Wholesale-Seminar-Casey

advertisement

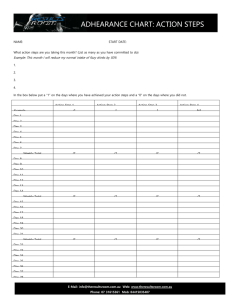

Dashboards: Employees Work Better When they Know the Score! Coach’s vs. Player’s Dashboards • Good coaches know all their team’s stats and study them voraciously. • Players really only need to know whether they are winning or losing, where the ball is at, and how much time is left in the game. Trademarks of Effective Players’ Dashboards 1. Set Clear, Focused Goals “Goals cannot sound noble but vague. Targets cannot be so blurry they can’t be hit. Your direction has to be so vivid that if you randomly woke one of your employees in the middle of the night and asked him, ‘Where are we going?’ he could still answer in a half-asleep stuper” -Jack Welch GE CEO Set Clear, Focused Goals “Improving our ability to multitask actually hampers our ability to think deeply and creatively . . . The more you multitask . . the less deliberative you become; the less you’re able to think and reason out a problem” -Jordan Grafman National Institute of Neurological Disorders Set Clear, Focused Goals “We are the most focused company that I know or have read of or have any knowledge of. We say no to good ideas every day. We say no to great ideas in order to keep the amount of things we focus on very small in number so that we can put enormous energy behind the ones we do choose.” -Tim Cook Apple CEO “I’m as proud of what we don’t do as what we do” -Steve Jobs Trademarks of Effective Players’ Dashboards 2. Engagement: Leaders Can Veto, But Not Dictate Team Goals • Leaders at each level decide which one or two focuses for their teams will most impact the company’s goal(s). • Individual team’s focuses must “win the war” Trademarks of Effective Player’s Dashboards 3. Goals Have Clear Finish Lines From X to Y by When? “Land a man on the moon and return him safely to earth before this decade is out . . . That challenge is one that we are willing to accept, one we are unwilling to postpone, and one which we intend to win” John F. Kennedy President of the United States Clear Finish Lines: Everyone Knows What Success Looks Like X TO Y BY WHEN X TO Y BY WHEN X TO Y BY WHEN X TO Y BY WHEN X TO Y BY WHEN X TO Y BY WHEN X TO Y BY WHEN X TO Y BY WHEN FOCUS ON ONE GOAL KEEP A SCORE BOARD ACCOUNT WEEKLY TRACK THE LEAD MEASURES Track The Lead Measures Lead Measures Lag Measures • Measures the Goal From X to Y Lead Measures • Predictive Measures something that leads to the goal • Influenceable Something that can be highly influenced Lag Measures Keys to Effective Players’ Scoreboards • Simple • Highly visible to the team • Shows lag and lead measures • Everyone can immediately tell if they are winning GOAL Increase Revenue from $2 to $3 Million By 12/31 LEAD MEASURE Generate 10 new leads per week per sales associate LEAD MEASURE Convert 5% of leads $4.0 $2.0 $1 2 3 4 Associate John Bob Mary Seth Total 1 6 17 3 12 39 2 4 7 2 12 25 3 14 14 3 2 33 2 3 4 5 4 1 1 7 8 18 6 5 15 5 15 7 42 6 15 9 8 16 48 10% 5% 0% 1 5 6 Keep a Scoreboard “People are most satisfied with their jobs (and therefore most motivated) when those jobs give them the opportunity to experience achievement” Frederick Herzberg Published in Harvard Business Review: “One More Time: How Do You Motivate Employees?” Weekly Accountability Sessions Account Review Scoreboard Plan • Review commitments that were made last week • Use the dashboard to celebrate success and learn from failures • Clear obstacles and make new commitments Dashboards Employees Work Better When They Know The Score “When we deal in generalities, we shall never succeed. When we deal in specifics, we shall rarely have a failure. When performance is measured, performance is improved. When performance is measured and reported, the rate of performance accelerates” Questions Please don’t hesitate Forecasting & Managing Cash Why Cash is King and How to Keep it That Way Why do we forecast & manage cash? 16 Paying Bills with? Gross Profit Sales less Costs of Sales EBITDA Earnings Before Interest Net Income Taxes, Depreciation & Gross Profit less Operating Amortization Expenses CASH IS KING 17 CLIENT EXAMPLE Profitably growing yourself bankrupt Business Model 2 Month HIGHLY PROFITABLE FINANCIALS Month 1 Gross Margin 50%+ Expenses 5% & Month 2 Sales 100 COS (50) Expenses (5) Income 45 200 (100) (10) 90 Cash (165) Client Terms (55) 18 WALMART EXAMPLE Skinny Margins – Strong Cash Flow Business Model 2 Month MARGINALLY PROFITABLE – DVDS – 500,000 FINANCIALS Month 1 Gross Margin 25% Expenses 20% & Month 2 Sales 100 COS (75) Expenses (20) Income 5 200 (100) (10) 90 Cash 15 Client Terms 5 Vendor Terms 19 Cash Forecasting Short Term vs Long Term Long Term 13 Week Think: Think: In Game Adjustments Changing Defense Injury Time remaining Small lead Basketball Coach Game Plan Watch film Study w staff Talk to team Set game plan Leanest Period 10 Week/Month 8 6 4 2 0 “Plans are Useless, but planning is essential” Dwight D 20 LONG TERM Cash Forecast Game Planning LACK OF PLANNING Most companies forecast LT Most importantly profitability but not working capital and cash WHY DO IT? CAPACITY PLANNING INVESTOR REQUIREMENT EARLY WARNING SYSTEM 21 SHORT TERM Cash Forecast In Game Planning & Adjusting LACK OF PLANNING Most importantly Even fewer have a proper ST cash forecast WHY DO IT? CONFIDENCE INVESTOR REQUIREMENT EARLY WARNING SYSTEM SPOTTING BAD TRENDS 22 13 Week Cash Flow Forecast Crucial Elements A powerful management tool, the 13-Week Cash Flow projection, refreshed weekly, should be used by all companies, both healthy and distressed to assist with managing and anticipating short-term liquidity needs. 13 Weeks Maintains accuracy, but long enough to react Weekly Avoids “intra-month” surprises Beginning vs Ending Cash Liquidity tracks available liquidity weekly Major Categories Variance Analysis sufficient explanations Weekly Accountability management tool naturally grouped, summarized Specific Unusual items Graph Simple cash & liquidity trending Reconciles weekly QR code 23 CASH FLOW FORMULA simple version For any given period: Inc Income Sales less Costs +/- Inv D In Inventory Additions to inventory = less cash +/- AR +/- AP D in Accounts Receivable D in Accounts Payable Increases to AR means you didn’t collect = less cash Decreases to AP means you paid vendors = less cash 24 Managing Cash key items to focus on Increase Revenue + Decrease Costs Inventory Categorize – Safety, Replenishment, Excess Don’t treat all SKUs the same Income Set target fill rate vs customer satisfaction Cash Avoid “life-time” buys Invoice properly Obtain terms…and with early pay discounts Pay on time Set proper customer expectations Accounts Payable Accounts Receivable Incentives for cash collection – measure & reward Focus on dispute resolution 25