Day 7 The Time Value of Money

advertisement

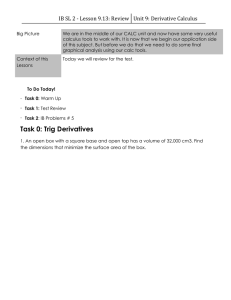

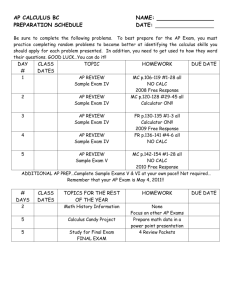

THE TIME VALUE OF MONEY BACK TO THE FUTURE Future Value Investment Interest or Yield Investment 10 ___ x $1,000 100 10% 10% = .1 50% = .5 = 1 10 ___ Yield = .1 8% = .08 6.5% = = $100 Annual Yield .065 Compound Interest -- Interest earning interest How often is interest added to investment principal? Examples: annually, monthly, weekly, daily Annually $1,000 @ 12% = $120 Monthly Interest = $10 Monthly $1,000 @ 12% = $126.83 Month 1 $1,000 x .12/12 = $10 Month 2 $1,010 x .12/12 = $10.10 Month 3 $1,020 x .12/12 = $10.30 Future Value Computation Beginning of Year Investment Income End of Year 1 = 100% $1,000 x 1 = $1,000 $1,000 x .08 = _____ 80 $1,080 $1,000 x 1.08 = $1,080 $1,080 x 1.08 = $1,166 Investment x (1 + Interest Rate) Present Value x (1 + int) PV x (1 + int) 2 = Future Value = Future Value End of year 1 = Future Value End of year 2 PV x (1 + int) n = Future Value Number of Payment Periods FUTURE VALUE FUTURE VALUE Future Value Computation Beginning of Year End of Year Investment $100,000 x 1 = $100,000 Income $100,000 x .08 = 8,000 _______ $108,000 $100,000 x 1.08 = $108,000 $108,000 x 1.08 = $116,640 In your browser Type in www.openoffice.org Click on the “I want to download OpenOffice.org” button OpenOffice.org calc Click on the “Download now!” button Save the file to your Desktop Go to your desktop and double click the OpenOffice.org Icon to install it. OpenOffice.org calc OpenOffice.org calc Click the ‘Insert Function’ (fx) icon FUTURE VALUE OpenOffice.org calc The ‘Function Wizard’ Box Appears FUTURE VALUE OpenOffice.org calc The ‘Function Wizard’ Box Appears Highlight ‘FV’ FUTURE VALUE Double click on ‘FV’ OpenOffice.org calc The ‘function’ formula Open Office utilizes appears as you type Type ‘.08’ Type ‘2’ Type ‘0’ Type ‘-100000’ FUTURE VALUE The calculated answer appears here even before you click the ‘OK’ icon The ‘Function Arguments’Then Boxes Appears click ‘OK’ Positive and Negative Numbers Ask yourself “Does this financial transaction allow me to put money IN my pocket or require me to take money OUT of my pocket? IN your pocket = type in a POSITIVE Number OUT of your pocket = type in a NEGATIVE Number If you take $100,000 and put it in an investment where did the $100,000 come from? OUT of your pocket = -100,000 After 2 years the investment gives you $116,640 IN your pocket Positive and Negative Numbers Future Value of a Steam of Payments Future Value Computation Beginning of Year End of Year Investment $100,000 x 1 = $100,000 Income $100,000 x .08 = 8,000 _______ $108,000 Investment = $208,000 + $100,000 Income $208,000 x .08 = 16,640 _______ $224,640 OpenOffice.org calc Future Value of a Steam of Payments Click on function icon (fx) Type ‘fv’ (future value) Click on ‘Next’ OpenOffice.org calc Future Value of a Steam of Payments The Future Value ‘Function Wizard’ Box Appears Type ‘.08’ Type ‘2’ Type ‘-100,000’ Type ‘0’ Scroll Down OpenOffice.org calc Future Value of a Steam of Payments Type Type is a value representing the timing of the payment: Payment at the beginning of the period = 1 Investment Contribution First Pension Check Payment at the end of the period = 0 or omitted Debt Payment OpenOffice.org calc Future Value of a Steam of Payments See the Answer Type ‘1’ Then click ‘OK’ Compounding What if your money compounds monthly or payments are made monthly instead of annually? 12 percent interest annually = .12 monthly = .12/12 quarterly = .12/4 payments annually = 1 monthly = 1 * 12 quarterly = 1 * 4 PRESENT VALUE Present Value Computation Beginning of Year End of Year Investment $100,000 / 1.08 = $92,593 Investment $92,593 / 1.08 = $85,734 $92,593 x 1.08 = $100,000 OpenOffice.org calc PRESENT VALUE Click on function icon (fx) Type ‘pv’ (present value) Click on ‘Next’ OpenOffice.org calc PRESENT VALUE The ‘Function Wizard’ Box Appears Type ‘.08’ Type ‘2’ Type ‘0’ Type ‘100000’ Then click ‘OK’ Present Value of a Stream of Payments Present Value Computation End of Year Beginning of Year Investment $100,000 / 1.08 = $92,593 Investment $100,000 / 1.08 2 = $85,734 Investment $100,000 / 1.08 3 = $79,383 Present Value of a Stream of Payments Present Value Computation End of Year Beginning of Year Investment $100,000 / 1.08 = $92,593 Investment $100,000 / 1.08 2 = $85,734 Investment $100,000 / 1.08 3 = ________ $79,383 $257,710 OpenOffice.org calc Present Value of a Stream of Payments Click on function icon (fx) Type ‘pv’ (present value) Click on ‘OK’ OpenOffice.org calc PRESENT VALUE The ‘Function Wizard’ Box Appears Type ‘.08’ Type ‘3’ Type ‘100,000’ Type ‘0’ Scroll Down OpenOffice.org calc PRESENT VALUE Verify Answer Type ‘0’ Then click ‘OK’ Four Practice Problems Future Value of a Lump Sum OpenOffice.org calc Future Value of a Stream of Payments OpenOffice.org calc Present Value of a Stream of Payments OpenOffice.org calc Present Value of a Future Lump Sum OpenOffice.org calc