2006 lgm - cattle - Montana State University

advertisement

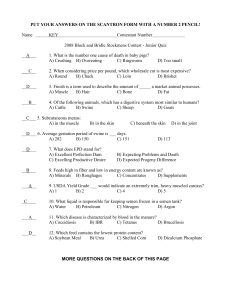

Livestock Gross Margin (LGM) For Cattle By Duane Griffith April 2008 Risk Management Agency LGM Cattle Overview Available In All Counties In The States Of: CO, IL, IN, IA, KS, MI, MN, MO, MT, NE, NV, ND, OH, OK, SD, TX, UT, WV, WI, & WY Coverage For Production And Marketing Risks Location of Cattle???? LGM Cattle Overview Protects Against Loss Of Gross Margin Market Value Of Cattle Minus Cost Of Feeder Cattle Minus Cost Of Feed Equals Gross Margin Expected Values versus Actual Values LGM Cattle Overview 12 Insurance Periods Each Year Each Insurance Period Runs For 11 Months Cattle NOT Insured The First Month Of Any Insurance Period Sales Period Begins The Last Business Day Of The Month Until 9:00 AM CST The Following Day If Expected Gross Margins Not On Website, LGM Not Offered That Period http://www.rma.usda.gov/tools/livestock.html LGM Cattle Overview Only Authorized Agents May Sell LGM First Day Applications Can Be Submitted Is January 31 LGM Cattle Is Sold Monthly Thereafter LGM Cattle Overview LGM Pays At The End Of 11-month Period If Gross Margin Guarantee – Actual Gross Margin > 0 Gross Margin Values Determined From Futures Markets, And State & National Agricultural Statistics Service Data Actual Price Received Or Paid By Producer is Not Used In Any Calculation LGM Commodity Exchange Endorsement Two Types Of Operations Insured Calf Finishing Yearling Finishing Provides Tables that: Determine Contract Month You Reference Determine Values Used To Establish Expected (EGM) And Actual Gross Margin (AGM) Calf Finishing Operation Purchases 550-pound Calves And Feed Them Until Slaughter Assumes: 550-Pound Purchase Weight; And, 1,150-Pound Slaughter Weight Yearling Finishing Operation Purchases Yearling Steers And Heifers And Feed Them Until Slaughter: Assumes: 750-Pound Purchase Weight; And, 1,250-Pound Slaughter Weight Definitions Target Marketing Number Of Cattle Elected To Insure In Each Month During Insurance Period Target Marketing Report Insured Submits Report Showing Target Marketing For Each Month Definitions Approved Target Marketing's Maximum Target Marketing's Allowed Based On The Lesser Of Farm Capacity Or Underwriting Capacity For The 10 Month Insurance Period Definitions Actual Marketing Total Number Cattle Sold In Each Month Of The Insurance Period Marketing Report Report Showing Actual Marketing For Each Month; And, Accompanied By Packer Sales Receipts Definitions CBOT CME Used To Determine Actual & Expected Corn Prices Used To Determine Actual And Expected Cattle Price Feeder Cattle Price Basis (Cattle, Feeder Cattle, And Corn) State And Month Specific Estimates Of Differences Between Local Prices And CME Or CBOT Future Prices Definitions Deductible Zero To $150 Per Head In $10 Increments EGM/Head For Calf Finishing Operations Expected Cattle Price For State & Month Cattle Are Marketed X 1150 lbs. Subtract Expected Cost Of Feed Four Months Prior Subtract Expected Feeder Cattle Price Eight Months Prior X 550 lbs. =EGM EGM/Hd For Yearling Finishing Operations Expected Cattle Price For Month Cattle Are Marketed X 1250 lbs. Subtract Expected Cost Of Feed Two Months Prior Subtract Expected Feeder Cattle Price Five Months Prior X 750 lbs. = EGM Gross Margin Guarantee Expected Total Gross Margin (EGM) Minus The Deductible Times The Sum Of Target Marketings Causes Of Loss Covered LGM Insures The Difference Between Actual Gross Margin And Gross Margin Guarantee Must Be Unavoidable Cause Of Loss, As Required By Act LGM Policy Does Not Insure Against: Death Or Other Loss Or Destruction Of Cattle, And Any Other Loss Or Damage Of Any Kind Insurance Period Coverage Begins One Month And One Day After Closing Date Premium Must be Paid In Full Coverage Ends The Earliest Of: Last Month With Target Marketings; As Otherwise Stated In The Policy; Or, If The End Date Is Sat. Sun. Or Federal Holiday, Or Relevant Report Is Not Available To FCIC For That Day Or Any Other Day Of Ending Period, Then Actual Ending Value Will Be Based On Most Recent Reports Made Prior To That Date Determining Indemnities Insurance Provider Will Send Notice Of Probable Loss Ten Days After at End of Period Insured Submits Marketing Report Within 15 Day Of Receipt Of Notice Of Probable Loss Actual Marketing Are Less Than 75% Of Total Target Marketing, Indemnity is Reduced Percentage By Which Actual Marketing Fell Below Total Of Target Marketing Other Insurance Insured Must Not Obtain Any Other Livestock Insurance Issued Under The Authority Of The Act On Insured Cattle Policy Does Not Prevent Insured From Obtaining Other Insurance Is Not Issued Under The Authority Of The Act Protects Against Substantially The Same Peril However, The Subrogation Provisions May Apply Offsetting Transactions Insured Must Not Enter Into Any Off-setting Financial Transactions Taking An Offsetting Position Of Commodity Futures Or Options Markets Violation Of The Above Will Result In Denial Of Indemnity And No Premium Refund Will Be Given Record Retention Requirement To Maintain Records For Three Years Current Year Failure To Keep Such Records Will Result In No Indemnity Insured Will Still Be Required To Pay All Premiums Owed Example Gross Margin Calculations Joe Farmer, Feb 28th On February 28th Joe Elects To Insure: 500 Head Of Yearling To Finish Cattle Intended To Be Sold In June; And, 2000 Head Of Yearling To Finish Cattle Intended To Be Sold In November Joe Chooses A Deductible Of $30 Per Head Expected June Prices on Feb. 28th Expected Live Cattle Price For June Basis For June Live Cattle Is -$5.52 Expected Feeder Cattle Price January $114.30 $ 95.80 Basis For January Feeder Cattle Is -$11.63 Expected Corn Price For April Basis For April Corn Is -$0.37 $ 2.14 Expected Cost Of Cattle, Feeder Cattle And Corn For Cattle To Be Sold In June Expected Live Cattle Price $ 95.80 $ -5.52 Minus Live Cattle Basis Equals $ 90.28 Expected Feeder Cattle Price $114.30 Minus Feeder Cattle Basis $ -11.63 Equals $102.67 Expected Corn Price $ 2.14 Minus Corn Basis $ -.37 Equals $ 1.77 Expected Cost Of Feed For Yearling Finishing Operation To Be Sold In June LGM Estimated Required Bu. of Corn Times Expected Corn Price For The Month Equals Expected Feed Costs/Head 57.5 $ 1.77 $101.78 Expected Gross Margin (EGM) Per Head For June Expected Cattle Price ($90.28 X 12.5 Hundred Weight) Minus Cost Of Feed $1,128.50 $101.78 Equals Minus Expected Feeder Cattle Price ($102.67 X 7.5 Hundred Weight) Equals EGM $1,026.72 $770.03 $256.69 Expected Gross Margin (EGM) June Cattle Expected Gross Margin June $256.69/Hd X 500 Head Target Marketings $128,345 Actual Cost Of Cattle, Feeder Cattle And Corn For Cattle To Be Sold In June Actual Live Cattle Price For June $ 92.40 Plus Basis for June Live Cattle $ -5.52 Equals $ 86.88 Actual Feeder Cattle Price For June $114.30 Plus Basis For June Feeder Cattle $ -11.63 Equals $102.67 Actual Corn Price For Sept. $ 2.18 Plus Basis For Sept. Corn $ -0.37 Equals $ 1.81 Actual Cost Of Feed For Cattle To Be Sold In June LGM Estimated Required Bu. of Corn For a Yearling Finishing 57.5 Bu. Operation Times Actual Corn Price For Month $ 1.81 Equals Feed Costs Per Head $104.08 Actual Gross Margin (AGM) Per Head For June Actual Cattle Price $1,086.00 ($86.88 X 12.5 Hundred Weight) Minus Cost Of Feed $104.08 Equals $981.92 Minus Actual Feeder Cattle Price $770.03 ($102.67 X 7.5 Hundred Weight) Equals Actual Gross Margin (AGM) $211.89 November Cattle Example Expected November Prices on Feb. 28th Expected Live Cattle Price For Nov. Basis For November Live Cattle Is -$9.61 Expected Feeder Cattle Price in June $105.10 $ 91.20 Basis For June Feeder Cattle Is -$11.80 Expected Corn Price For Sept. Is Basis For Sept. Corn Is -$0.33 $ 2.30 Expected Cost Of Cattle, Feeder Cattle And Corn For Cattle To Be Sold In November Expected Live Cattle Price $ 91.20 Plus Live Cattle Basis $ -9.61 Equals $ 81.59 Expected Feeder Cattle Price Plus Feeder Cattle Basis $105.10 $ -11.80 Equals $ 93.30 Expected Corn Price Plus Corn Basis Equals $ 2.30 $ -.33 $ 1.97 Expected Cost Of Feed For Cattle To Be Sold In November LGM Estimated Required Bu. of Corn For A Yearling Finishing Operation 57.5 Bu. Times Expected Corn Price For Month $ Equals Feed Costs for Cattle Sold in November $113.28 1.97 Expected Gross Margin Per Head For November Cattle Expected Cattle Price ($81.59 X 12.5 Hundred Weight) $1,019.88 Minus Cost Of Feed $ 113.28 Equals $ 906.60 Minus Expected Feeder Cattle Price $93.30 X 7.5 Hundred Weight $ 699.75 Equals Expected Gross Margin-EGM $ 206.85 Expected Gross Margin (EGM) November Cattle Expected Gross Margin November Cattle $206.85/Head X 2,000 Head Target Marketings $413,700 Actual Cost Of Cattle, Feeder Cattle And Corn For Cattle To Be Sold In November Actual Live Cattle Price For Nov. $ 90.65 (½ Based On Oct. And ½ Based On Dec.) Plus Basis-November Live Cattle $ -9.61 Equals $ 81.04 Actual Feeder Cattle Price For June $108.78 (2/3 Based On May And 1/3 Based On Sept.) Plus Basis For June Feeder Cattle $ -11.80 Equals $ 96.98 Actual Corn Price For Sept. $ 2.38 Plus Basis For Sept. Corn $ -0.33 Equals $ 2.05 Actual Cost Of Feed For Cattle To Be Sold In November LGM Estimated Required Bu. of Corn 57.5 Bu. For a Yearling Finishing Operation Times Actual Corn Price For Month $ 2.05 Equals Actual Feed Costs/Head-Nov. $117.88 Actual Gross Margin Per Head For November Actual Cattle Price ($81.04 X 12.5 Hundred Weight) Minus Actual Cost Of Feed $1,013.00 $117.88 Equals Minus Actual Feeder Cattle Price ($96.98 X 7.5 Hundred Weight) Equals Actual Gross Margin (AGM) $895.12 $727.35 $167.77 June and November Combined Expected Gross Margin (EGM) Expected Gross Margin June Cattle $256.69/Hd X 500 Head Target Marketings Expected Gross Margin November Cattle $206.85 X 2,000 Head Target Marketings Total Expected Gross Revenue (EGM) Gross Margin Guarantee EGM $542,045 Minus ($30/Hd deductible X 2,500 head) $128,345 $413,700 $542,045 $467,045 Actual Gross Margin (AGM) Per Month June = Actual Gross Margin Per Head Of $211.89 X Target Marketings (500 Head) November = Actual Gross Margin Per Head Of $167.77 X Target Marketings (2,000 Head) Total June + November AGM Indemnity Paid is: Gross margin guarantee $467,045 minus the actual total gross margin $441,485 $105,945 $335,540 $441,485 $25,560 Questions?? LGM Forms © 2006 NCIS LGM 47 © 2006 NCIS LGM 48 © 2006 NCIS LGM 49 © 2006 NCIS LGM 50 © 2006 NCIS LGM 51 © 2006 NCIS LGM 52 © 2006 NCIS LGM 53 Definitions Insurance Period Crop Year © 2006 NCIS 11 Month Period Stated In Summary Of Insurance; And, Cattle Are Not Insurable In The First Month Of Any Insurance Period July 1 Thru June 30; And, Designated By The Year It Ends [2006-NCIS 916 (Definitions)] LGM 54 Example Of SCD 3/31 & Insurance Month Of July – Yearling Finishing Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May YEARLING FINISHING X X – A month that contains a futures contract for that commodity Sales Closing (Red) Insurance Month (Green – month cattle are marketed) Live Cattle Price (Blue- Same as insurance date) Yearling Finishing Feeder Cattle Price (Orange – 5 months prior to insurance date) Yearling Finishing Corn Price (Yellow – 2 months prior to insurance date) © 2006 NCIS LGM 55 Example Of SCD 3/31 & Insurance Month Of July – Yearling Finishing Table 1. Cycles within the insurance periods for LGM for Cattle Insurance Col. 1 Sales Closing Date Mar 31 © 2006 NCIS Col. 2 Col. 3 Insurance Insurance Month Period May Apr-Feb Jun Jul Aug Sep Oct Nov Dec Jan Feb Col. 6 Col. 5 Yearling Finishing Corn Live Cattle Feeder Cattle Price Price Price Mar Dec May Apr Jan Jun May Feb Jul Jun Mar Aug Jul Apr Sep Aug May Oct Sep Jun Nov Oct Jul Dec Nov Aug Jan Dec Sep Feb Col. 4 Col. 9 Col. 8 Calf Finishing Corn Live Cattle Feeder Cattle Price Price Price Jan Sep May Feb Oct Jun Mar Nov Jul Apr Dec Aug May Jan Sep Jun Feb Oct Jul Mar Nov Aug Apr Dec Sep May Jan Oct Jun Feb Col. 7 LGM 56 Example Of SCD 3/31 & Insurance Month Of Oct. – Yearling Finishing Table 1. Cycles within the insurance periods for LGM for Cattle Insurance Col. 1 Sales Closing Date Mar 31 © 2006 NCIS Col. 2 Col. 3 Insurance Insurance Month Period May Apr-Feb Jun Jul Aug Sep Oct Nov Dec Jan Feb Col. 6 Col. 5 Yearling Finishing Corn Live Cattle Feeder Cattle Price Price Price Mar Dec May Apr Jan Jun May Feb Jul Jun Mar Aug Jul Apr Sep Aug May Oct Sep Jun Nov Oct Jul Dec Nov Aug Jan Dec Sep Feb Col. 4 Col. 9 Col. 8 Calf Finishing Corn Live Cattle Feeder Cattle Price Price Price Jan Sep May Feb Oct Jun Mar Nov Jul Apr Dec Aug May Jan Sep Jun Feb Oct Jul Mar Nov Aug Apr Dec Sep May Jan Oct Jun Feb Col. 7 LGM 57 X Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May Example Of SCD 3/31 & Insurance Month Of Oct. – Yearling Finishing X X – A month that contains a futures contract for that commodity Sales Closing (Red) Insurance Month (Green – month cattle are marketed) Live Cattle Price (Blue- Same as insurance date) Yearling Finishing Feeder Cattle Price (Orange – 5 months prior to insurance date) Yearling Finishing Corn Price (Yellow – 2 months prior to insurance date) © 2006 NCIS LGM 58 Example Of SCD 1/31 & Insurance Month Of June – Calf Finishing Table 1. Cycles within the insurance periods for LGM for Cattle Insurance Col. 1 Sales Closing Date Jan 31 © 2006 NCIS Col. 2 Col. 3 Insurance Insurance Period Month Feb-Dec Mar Apr May Jun Jul Aug Sep Oct Nov Dec Col. 4 Col. 5 Col. 6 Yearling Finishing Live Cattle Feeder Cattle Corn Price Price Price Mar Oct Jan Apr Nov Feb May Dec Mar Jun Jan Apr Jul Feb May Aug Mar Jun Sep Apr Jul Oct May Aug Nov Jun Sep Dec Jul Oct Col. 7 Col. 8 Col. 9 Calf Finishing Live Cattle Feeder Cattle Corn Price Price Price Mar Jul Nov Apr Aug Dec May Sep Jan Jun Oct Feb Jul Nov Mar Aug Dec Apr Sep Jan May Oct Feb Jun Nov Mar Jul Dec Apr Aug LGM 59 Example Of SCD 1/31 & Insurance Month Of June – Calf Finishing X Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May CALF FINISHING X X – A month that contains a futures contract for that commodity Sales Closing (Red) Insurance Month (Green – Month cattle are marketed) Live Cattle Price (Blue- Same as insurance date) Calf Finishing Feeder Cattle Price (Pink – 8 months prior to insurance date) Calf Finishing Corn Price (Purple – 4 months prior to insurance date) © 2006 NCIS LGM 60 Example Of SCD 1/31 & Insurance Month Of Nov. – Calf Finishing Table 1. Cycles within the insurance periods for LGM for Cattle Insurance Col. 1 Sales Closing Date Jan 31 © 2006 NCIS Col. 2 Col. 3 Insurance Insurance Period Month Feb-Dec Mar Apr May Jun Jul Aug Sep Oct Nov Dec Col. 4 Col. 5 Col. 6 Yearling Finishing Live Cattle Feeder Cattle Corn Price Price Price Mar Oct Jan Apr Nov Feb May Dec Mar Jun Jan Apr Jul Feb May Aug Mar Jun Sep Apr Jul Oct May Aug Nov Jun Sep Dec Jul Oct Col. 7 Col. 8 Col. 9 Calf Finishing Live Cattle Feeder Cattle Corn Price Price Price Mar Jul Nov Apr Aug Dec May Sep Jan Jun Oct Feb Jul Nov Mar Aug Dec Apr Sep Jan May Oct Feb Jun Nov Mar Jul Dec Apr Aug LGM 61 Example Of SCD 1/31 & Insurance Month Of Nov. – Calf Finishing X Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May CALF FINISHING X X – A month that contains a futures contract for that commodity Sales Closing (Red) Insurance Month (Green – Month cattle are marketed) Live Cattle Price (Blue- Same as insurance date) Calf Finishing Feeder Cattle Price (Pink – 8 months prior to insurance date) Calf Finishing Corn Price (Purple – 4 months prior to insurance date) © 2006 NCIS LGM 62 Definitions (Expected) Expected Cattle Price (For Months With An Unexpired Futures Contract) Simple Avg. Of CME Live Cattle Futures For A Month Over Last 3 Days Of Trading In The Month Of The Sales Closing Date Plus State-Specific Cattle Basis For The Month (Table 2) © 2006 NCIS [2006-NCIS 916 (Definitions)] LGM 63 Definitions (Expected) Expected Cattle Price (For Months Without A Futures Contract) Weighted Avg. Of CME Live Cattle Futures Of The Two Surrounding Months With Contracts Over Last 3 Days Of Trading In The Month Of The Sales Closing Date Plus State-Specific Cattle Basis For The Month (Table 2) © 2006 NCIS [2006-NCIS 916 (Definitions)] LGM 64 Definitions (Expected) Expected Feeder Cattle Price (For Months With An Unexpired Futures Contract) © 2006 NCIS Simple Avg. Of CME Feeder Cattle Futures For A Month Over Last 3 Days Of Trading In The Month Of The Sales Closing Date Plus The State-Specific AND Operation-Specific Feeder Cattle Basis For That Month (Tables 3 & 4) [2006-NCIS 916 (Definitions)] LGM 65 Definitions (Expected) Expected Feeder Cattle Price (For Months With An Expired Futures Contract) © 2006 NCIS Simple Avg. Of CME Feeder Cattle Futures For A Month Over Last 3 Days Of Trading Of The Month Prior To Contract Expiration Plus The State-Specific AND Operation-Specific Feeder Cattle Basis For That Month (Tables 3 & 4) [2006-NCIS 916 (Definitions)] LGM 66 Definitions (Expected) Expected Feeder Cattle Price (For Months Without A Futures Contract) Weighted Avg. Of CME Feeder Cattle Futures Of The Two Surrounding Months With Contracts Refer To Previous Two Slides For Determination Of Prices On Expired & Unexpired Contracts Plus The State-specific AND Operationspecific Feeder Cattle Basis For That Month (Tables 3 & 4) © 2006 NCIS [2006-NCIS 916 (Definitions)] LGM 67 Definitions (Expected) Expected Corn Price (For Months With An Unexpired Futures Contract) Simple Avg. Of CBOT Corn Futures For A Month Over Last 3 Days Of Trading In The Month Of The Sales Closing Date Plus State-Specific Corn Basis For The Month (Table 5) © 2006 NCIS [2006-NCIS 916 (Definitions)] LGM 68 Definitions (Expected) Expected Corn Price (For Months With An Expired Futures Contract) Simple Avg. Of CBOT Corn Futures For A Month Over Last 3 Days Of Trading In The Month Prior To The Futures Contract Expiration Plus State-Specific Corn Basis For The Month (Table 5) © 2006 NCIS [2006-NCIS 916 (Definitions)] LGM 69 Definitions (Expected) Expected Corn Price (For Months Without A Futures Contract) Weighted Avg. Of CBOT Corn Futures Of The Two Surrounding Months With Contracts Over Last 3 Days Of Trading In The Month Of The Sales Closing Date Plus State-Specific Corn Basis For The Month (Table 5) © 2006 NCIS [2006-NCIS 916 (Definitions)] LGM 70 Definitions (Expected) Expected Cost Of Feed © 2006 NCIS Yearling Finishing: 57.5 Bu. X Expected Corn Price For The Month Calf Finishing: 54.5 Bu. X Expected Corn Price For The Month [2006-NCIS 916 (Definitions)] LGM 71 Definitions (Expected) Expected Gross Margin Per Month Expected Gross Margin Per Head For The Type Of Operation X Target Marketings For That Month Expected Total Gross Margin Summation Of Each Month’s (In The Insurance Period) © 2006 NCIS Target Marketings X Expected Gross Margin Per Head [2006-NCIS 916 (Definitions)] LGM 72 Definitions (Actual) Actual Gross Margin Per Head For Yearling Finishing Operations © 2006 NCIS Actual Cattle Price For Month Cattle Are Marketed X 1250 lbs. Subtract Actual Cost Of Feed Two Months Prior Subtract Actual Feeder Cattle Price Five Months Prior X 750 lbs. [2006-NCIS 916 (Definitions)] LGM 73 Definitions (Actual) Actual Gross Margin Per Head For Calf Finishing Operations © 2006 NCIS Actual Cattle Price For Month Cattle Are Marketed X 1150 lbs. Subtract Actual Cost Of Feed Four Months Prior Subtract Actual Feeder Cattle Price Eight Months Prior X 550 lbs. [2006-NCIS 916 (Definitions)] LGM 74 Definitions (Actual) Actual Cattle Price Simple Avg. Daily Settlement Prices Last 3 Trading Days Prior To CME Live Cattle Contract Expiration Date © 2006 NCIS One-half The Average Of Immediately Surrounding Months When Marketings Fall Into Months Without Futures Contracts Plus The State-Specific Cattle Basis For The Month (Table 2) [2006-NCIS 916 (Definitions)] LGM 75 Definitions (Actual) Actual Corn Price Simple Avg. Daily Settlement Prices ($ Per Bushel) Last 3 Trading Days Prior To CBOT Corn Futures Contract Expiration Date © 2006 NCIS For Months When There Is Not An Expiring Contract, Use A Weighted Average Of Prices Of The Nearest Two Surrounding Contract Months Plus The State-specific Corn Basis For The Month (Table 5) [2006-NCIS 916 (Definitions)] LGM 76 Definitions (Actual) Actual Cost Of Feed Yearling Finishing: 57.5 Bu. X Actual Corn Price For The Month (Or As Stated In The SPOI’s) © 2006 NCIS Calf Finishing: 54.5 Bu. X Actual Corn Price For The Month (Or As Stated In The SPOI’s) [2006-NCIS 916 (Definitions)] LGM 77 Definitions (Actual) Actual Feeder Cattle Price Simple Avg. Daily Settlement Prices Last 3 Trading Days Prior To CME Feeder Cattle Contract Expiration Date Weighted Average Of Immediately Two Surrounding Months When Marketings Fall Into Months Without Futures Contracts Plus The State-Specific Feeder Cattle Basis (Yearling or Calf) For The Month (Tables 3 & 4) © 2006 NCIS [2006-NCIS 916 (Definitions)] LGM 78 Definitions (Actual) Actual Gross Margin Per Month Actual Gross Margin Per Head For The Type Of Operation X Target Marketings For That Month Actual Total Gross Margin Summation Of Each Month’s (In The Insurance Period) © 2006 NCIS Target Marketings X Actual Gross Margin Per Head [2006-NCIS 916 (Definitions)] LGM 79 Definitions (Actual) Actual Marketings Total No. Cattle Sold In Each Month Of The Insurance Period © 2006 NCIS Proof Of Sales Required Used To Verify Ownership And Determine Approved Target Marketings [2006-NCIS 916 (Definitions)] LGM 80 Coverage Availability Insurance Agent Does Not Have Authority To Bind Coverage Coverage Will Only Become Effective When Insurance Provider: © 2006 NCIS Notifies Insured In Writing That Application Has Been Accepted And Approved; And, Issues Written Summary Of Insurance. [2005-NCIS 916 2.(b)] LGM 81 Coverage Availability For Subsequent Insurance Periods, Coverage Will Only Be Effective If: There Is Sufficient Underwriting Capacity ; And, Insurance Provider Issues A Written Summary Of Coverage To The Insured Available For Sale Only On Business Days When FCIC’s UCM Web Site Is Operational © 2006 NCIS [2004-NCIS 916 2.(b)] LGM 82 Coverage Availability Can Be Purchased From Time Starting After Validation Of Prices And Ending On Following Day At 9:00 A.M. Central Time Or As Otherwise Specified In Special Provisions Coverage May Not Be Available For Purchase: © 2006 NCIS If Expected Gross Margins Are Not Available On RMA Website; Or, In Instances Of News Report, Announcement, Or Other Event That Is Believed To Result In Market Conditions Significantly Different Than Those Used To Rate LGM [2005-NCIS 916 2.(c)] LGM 83 Coverage Availability © 2006 NCIS LGM Sales Will Resume, After A Halting Or Suspension In Sales At Discretion Of Manager Of RMA Application Must Be Completed Not Later Than The Sales Closing Date Of Each Insurance Period [2005-NCIS 916 2.(c) & (d)] LGM 84 Coverage Availability No Policy Can Be Sold For Any Month Where: © 2006 NCIS Expected Gross Margins Are Not Available On RMA Website; Or Price Data Is Not Timely Provided To FCIC For Validation Before 9:00 AM Close Of Sales Period. [2005-NCIS 916 2.(a)] LGM 85 Coverage Availability Insurance Provider Will Not Accept Application Or Extend Coverage Unless They Are Notified By FCIC That Underwriting Capacity Is Available Sales For Year Will Be Suspended Or Terminated If There Is Insufficient Underwriting Capacity © 2006 NCIS [2005-NCIS 916 2.(a)] LGM 86 Insurance Coverage All Cattle Will Be Insured At 100% Share © 2006 NCIS Share Should Be Reflected By The Number Of Cattle Listed On The Target Marketing [06-LGM Q&A] LGM 87 Insurance Coverages Deductible Amount Must Be Selected By SCD. Insured May Select Only One Deductible Amount That Is Applicable For All Target Marketings. Target Marketings Must Be Submitted By SCD For Each Insurance Period Insured Desires Coverage. © 2006 NCIS [2005-NCIS 916 3.(b), (c), & (d)] LGM 88 Insurance Coverages Insured With Yearling Finishing And Calf Finishing Operations: © 2006 NCIS May Have Separate Guarantees And Loss Payments May Have Separate Deductibles Are Still Limited To 5,000 Head Per Insurance Period And 10,000 Annually [06-LGM Q&A] LGM 89 Insurance Coverages Target Marketings: © 2006 NCIS For Any Month Cannot Be Greater Than Approved Target Marketings For Insurance Period; Are Due At The Time Of Application In Initial Insurance Period; And, Are Due By SCD In Subsequent Insurance Periods [2005-NCIS 916 3.(e)] LGM 90 Insurance Coverages © 2006 NCIS No Indemnity Will Be Owed But Insured Will Still Be Responsible For Any Premiums Owed If Determined That Insured’s Marketing Report: Is Not Supported By Written Verifiable Records; And, Fails To Accurately Report Actual Marketings Or Other Material Information Total Number Of Cattle Insured May Not Exceed 5,000 Head In Any Insurance Period Or 10,000 Head In Any Insurance Year [2005-NCIS 916 3.(f) & (g)] LGM 91 Insurance Coverages Sales Of LGM For Cattle May Be Suspended If Extraordinary Events Occur That Interfere With Effective Functioning Of Corn, Feeder Cattle , Or Live Cattle Commodity Markets Evidence Of Such Events May Include, But Is Not Limited To Consecutive: © 2006 NCIS Limit Down Moves In Live Cattle Futures Markets; Or Limit Up Moves In The Feeder Cattle And/Or Corn Futures Markets [2005-NCIS 916 3.(h)] LGM 92 SCD 2/28 & Insurance Month of June Yearling Finishing X Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May YEARLING FINISHING X X – A month that contains a futures contract for that commodity Sales Closing (Red) Insurance Month (Green – month cattle are marketed) Live Cattle Price (Blue- Same as insurance date) Yearling Finishing Feeder Cattle Price (Orange – 5 months prior to insurance date) Yearling Finishing Corn Price (Yellow – 2 months prior to insurance date) © 2006 NCIS LGM 93 Premium Calculation “Determinant Monte Carlo Simulation Procedure” Used To Calculate Premium “Black Box”/Calculator Program Used: For Simplicity In Quoting LGM for cattle. Less Room For Error When Completing Lengthy Calculation Process SCD 2/28 & Insurance Month Of Jun & Nov. – Yearling Finishing Table 1. Cycles within the insurance periods for LGM for Cattle Insurance Col. 1 Col. 2 Col. 3 Sales Closing Insurance Insurance Date Period Month Feb 28 Mar-Jan Apr May Jun Jul Aug Sep Oct Nov Dec Jan Col. 4 Col. 5 Col. 6 Yearling Finishing Live Cattle Feeder Cattle Corn Price Price Price Apr Nov Feb May Dec Mar Jun Jan Apr Jul Feb May Aug Mar Jun Sep Apr Jul Oct May Aug Nov Jun Sep Dec Jul Oct Jan Aug Nov Col. 7 Col. 8 Col. 9 Calf Finishing Live Cattle Feeder Cattle Corn Price Price Price Apr Aug Dec May Sep Jan Jun Oct Feb Jul Nov Mar Aug Dec Apr Sep Jan May Oct Feb Jun Nov Mar Jul Dec Apr Aug Jan May Sep SCD Feb. 28th & Insurance Month of June – Yearling Finishing X X X – A month that contains a futures contract for that commodity Sales Closing (Red) Insurance Month (Green – month cattle are marketed) Live Cattle Price (Blue- Same as insurance date) Yearling Finishing Feeder Cattle Price (Orange – 5 months prior to insurance date) Yearling Finishing Corn Price (Yellow – 2 months prior to insurance date) Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May YEARLING FINISHING SCD Feb. 28th & Insurance Month of November – Yearling Finishing X X – A month that contains a futures contract for that commodity Sales Closing (Red) Insurance Month (Green – month cattle are marketed) Live Cattle Price (Blue- Same as insurance date) Yearling Finishing Feeder Cattle Price (Orange – 5 months prior to insurance date) Yearling Finishing Corn Price (Yellow – 2 months prior to insurance date) Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May Apr Mar Feb Jan Dec Nov Oct Sep Aug Jul Jun May YEARLING FINISHING Definitions See The LGM For Cattle Commodity Exchange Endorsement For The Value Of All Basis Insurance Period Coverage Begins One Month And One Day Following Sales Closing Date Provided Premium Has Been Paid In Full Coverage Ends The Earliest Of: Last Month With Target Marketings; As Otherwise Stated In The Policy; Or, If The End Date Is Sat. Sun. Or Federal Holiday, Or Relevant Report Is Not Available To FCIC For That Day Or Any Other Day Of Ending Period, Then Actual Ending Value Will Be Based On Most Recent Reports Made Prior To That Date Determining Indemnities Insurance Provider Will Send Notice Of Probable Loss To Insured Approximately Ten Days After All Actual Gross Margins Applicable For Insurance Period Are Released By RMA Insured Must Submit Marketing Report Within 15 Day Of Receipt Of Notice Of Probable Loss If Total Of Actual Marketings Are Less Than 75% Of Total Target Marketing, Indemnity Will Be Reduced By Percentage By Which Actual Marketings Fell Below Total Of Target Marketings Premium Due For Initial Insurance Period, Premium Is Due With Application For Insurance For Subsequent Insurance Periods, Premium Is Due: With Target Marketings Report. No Later Than Sales Closing Date (SCD) The Premium Is Listed On Summary Of Coverage