possible purchase price • Cow operating cost $700.00 annually • 85% weaned calf crop Judging the investment… • beefextension.com (select Bid Price Estimate Calculator) Are these price levels a realistic estimate? Better yet, is a constant 8 year annual cow cost estimate realistic? A Good Investment Does Not Always Equal Cash Flow • Cash flow is limited in Years 0-5 due to initial investment and financing! • Financed cows don’t always equate to improved CF • Annual debt service is $693/cow in this scenario Annual Cow Cost is Vital, Imperative, Essential, Critical…! • Annual Cow Cost is a significant element in this equation. • Higher annual cow cost means that we have to get a much better “deal” on the cows for the investment to work. Which would make you the most nervous???? Assume a the financial and market conditions are the same. Purchase money is being financed. A. 40 Reg. SimAngus Heifers, high quality, $3,500 each B. Buying a full load of 400# steers to feed/graze for 120 days C. Buying $1,700 yearling heifers (40 hd). Buy, grow, breed, sell as breds D. Buying 40 thin open cows, feeding through winter with a bull turned in E. Retain ownership of existing calf crop for 120 days • Its easier to predict the weather tomorrow than in 3 years. • Price protection strategies exist for many short run options. • Buying/financing breds at $3,000-3,500 will require maintains record returns to not become a drain on unfinanced cows or other income streams Do record high prices mean that everyone should expand? • NO! • There are other opportunities to consider • Cull cow marketing • Developing and selling bred heifers • Stocker runs with excess grass (feed is pretty cheap relatively speaking) • Retained ownership of existing calves (sell as feeders or keep hfrs and market your own breds) • Invest in cost saving items, widen your margin • Making money can be done in many forms, its not only about increasing mature cow numbers. Wrap up • Markets can be delicate at high price levels • Current conditions to reinforce that value of replacements • Still a weather component… • Separation of cash flow and investment • What will be the cyclical nature moving forward? • Two things close the profit gap, rising costs and shrinking sales… • Maximize net returns on existing ventures • Investing in the cattle business does not have to mean buying more cows THANK YOU!