ADJUSTING ENTRY FOR SUPPLIES

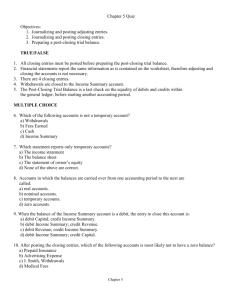

advertisement

Chapter 17 Recording Adjusting and Closing Entries for a Partnership OBJECTIVES: Identify accounting concepts and practices related to adjusting and closing entries for a merchandising business organized as a partnership Record adjusting entries Record closing entries for income statement accounts Record closing entries for net income or loss and partners’ drawing accounts Prepare a post-closing trial balance Entries at the end of the Fiscal Period Adjusting - used to bring the general ledger accounts up to date. (correct balances) Closing - prepare temporary accounts for the next fiscal period. Recorded in the General Journal. No source document. MATCHING EXPENSES WITH REVENUE Copy the adjusting entries from the worksheet to the general journal and post. PARTIAL WORK SHEET SHOWING ADJUSTMENTS ADJUSTING ENTRY FOR MERCHANDISE INVENTORY AFTER ADJUSTMENT BEFORE ADJUSTMENT Income Summary Adj. (a) 15,840.00 Merchandise Inventory Bal. 270,480.00 (New Bal. 254,640.00) Adj. (a) 15,840.00 ADJUSTING ENTRY FOR OFFICE SUPPLIES INVENTORY AFTER ADJUSTMENT BEFORE ADJUSTMENT Supplies Expense—Office Adj. (b) 4,730.00 Supplies —Office Bal. (New Bal. 6,480.00 1,750.00) Adj. (b) 4,730.00 ADJUSTING ENTRY FOR STORE SUPPLIES INVENTORY AFTER ADJUSTMENT BEFORE ADJUSTMENT Supplies Expense—Store Adj. (c) 3,910.00 Supplies —Store Bal. (New Bal. 6,944.00 3,034.00) Adj. (c) 3,910.00 ADJUSTING ENTRY FOR PREPAID INSURANCE AFTER ADJUSTMENT BEFORE ADJUSTMENT Insurance Expense Adj. (d) 3,170.00 Prepaid Insurance Bal. (New Bal. 5,800.00 2,630.00) Adj. (d) 3,170.00 ADJUSTING ENTRIES RECORDED IN A JOURNAL 2 1 3 5 1. Heading 2. Date 3. Account Debited 4. Debit 5. Account Credited 6. Credit 4 6 TO DO: Work Together, pg 433 On your own, pg 433 Chapter 17-2: Recording Closing Entries for Income Statement Accounts 4 closing entries: 1. An entry to close income stmt accounts with CR balances 2. An entry to close income stmt accounts with DR balances 3. An entry to record net income or net loss and close income summary account 4. Entries to close partners’ drawing accounts Closing Entries: Record in general journal Permanent accounts real accounts – Assets, liabilities, capital accounts – Ending balances are beginning balances for next fiscal period Temporary accounts nominal accounts – Revenue, cost, expenses, withdrawals – Must have a 0 balance at end of fiscal period Close all income statement accounts with credit balances to income summary. – Examples: Sales, Interest Income Close all income statement accounts with debit balances to income summary. – Ex) expenses, cost accounts THE INCOME SUMMARY ACCOUNT Income Summary Debit Total expenses (Debit balance is the net loss.) Credit Total Revenue (Credit balance is the net income.) Income Summary used to summarize info about net income *Used only at end of fiscal period to prepare ledger accounts for new period *Does not have a normal balance side *If Revenue is greater than expenses, it will have a CR balance = net income *Ending balance should match net income/loss CLOSING ENTRY FOR AN INCOME STATEMENT ACCOUNT WITH A CREDIT BALANCE 1 2 1. Heading 2. Date 3. Debit to Close 4. Credit 3 4 CLOSING ENTRY FOR INCOME STATEMENT ACCOUNTS WITH DEBIT BALANCES 1. Date 2. Account Debited 3. Credit to Close 4. Debit Total 3 3 1 2 4 SUMMARY OF CLOSING ENTRY FOR INCOME STATEMENT ACCOUNTS WITH DEBIT BALANCES Income Summary Adj. (mdse. inv.) Closing (costs and expenses) 15,840.00 337,664.15 Purchases Bal. 189,960.00 Closing (New Bal. zero) Advertising Expense Closing (revenue) (New Bal. 423,120.00 69,615.85) Rent Expense 189,960.00 Bal. 21,000.00 Closing (New Bal. zero) Salary Expense 21,000.00 Bal. 6,600.00 Closing (New Bal. zero) Credit Card Fee Expense 6,600.00 Bal. 89,400.00 Closing (New Bal. zero) Supplies Expense—Office 89,400.00 Bal. 3,385.00 Closing (New Bal. zero) Insurance Expense 3,385.00 Bal. 4,730.00 Closing (New Bal. zero) Supplies Expense—Store 4,730.00 Bal. 3,170.00 Closing (New Bal. zero) Miscellaneous Expense 3,170.00 Bal. 3,910.00 Closing (New Bal. zero) Utilities Expense 3,910.00 Bal. 2,584.15 Closing (New Bal. zero) Payroll Taxes Expense 2,584.15 Bal. 3,820.00 (New Bal. zero) 3,820.00 Bal. 9,105.00 (New Bal. zero) 9,105.00 Closing Closing TO DO: Work Together, pg 442 On your own, pg 442 App 17-1, 17-2 Chapter 17-3: Recording Additional Closing Entries Net income increases equity must CR to capital accounts – Share for each partner is shown on distribution of net income stmt Income Summary balance must be reduced to 0 Net Income CR to capital Net Loss DR to capital The capital accounts must now show ending capital reported on the owners’ equity statement and balance sheet. Close partners’ drawing accounts to partners’ capital accounts. DO NOT use Income Summary to close Drawing accounts CLOSING ENTRY TO RECORD NET INCOME OR LOSS AND CLOSE THE INCOME SUMMARY ACCOUNT 3 5 2 1 4 1. Date 2. Account Debited 3. Debit to Close 4. Accounts Credited 5. Credits to Record Net Income CLOSING ENTRIES FOR THE PARTNERS’ DRAWING ACCOUNTS 2 1 4 3 1. Date 2. Account Debited 3. Debit to Close 4. Account Credited 5 5. Credits to Close COMPLETED CLOSING ENTRIES FOR A PARTNERSHIP RECORDED IN A JOURNAL NEXT STEP: POSTING!!! TO DO: Work Together, pg 442 On your own, pg 442 After Adjusting and Closing Entries are Posted All permanent accounts are open and have the correct balance. All temporary accounts are closed Must now create a: – Post-Closing Trial Balance: • Prepared to prove the equality of the general ledger before starting a new fiscal period. POST-CLOSING TRIAL BALANCE 1 1. Write the heading. 2. List accounts that have balances. 3. Write debit balances. 3 2 4 5 6 4. Write credit balances. 5. Write the word Totals. 6. Total Debit column. 7. Total Credit column. 8. Verify equality of totals. 9. Rule double lines. 7 8 9 ACCOUNTING CYCLE FOR A MERCHANDISING BUSINESS ORGANIZES AS A PARTNERSHIP. 1. Source documents checked for accuracy, and transactions are analyzed. 1 2 9 2. Transactions are recorded in a journal. 3. Journal entries are posted to ledgers. 3 8 4 5 7 4. Schedules of accounts payable and accounts receivable are prepared from subsidiary ledgers. 5. Work sheet is prepared. 6. Financial statements are prepared. 7. Adjusting and closing entries are journalized. 6 8. Adjusting and closing entries are posted. 9. A post-closing trial balance is prepared. TO DO: Work Together, pg 447 On your own, pg 447 App. prob 17-3, 17-4, 17-5, pg 450 Summary: Mastery 17-6 Ch 17 Quiz