Money has three functions in the economy: Medium of exchange

advertisement

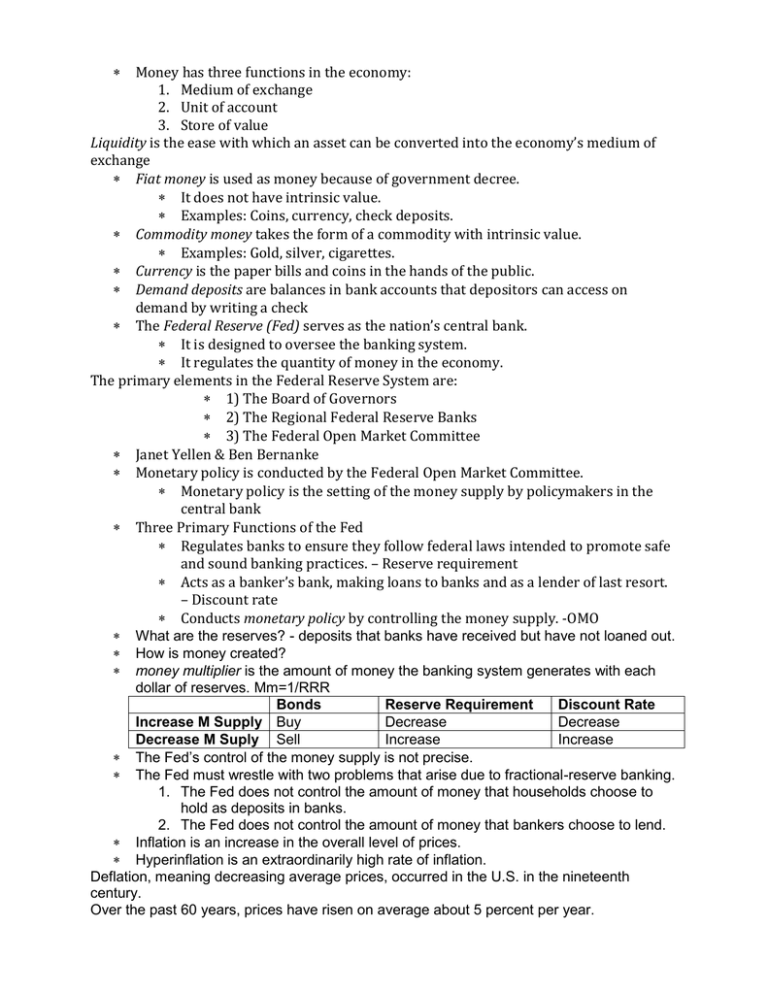

Money has three functions in the economy: 1. Medium of exchange 2. Unit of account 3. Store of value Liquidity is the ease with which an asset can be converted into the economy’s medium of exchange Fiat money is used as money because of government decree. It does not have intrinsic value. Examples: Coins, currency, check deposits. Commodity money takes the form of a commodity with intrinsic value. Examples: Gold, silver, cigarettes. Currency is the paper bills and coins in the hands of the public. Demand deposits are balances in bank accounts that depositors can access on demand by writing a check The Federal Reserve (Fed) serves as the nation’s central bank. It is designed to oversee the banking system. It regulates the quantity of money in the economy. The primary elements in the Federal Reserve System are: 1) The Board of Governors 2) The Regional Federal Reserve Banks 3) The Federal Open Market Committee Janet Yellen & Ben Bernanke Monetary policy is conducted by the Federal Open Market Committee. Monetary policy is the setting of the money supply by policymakers in the central bank Three Primary Functions of the Fed Regulates banks to ensure they follow federal laws intended to promote safe and sound banking practices. – Reserve requirement Acts as a banker’s bank, making loans to banks and as a lender of last resort. – Discount rate Conducts monetary policy by controlling the money supply. -OMO What are the reserves? - deposits that banks have received but have not loaned out. How is money created? money multiplier is the amount of money the banking system generates with each dollar of reserves. Mm=1/RRR Bonds Reserve Requirement Discount Rate Increase M Supply Buy Decrease Decrease Decrease M Suply Sell Increase Increase The Fed’s control of the money supply is not precise. The Fed must wrestle with two problems that arise due to fractional-reserve banking. 1. The Fed does not control the amount of money that households choose to hold as deposits in banks. 2. The Fed does not control the amount of money that bankers choose to lend. Inflation is an increase in the overall level of prices. Hyperinflation is an extraordinarily high rate of inflation. Deflation, meaning decreasing average prices, occurred in the U.S. in the nineteenth century. Over the past 60 years, prices have risen on average about 5 percent per year. Figure 1 Money Supply, Money Demand, and the Equilibrium Price Level Value of Money, 1 /P (High) Price Level, P Money supply 1 3 1.33 /4 12 / Equilibrium value of money (Low) (Low) 1 A 2 Equilibrium price level 14 4 / Money demand 0 Quantity fixed by the Fed Quantity of Money (High) Copyright © 2004 South-Western Nominal variables are variables measured in monetary units. Real variables are variables measured in physical units Changes in the money supply affect nominal variables but not real variables. monetary neutrality The velocity of money refers to the speed at which the typical dollar bill travels around the economy from wallet to wallet V = (P Y)/M When the government raises revenue by printing money, it is said to levy an inflation tax. Fisher effect refers to a one-to-one adjustment of the nominal interest rate to the inflation rate. The real interest rate stays the same Shoeleather costs - Shoeleather costs are the resources wasted when inflation encourages people to reduce their money holdings. Menu costs - Menu costs are the costs of adjusting prices. Relative price variability - Inflation distorts relative prices. Consumer decisions are distorted, and markets are less able to allocate resources to their best use. Tax distortions - Inflation exaggerates the size of capital gains and increases the tax burden on this type of income. Confusion and inconvenience Arbitrary redistribution of wealth - Unexpected inflation redistributes wealth among the population in a way that has nothing to do with either merit or need. Table 1 How Inflation Raises the Tax Burden on Saving 30 The classical principle of monetary neutrality states that changes in the money supply do not influence___________ variables and is thought most applicable in the ______ run Copyright©2004 South-Western nominal, short nominal, long real, short If nominal GDP is $400, real $200, and the money supply is $100, then the price level is 1/2, and velocity is 2 the price level is 1/2, and velocity is 4 the price level is 2, and velocity is 2 the price level is 2, and velocity is 4 Hyperinflations occur when the government runs a large _________, which the central bank finances with a substantial monetary __________ deficit, contraction deficit, expansion surplus, contraction surplus, expansion In a system of fractional-reserve banking, even without any action by the central bank, the money supply declines if households choose to hold __________ currency or if banks choose to hold __________ excess reserves more, more more, less less, more less, less Barack takes $100 of currency from his wallet and deposits it into his checking account. If the bank adds the entire $100 to reserves, the money supply _______, but if the bank lends out some of the $100, the money supply _______ increases, increases even more increases, increases by less is unchanged, increases decreases, decreases by less Who is currently chairman of the Fed? Lupe Fiasco Alan Greenspan Janet Yellen Hillary Clinton According to the quantity theory of money and the Fisher effect, if the central bank increases the rate of money growth inflation and the nominal interest rate both increase inflation and the real interest rate both increase the nominal interest rate and the real interest rate both increase inflation, the real interest rate, and the nominal interest rate all increase A recession is a period of declining real incomes, and rising unemployment. A depression is a severe recession Economic fluctuations are irregular and unpredictable. Fluctuations in the economy are often called the business cycle. Most macroeconomic variables fluctuate together. As output falls, unemployment rises. Short run Long run Monetary illusion Focus on nominal “We are stupid… Monetary neutrality Focus on real …but we also learn fast” Figure 2 Aggregate Demand and Aggregate Supply... Price Level Aggregate supply Equilibrium price level Aggregate demand 0 Equilibrium output Quantity of Output Copyright © 2004 South-Western The Price Level and Consumption: The Wealth Effect - A decrease in the price level makes consumers feel more wealthy, which in turn encourages them to spend more. The Price Level and Investment: The Interest Rate Effect - A lower price level reduces the interest rate, which encourages greater spending on investment goods. The Price Level and Net Exports: The Exchange-Rate Effect - When a fall in the U.S. price level causes U.S. interest rates to fall, the real exchange rate depreciates, which stimulates U.S. net exports. Shifts arising from (All components of the GDP!) Consumption (9/11) Investment (taxation) Government Purchases (elections) Net Exports ($/euro) Sticky price theory - Prices of some goods and services adjust sluggishly in response to changing economic conditions: Shifts in SRAS arising from: Labor (immigration) Capital Natural Resources (fracking) Technology. Expected Price Level - An increase in the expected price level reduces the quantity of goods and services supplied and shifts the short-run aggregate supply curve to the left. Two causes: 1. Shifts in Aggregate Demand An Adverse Shift in Aggregate Supply When the economy goes into a recession, real GDP ___________ and unemployment _____________ rises, falls rises, rises falls, rises falls, falls An increase in the aggregate demand for goods and services has a larger impact on output ___________ and a larger impact on the price level _________ in the short run, in the long run ? in the long run, in the short run in the short run, also in the short run in the long run, also in the long run The idea that economic downturns result from an inadequate aggregate demand for goods and services is derived from the work of which economist? Adam Smith David Hume David Blake John Maynard Keynes