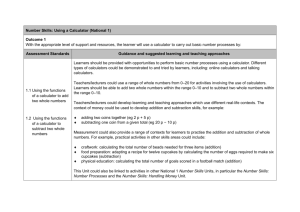

PowerPoint Slides 3

advertisement

FIN 200: Personal Finance Topic 3-The Time Value of Money Larry Schrenk, Instructor Learning Objectives 3. Explain the reasons for a time value of money. ▪ Explain compounding and discounting. Define a lump sum payment. 4. Calculate the present and future value . ▪ 1. 2. The Time Value of Money Time Value of Money Why a Time Value of Money? Components▪ Opportunity Cost Inflation Risk NOTE: I will use ‘cash flow’ (CF) as a general term to designate any flow of money positive or negative.▪ Compounding 5 (of 40) Compounding (Saving) Compounding is calculating the amount you will have in the future: if, for example, you put money in a savings account. If you make a deposit, called the present value (PV), how much will you have after N years if you get I/Y interest rate per year?▫ The answer is the future value (FV). 6 (of 40`) Future Value (FV) Compounding This is the equivalent to a one-time deposit in a savings account. If I put in $100.00 today, how much will I have in... One year? Ten years? One hundred years? Note on Percentages Percentages can be expressed in Integer form 8%, or Decimal form 0.08. These are mathematically the same. But calculators normally have a ‘percentage convention’ when you do financial calculations: If the interest rate is 12%, you should type 12 (the calculator assumes the ‘%’).▫ 8 (of 40`) Future Value (FV) Calculating the Future Value How much do I have after one year? If the interest rate (I/Y) is 10%, then $100.00 × (1 + 10%) = $100.00 × 1.1 = $110.00▫ I multiply the original sum by 1, because I still have my original deposit ($100.00) and I also multiply by 0.10 to calculate the additional interest ($10.00). NOTE: In calculations the red font will indicate the solution or emphasize a certain part of a calculation 9 (of 40`) Future Value (FV) Calculating the Future Value How much do I have after two years?▪ At the beginning of the second year I have $110.00. If the interest rate is 10%, then in two years: $110.00 × (1 + 10%) = $110.00 × 1.1 = $121.00▪ 10 (of 40`) Compound Interest Compound Interest: Interest is ‘compound’ because we get interest on previous interest. How do we get $121.00 after two years? Original amount: $100.00▪ Interest in first year: $10.00 Interest in second year: $10.00 Interest in the second year on the interest from the first year $10.00 × (1 + 10%): $1.00 TOTAL $121.00▪ 11 (of 40`) Simple Interest Simple interest is when you do not receive interest on the previous interest. Deposit $100 at a simple interest rate of 10%. Deposit Year 1 Year 2 Year 3 $100 $110 $120 $130... Simple interest is rarely used in modern financial calculations because it underestimates the true value of an investment over several periods. 12 (of 40`) Future Value (FV) Calculating the Future Value How much do I have after more years? We can generalize the technique, so that each year the value increases by 1 + I/Y (here 1 + 10%). Year Formula 0 Value $100.00 1 $100.00(1.10) = $110.00 2 $100.00(1.10)(1.10) = $121.00 3 $100.00(1.10)(1.10)(1.10) = $133.10 4 $100.00(1.10)(1.10)(1.10)(1.10) = $146.41 13 (of 40`) Timelines If the timing of cash flows is ever confusing, use a timeline: I/Y I/Y 1 0 I/Y I/Y 2 3 4 FV PV 10% 0 $100.00 10% 1 10% 10% 2 3 4 ??? 14 (of 40`) Future Value Formula We could construct a formula: FV PV 1 I / Y N FV is the value of our money in year N. PV is how much we invest now. I/Y is the interest rate each year. N is the number of years we let it grow. 15 (of 40`) Calculations Possible Methods of Calculation Formulae–Complicated Tables (Textbook)–Confusing Calculator! 16 (of 40`) Calculator Help In examples I use one particular calculator, but fortunately most financial calculators work is almost the same way. If you get into trouble, first try reading the manual, though these can be very confusing. If you can’t figure it out, didn't get frustrated, instead... Come to office hours. Bring your calculator and the manual. 17 (of 40`) Calculator Buttons For Now… FV = Future Value PV = Present Value N = Number of Payments I/Y, I = Interest Rate CPT = Compute (only on the TI) Later… PMT = Payment P/Y = Payments per Year 18 (of 40`) Future Value with a Calculator How much do we have after 4 years if we begin with $200 and the interest rate is 12%?▪ Input 4, Press N 2. Input 12, Press I/Y 3. Input 200, press +/-, press PV (you get -200) (Why negative? In a minute) 4. Press CPT, FV to get 314.70, i.e., $314.70 NOTES: 1) Calculators assume the % when you press the I/Y key (do not input 12% as 0.12), 2) some calculators do not require the CPT key, and 3) the order of the inputs does not matter.▪ 1. 19 (of 40`) Future Value with a Calculator 0 I/Y 1 I/Y 2 I/Y I/Y 3 FV PV Number of Periods N Annual Interest Present Value Future Value 20 (of 40`) Future Value with a Calculator 12% 0 12% 1 2 12% 12% 3 4 $314.70 $200.00 4 12 -200 314.70 Remember to press CPT, before FV (TI Only). 21 (of 40`) Essential Note: Clearing/Resetting When you start a new problem, remove any values the calculator may hold from the last calculation. You can ‘clear’ selected values. This is the process of returning them to the default (usually 0 for numeric values). The more thorough solution is to ‘reset’ your calculator which clears all values, e.g., you will lose any numbers held in memory. Do not assume that turning your calculator off and on clears all the values. 22 (of 40`) TI and HP Calculators Reset/Clear the TI [2nd ] [RESET] [ENTER] “RST 0.00” Reset/Clear the HP [Orange] [C ALL] 23 (of 40`) Why the Negative? We calculate: FV PV 1 I / Y N The calculator calculates: FV PV 1 I / Y 0 N For the latter calculation, one and only one of the cash flows we input must be negative, but it does not matter which one. 24 (of 40`) Compounding Practice Problems How much is $350.00 worth in 5 years if the interest rate is 9%?▪ $538.52 How much is $400.00 worth in 15 years if the interest rate is 11%? $1,913.84 How much is $1.00 worth in 100 years if the interest rate is 15%? $1,174,313.45▪ 25 (of 40`) Discounting 26 (of 40) Discounting Discounting is calculating the current value (PV) of money coming in the future. What is the current value (PV) of money (FV) I expect to receive in N years given I/Y interest? The answer is the present value (PV). If someone promises me $100.00 next year, how much is that worth today? Or how much would I need to save today to have $100.00 next year? 27 (of 40`) Discounting Discounting is the exact opposite of compounding. More technically, discounting is the inverse of compounding. If I start with $100.00, compound it and then discount it (using the same values, e.g., N), I get the original $100.00. 28 (of 40`) Discounting What is the value today of $100.00 I receive it in... One year? Ten years? One hundred years? 29 (of 40`) Discounting Calculating the Present Value How much is money worth if I receive it in one year? If the interest rate (I/Y) is 10%, then $100.00/(1 + 10%) = $100.00/1.1 = $90.91 All I did was change the ‘×’ to ‘/’ in the formula. I divide the original future value by 1 + 10%, because 10% is the growth of money over time. 30 (of 40`) Discounting We can generalize this for money coming at different times: Year Formula 0 Value $100.00 1 $100.00/(1.10) = $90.91 2 $100.00/(1.10)(1.10) = $82.64 3 $100.00/(1.10)(1.10)(1.10) = $75.13 4 $100.00/(1.10)(1.10)(1.10)(1.10) = $68.30 31 (of 40`) Timelines Again, if the timing of cash flows is ever confusing, use a time line: I/Y I/Y 1 0 I/Y I/Y 2 3 4 FV PV 10% 0 ??? 10% 1 10% 10% 2 3 4 $100.00 32 (of 40`) Present Value Formula We could construct a formula: PV FV 1 I / Y N FV is the value of our money in year N. PV is how much we invest now. I/Y is the interest rate each year. N is the number of years we let it grow. But again we will just use a calculator. 33 (of 40`) Present Value with a Calculator How much is $200 received in 4 years worth now, if we the interest rate is 12%?▪ Input 4, press N 2. Input 12, press I/Y 3. Input 200, press +/-, press FV (you get -200) 4. Press CPT, PV to get 127.10, i.e., $127.10 NOTES: 1) Calculators assume the % when you press the I/Y key (do not input 12% as 0.12), 2) some calculators do not require the CPT key, and 3) the order of the inputs does not matter. ▪ 1. 34 (of 40`) Present Value with a Calculator 12% 0 12% 1 2 12% 12% 3 4 $200.00 $127.10 4 12 127.10 -200 Remember to press CPT, before FV (if necessary). 35 (of 40`) Discounting Practice Problems How much is $350.00 received in 5 years worth if the interest rate is 9%?▪ $227.48 How much is $400.00 received in 15 years worth if the interest rate is 11%? $83.60 How much is $1,000,000 received in 100 years worth if the interest rate is 15%? 85 cents!▪ 36 (of 40`) Ethical Dilemma (Chap. 3, 76.16) Cindy and Jack have budgeted $300 per month for car payments. A salesman, Herb, insists that they look at a more expensive car with payments of $500 per month. They can only afford the expensive car by discontinuing a $200 monthly retirement contribution. Since they plan to retire in 30 years, Herb explains that they would only need to stop the $200 monthly payments for the five years of the car loan and calculates that the $12,000 in lost contributions could be made up over the remaining 25 years by increasing their monthly contribution by only $40 per month. a. Comment on the ethics of a salesperson who attempts to talk customers into spending more than they had originally planned and budgeted. b. Is Herb correct in his calculation? 37 (of 40`)