WHAT’S UP WITH C&C SPORTS?

Costs skyrocketed

Variance analysis – 4th quarter

• Lining: $6,250 F price; $8,000 U quantity

• DL: $1,650 U rate; $14,400 U efficiency

• VOH: $26,195 U spending; $3,955 U efficiency

Additional jackets appear to have added

complexity to production processes

Need to better understand product costs

TRADITIONAL COSTING AND PORS

ACTIVITY-BASED COSTING CONCEPT

WHAT’S THE COST DRIVER?

DLHS?

BATCHES

MOVED?

Suppose one batch of jackets takes 15 hours and three

batches of jerseys take 15 hours.

Do both products consume the same amount of

forklift resource?

TYPES OF ACTIVITIES

Unit-level

Batch-level

Product-level

Customer-level

Organization-level

TYPES OF ACTIVITIES

Unit-level

• Incurred by production or acquisition of a single unit of product or

the delivery of a single unit of service

Batch-level

• Incurred when a group of similar things are made, handled or

processed at the same time

Product-level

• Incurred in support of different products or processes

Customer-level

• Incurred to support and sustain a specific customer

Organization-level

• Incurred to support and sustain a business unit

UNIT LEVEL ACTIVITIES

Volume or level of activity is

proportional to the number of

units produced

Costs incurred to perform

these activities can be

allocated using traditional

methods such as DLH or MH

C&C – operating sewing

machines

BATCH-LEVEL ACTIVITIES

Volume or level of activity is

proportional to the number

of batches produced

Costs are incurred when a

group of similar things are

made or handled at the

same time

C&C – Moving batches of

products

PRODUCT-LEVEL ACTIVITIES

Activities that support

the production and sale

of individual products

Related to all units and

batches produced,

regardless of volume

C&C – creating patterns

for new products

CUSTOMER LEVEL-ACTIVITIES

Activities performed to

support specific customers

Not dependent on the

number of units or products

sold to that customer

Costs for these resources

do not affect product cost

C&C – making sales calls

ORGANIZATION-SUSTAINING ACTIVITIES

Activities performed to

maintain the plant facility and

provide managerial

infrastructure

Not dependent on the volume

of production, just the number

of facilities maintained

The cost of these resources is

not allocated to products

C&C – renting factory space

COMPARISON OF GAAP AND ABC COSTS

Cost Category

GAAP-Based Product Cost

Activity-Based Product Cost

Direct Materials

✔

✔

Direct Labor

✔

✔

Unit-Level

✔

✔

Batch-Level

✔

✔

Product-Level

✔

✔

Organization-Level

✔ NOTICE: Under ABC, organization-

Manufacturing Overhead

S&A Expense

Unit-Level

Batch-Level

Product-Level

level costs are not allocated to

products

NOTICE: Under traditional costing,

S&A expenses are not allocated to

products

✔

✔

✔

FIVE STEPS TO IMPLEMENT ABC

Identify activities

Develop activity cost pools

Calculate activity cost pool rates

Allocate costs to products or services

Calculate unit product costs

ACTIVITY-BASED COSTING (STEPS 1 & 2)

See Exhibit 7-5 for details of costs to activity pools

ACTIVITY-BASED COSTING (STEP 3)

See Exhibit 7-6 for details of activity cost pool rates

ACTIVITY-BASED COSTING (STEP 4)

See Exhibit 7-7 for details of cost

allocations to each product

ACTIVITY-BASED COSTING (STEP 5)

÷

÷

÷

COMPARISON OF TRADITIONAL & ABC COSTING

UNDER TRADITIONAL COSTING SYSTEMS…

Small volume jobs are typically under-costed

Large volume jobs are typically over-costed

In ABC, this is corected as batch-related and

product-level costs are allocated using appropriate

batch and product cost drivers

BE CAREFUL…

WHEN YOU CHOOSE THE COST POOLS AND

COST DRIVERS…

Once you select a cost driver, you have to monitor

and collect data about the consumption of that

activity.

Can your system do that?

There is a cost/benefit tradeoff to consider

MANAGEMENT SAYS…

Labor costs are too high. What’s your first

reaction?

Reduce

headcount

THE KEY IS ACTIVITY MANAGEMENT

LOOK AT THE ACTIVITIES THAT USE LABOR RESOURCES

Inefficient production processes

Poor facilities layout

Non-value added activities

Untrained workforce

WHAT ADDS VALUE TO THE PRODUCT?

Look at your activities

If customers are willing to pay for an activity, it is

value-added

If customers aren’t willing to pay for it, the activity

is non-value-added

Eliminate the non-value-added activities and the

related resources to reduce costs

HOW IS ABC INFORMATION USED?

An ABC analysis may reveal interesting

information about product profitability.

Source: Activity Based Costing: How ABC is Used in the Organization, Copyright 2005,

SAS Institute Inc., Cary, NC. All Rights Reserved. Reproduced with permission of SAS

Institute Inc., Cary, NC

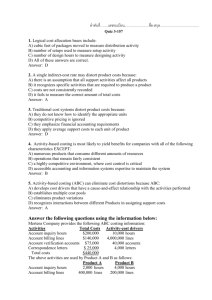

TRADITIONAL VS ABC PROFITABILITY

Traditional Costing

Pants

Jerseys

Award Jackets

Sales

$12.00

$14.80

$125.00

9.87

11.17

77.12

Product Margin/Unit

$ 2.13

$ 3.63

$ 47.88

Product Margin %

17.75%

24.53%

38.30%

Activity-Based Costing

Pants

Jerseys

Award Jackets

Sales

$12.00

$14.80

$125.00

Production Costs

8.20

10.57

80.04

Selling and Administrative

1.65

2.02

20.82

Product Margin/Unit

$ 2.15

$ 2.21

$ 24.14

Product Margin %

17.92%

14.93%

19.31%

Production Costs

DOES ABC CHANGE PRODUCTION COSTS?

NO

ABC re-allocates costs based on the activities

consumed by the products

ACTIVITY-BASED COSTING RECAP

Recognizes that various activities and cost levels

exist

Gathers costs into related cost pools

Uses multiple cost drivers to assign costs to

products and services based on the consumption

of resources by activities

ABC focuses on attaching costs to products and

services based on the activities used to produce,

perform, distribute or support those products and

services