Chapter 7

Incremental Analysis for Short-Term Decision Making

PowerPoint Authors:

Susan Coomer Galbreath, Ph.D., CPA

Charles W. Caldwell, D.B.A., CMA

Jon A. Booker, Ph.D., CPA, CIA

Cynthia J. Rooney, Ph.D., CPA

McGraw-Hill/Irwin

Copyright © 2014 by The McGraw-Hill Companies, Inc. All rights reserved.

Steps in the Decision-Making Process

7- 3

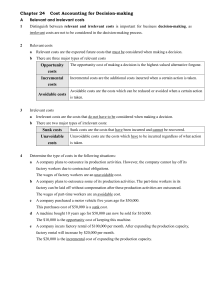

Relevant versus Irrelevant Costs

and Benefits

Relevant Costs have the potential

to influence a decision.

Two Criteria for a Relevant Cost

1. Occurs in the future

2. Differs between decision alternatives

Relevant costs are also called

differential costs, incremental

costs, or avoidable costs.

7- 4

Relevant versus Irrelevant Costs

and Benefits

Irrelevant costs are those that will

not influence a decision.

Costs that have been

incurred in the past.

(sunk costs)

Costs that are the

same regardless of the

alternative chosen.

7- 5

Opportunity Costs and Capacity

Considerations

An opportunity cost is the benefit that is

given up when one alternative is selected

over another.

At full capacity, adding

additional work requires

giving up a portion of

the existing work. The

benefit of the existing

work given up is an

opportunity cost.

With idle capacity,

additional work may be

added without

sacrificing existing work.

There is no opportunity

cost to the additional

work.

7- 6

Special-Order Decisions

A special order is a one-time

order that is outside the scope

of normal sales.

When analyzing a special

order, only the incremental

costs and benefits are relevant.

7- 7

Special-Order Decisions

A major university has asked Mattel to make a special

University Barbie, dressed in a sporty outfit with the

school’s logo and colors. The university bookstore has

offered to buy 25,000 of these dolls at a price of $7.00

each. Mattel has the capacity to fill the order without

affecting production of other Barbie products, which

are normally sold to toy stores and discount chains for

$9.00 each.

More Information

7- 8

Special-Order Decisions

Mattel estimates that its unit cost to produce the

University Barbie will be:

Should Mattel accept the special order?

7- 9

Incremental Analysis (with Excess

Capacity)

The special order

will result in a

profit of $2.00

per doll and a

total profit of

$50,000. Note

that fixed costs

are excluded

because they are

irrelevant to the

decision.

7- 10

Make-or-Buy Decisions

A decision to perform a particular activity or

function in-house or purchase from an outside

supplier has traditionally been called a make-orbuy decision, but could also be called an

insourcing versus outsourcing decision.

Key Questions

1.What costs will change?

2.Are there opportunity costs

associated with either alternative?

3.Are there other qualitative factors to

consider?

7- 11

Decisions to Keep-or-Drop Segments

Managers must sometimes decide whether to

eliminate a particular division or segment of the

business. These decisions are called keep-or-drop

decisions or continue-or-discontinue decisions.

Key Questions

1.How much will total revenue and total costs

change?

2.Will other segments or product lines be affected?

3.Are there opportunity costs associated with

keeping the segment?

4.Are there other qualitative factors to consider?

7- 12

Sell-or-Process Further Decisions

Businesses are often faced with the decision

to sell a product “as is” or refine it so that it can be

sold for a higher price.

As a general rule, we process

further only if incremental

revenues exceed incremental

costs.

Costs of manufacturing the

product up to the sell-orprocess decision point are

sunk and therefore irrelevant.

7- 13

Summary of Incremental Analysis

Common Rules for Analyzing Relevant Costs and Benefits:

• Relevant costs and benefits occur in the future and differ between

alternatives.

• Variable costs are usually relevant to the decision because they

vary with the number of units produced or sold.

• Fixed costs may not be relevant because they do not change with

the number of units produced or sold. Fixed costs that are directly

related to the decision may be avoidable and thus relevant.

• Opportunity costs are the lost benefit of choosing one alternative

over another. These costs are relevant and occur when capacity is

reached or resources are constrained.

• The quantitative analysis provides a starting point for making

decisions, but must be balanced against qualitative factors such as

quality considerations, customer loyalty, and other factors.

7- 14

Prioritizing Products with Constrained

Resources

When a limited resource restricts a company’s ability to

satisfy demand, the company is said to have a constrained

resource that is referred to as a bottleneck.

To maximize profits in the short run, a company with a

bottleneck must prioritize its products or services so as

to maximize contribution margin per unit of the

constrained resource.

The focus is on contribution margin because fixed costs

will not change in the short run, and are not relevant.

7- 15

End of Chapter 7

7- 16