collecting the tax

advertisement

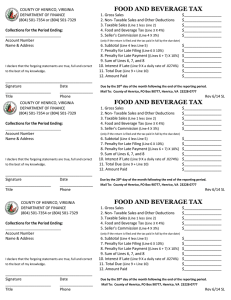

Meals Tax Training AGENDA • What is the tax and who is required to collect it? • Registration process • Collecting the tax and what is taxable • Remittance process and record keeping • Contact information and questions 2 CHRONOLOGY OF EVENTS • November 5, 2013, a majority of voters in the County approved a referendum giving the Board of Supervisors the authority to pass a Food and Beverage Tax ordinance. • February 25, 2014, the Board of Supervisors officially adopted the tax. 3 FOOD AND BEVERAGE TAX • The Food and Beverage Tax, commonly referred to as a “meals tax”, is a four percent (4%) tax levied on food and beverages. • June 1, 2014, restaurants and other establishments will begin collecting the tax. 4 WHO IS REQUIRED TO COLLECT THE TAX? The food and beverage tax is levied on food and beverages sold by restaurants as the term is defined in the Code of Virginia. Food served from delicatessen counters at convenience and grocery stores is also subject to the tax. Restaurants include but are not limited to: Amusement Parks Billiard Parlors Bowling Alleys Buffets Cafes Cafeterias Caterers (Licensed in Henrico) Coffee Shops Concession Stands Delicatessens Dining Rooms Health Clubs Hot Dog Stands Lunchrooms Mobile Food Services Nightclubs Office/Government Cafeterias Public and Private Clubs Push Carts Short Order Places Skating Rinks Sporting Venues Taverns Theaters 5 ADDITIONAL FACTS • To help offset the administrative costs associated with collecting the tax, a 3% discount has been included in the ordinance for those businesses that file and remit on a timely basis. • The filing and payment due dates for the meals tax correspond to filing and payment dates for the Virginia sales tax, the 20th day of the following month, to avoid confusion or duplication of effort. 6 REGISTRATION PROCESS 7 Registration Process • Every person responsible for the collection of the tax needs to file an application for a certificate of registration with our office. The application will be on a form designed by the County to provide information for the assessment and collection of this tax. • Upon approval of the application, a certificate of registration authorizing the collection of the meals tax will be issued to the applicant. • Each person with a certificate of registration is required to notify our office of any changes to the information provided on their application within thirty (30) days of the change. 8 Registration Form Rev 12/13 SL County of Henrico, Virginia Application for Certificate of Registration Food and Beverage Tax Department of Finance Business Section P O BOX 90775 Henrico VA 23273-0775 ACCOUNT NUMBER Separate Application Required for Each Location PLEASE REPORT BELOW ANY CHANGES IN THE PRE-PRINTED INFORMATION. OWNER’S NAME OWNER’S NAME Corporation Name or First Name, Middle Initial, and Last Name TRADE NAME TRADE NAME MAILING ADDRESS MAILING ADDRESS Number/Street or Route/Apt./Room Number/Street or Route/Apt./Room CITY STATE/ZIP PHYSICAL LOCATION CITY STATE/ZIP PHYSICAL LOCATION Number/Street or Route/Apt./Room TYPE OF ESTABLISHMENT (Please √ box which is most appropriate.) 01 Bakery 02 03 04 Caterer (including airline) Coffee Shop Convenience Store 05 06 07 Fast Food Restaurant Full Service Restaurant Gas Station 08 09 10 11 12 Grocery Store Hospital or Nursing Home Industrial Cafeteria Mobile Food Service Night Club or Tavern 13 Office or Government Cafeteria 14 Private or Public Club 15 School, College or University 16 Snack Bar or Concession Stand 99 Other (Please describe.) Number/Street or Route/Apt./Room OTHER INFORMATION Type of Food You Sell Average Cost of Meal for Two (including beverages and dessert) √ Applicable Response Under $25 $25-$50 $50+ Days and Hours of Operation Seating Capacity Square Footage ABC License Number (if applicable) VA Sales and Use Number Seasonal Business – Check months you are active. (√) JAN FEB MAR (Complete if you are only open part of the year.) APR MAY JUN JUL AUG SEPT OCT NOV DEC Office Use Only Please provide contact data for a person who has knowledge of your food and beverage tax return information and has permission to discuss that information. Name Phone Number Title Fax Number Location of Records E-Mail DECLARATION OF TAXPAYER – I declare that the foregoing and figures are true, full, and correct to the best of my knowledge and belief. Signature/Title Date Name (Please Print) For Assistance, please call (804) 501-7354 or (804) 501-7329 9 Certificate of Registration COUNTY OF HENRICO, VIRGINIA DEPARTMENT OF FINANCE CERTIFICATE OF REGISTRATION FOR THE COLLECTION OF FOOD AND BEVERAGE TAX NAME AND ADDRESS ACCOUNT NUMBER LOCATION OF SELLER THE NAMED SELLER IS HEREBY AUTHORIZED AND EMPOWERED TO COLLECT THE FOOD AND BEVERAGE TAX FOR THE COUNTY OF HENRICO REFER TO THIS NUMBER IN ALL CORRESPONDENCE BEGINNING LIABILITY DATE MONTH DAY YEAR DATE ISSUED MONTH DAY YEAR Rev 12/13 SL 10 Not Subject to Collecting the Meals Tax Department of Finance Business Section P O BOX 90775 Henrico VA 23273-0775 County of Henrico, Virginia Food and Beverage Tax Notification by Businesses Not Required to Collect ACCOUNT NUMBER Separate Form Required for Each Location Owner’s Name ______________________________ Trade Name ______________________________ Mailing Address __________________________________ City, State, ZIP __________________________ Physical Location ________________________________________________________________________ Mark any that apply: sell no food or beverage items at all sell only beverages, no food sell only desserts, ice cream or other snack foods sell only grocery items or food in bulk sell only some combination of beverages, snack foods or grocery items bakery with no seating convenience or grocery store that does not serve prepared foods from a delicatessen (made to order) counter hospital or nursing home providing food only to patients or residents industrial cafeteria selling only to employees (not applicable to government or office cafeterias) school, college or university selling only to students and employees volunteer fire department or rescue squad; nonprofit church or other religious body; educational, charitable, fraternal, or benevolent organization, selling on an occasional basis, not exceeding three times per calendar year as a fundraising activity, the gross proceeds of which are to be used by such church, religious body or organization exclusively for nonprofit educational, charitable, benevolent, or religious purposes If this information changes, you are required to provide accurate updated information to the County of Henrico Department of Finance. For Assistance Please Call (804) 501-7354 or (804) 501-7329 11 COLLECTING THE TAX 12 Common Exemptions • • • • Food and beverages when consumed and paid for by the Commonwealth of Virginia, any political subdivision of the Commonwealth, or the United States Food and beverages sold by restaurants to their employees as part of their compensation when no charge is made to their employee Food purchased for human consumption as “food” is defined in the Food Stamp Act of 1977, 7 U.S.C. § 2012, as amended, and federal regulations adopted pursuant to the act, except for the following items: sandwiches, salad bar items sold from a salad bar, prepackaged single-serving salads consisting primarily of an assortment of vegetables, and non-factory sealed beverages. A complete list of exemptions is provided in the Guidelines as well as on the website. 13 TAXABLE AND NON-TAXABLE ITEMS 14 Gratuities and Service Charges • Any discretionary gratuity is non-taxable. • Non-discretionary gratuity added to the cost of the meal is taxable if it is more than twenty percent (20%). Only the amount greater than 20% is taxable. 15 Restaurants – EXAMPLES OF TAXABLE ITEMS • • • • • Entrees and side dishes Sandwiches (hot or cold), burgers and hotdogs Pizza Soups, salads and buffets Beverages, desserts and snacks sold with a meal – EXAMPLES OF NON-TAXABLE ITEMS • Beverages not sold with a meal • Cookies, desserts, donuts, ice cream, popcorn and other snacks not sold with a meal • Grocery items, such as salads (potato, macaroni, etc.) sold by the pound, whole cakes or pies, coffee beans and other dry goods, and ice cream sold in bulk 16 Grocery and Convenience Stores – EXAMPLES OF TAXABLE ITEMS • • • • Hot foods served from the deli counter Made-to-order sandwiches from the deli counter Hot pizza from the deli counter Individual pieces of chicken served from the deli counter 17 Grocery and Convenience Stores – EXAMPLES OF NON-TAXABLE ITEMS • • • • • • • Cold or frozen foods that are normally served hot Prepackaged foods Beverages Foods sold by the pound Bakery items Whole, prepackaged cooked chickens Grocery items, such as salads (potato, macaroni, etc.) sold by the pound, whole cakes or pies, coffee beans and other dry goods, and ice cream sold in bulk 18 Caterers and Banquet Facilities, including Hotels – TAXABLE ITEMS Separately stated charges for food and beverages (following the same rules as restaurants, etc.). This applies to caterers located in Henrico, regardless of where the meals are delivered or consumed. – NON-TAXABLE ITEMS • Separately stated charges for services and rentals (audio visual equipment, dishes, room rental, etc.) • Complementary meals offered by hotels and bed-andbreakfasts as part of the individual guest’s room charge 19 REMITTANCE PROCESS AND RECORDKEEPING REQUIREMENTS 20 Remittance of Tax Collected • A business required to collect the meals tax must file a return and remit to the County any food and beverage taxes according to the following schedule: • Monthly Filers: Returns and payment are due on or before the 20th day of each month, covering the amount of tax collected during the preceding month. • Quarterly Filers: Returns and payment are due on or before the 20th day of the month immediately following the end of the quarter, covering the amount of tax collected during the preceding quarter. The quarterly returns and payment of tax shall be filed with the director of finance on or before April 20, July 20, October 20, and January 20, representing, respectively, the gross proceeds and taxes collected during the preceding quarters ending March 31, June 30, September 30 and December 31. • Seasonal Filers: Returns and payment are due on or before the 20th day of the month immediately following the collection of the tax, covering the amount of tax collected during the preceding month. 21 Penalties for Failure to File and Pay by the Due Date • A penalty of ten percent of the tax will be assessed for failure to file by the due date. • In addition, a penalty of ten percent of the tax due will be assessed for failure to pay by the due date. • Interest will be assessed at the rate of ten percent per year on the amount of tax and penalties past due. The interest will commence on the day following the day on which the tax was due and continue until paid. 22 Criminal Penalties Any person required to collect, account for, and pay over the meals tax who fails to collect or truthfully account for and pay over this tax, will be guilty of a class 1 misdemeanor. 23 Remittance Form COUNTY OF HENRICO, VIRGINIA DEPARTMENT OF FINANCE (804) 501-7354 or (804) 501-7329 Collections for the Period Ending: _____________________________________ Account Number Name & Address I declare that the forgoing statements are true, full and correct to the best of my knowledge. __________________________________________ Signature Date ______________________ ________________ Title Phone FOOD AND BEVERAGE TAX 1. Gross Sales 2. Non- Taxable Sales and Other Deductions 3. Taxable Sales (Line 1 less Line 2) 4. Food and Beverage Tax (Line 3 X 4%) 5. Seller’s Commission (Line 4 X 3%) $__________________ $__________________ $__________________ $__________________ $__________________ (only if the return is filed and the tax paid in full by the due date) 6. Subtotal (Line 4 less Line 5) 7. Penalty for Late Filing (Line 6 X 10%) 8. Penalty for Late Payment [(Lines 6 + 7) X 10%] 9. Sum of Lines 6, 7, and 8 10. Interest if Late (Line 9 X a daily rate of .0274%) 11. Total Due (Line 9 + Line 10) 12. Amount Paid $__________________ $__________________ $__________________ $__________________ $__________________ $__________________ $__________________ th Due by the 20 day of the month following the end of the reporting period. Mail To: County of Henrico, Lockbox #4733, P O Box 90791, Henrico, VA 23228-0791 Rev 1/14 SL 24 Examples TIMELY FILING/PAYMENT EXAMPLE COUNTY OF HENRICO, VIRGINIA DEPARTMENT OF FINANCE (804) 501-7354 or (804) 501-7329 Collections for the Period Ending: June 2014 Account Number Name & Address 1. Gross Sales 2. Non- Taxable Sales and Other Deductions 3. Taxable Sales (Line 1 less Line 2) 4. Food and Beverage Tax (Line 3 X 4%) 5. Seller’s Commission (Line 4 X 3%) $ $ $ $ $ 12,000 (2,000)* 10,000 400 (12) (only if the return is filed and the tax paid in full by the due date) I declare that the forgoing statements are true, full and correct to the best of my knowledge. _John Doe______________ Signature _Accountant____________ Title FOOD AND BEVERAGE TAX _____7/1/14___ Date _XXX-XXXX____ Phone 6. Subtotal (Line 4 less Line 5) 7. Penalty for Late Filing (Line 6 X 10%) 8. Penalty for Late Payment [(Lines 6 + 7) X 10%] 9. Sum of Lines 6, 7, and 8 10. Interest if Late (Line 9 X a daily rate of .0274%) 11. Total Due (Line 9 + Line 10) 12. Amount Paid $ 388 $__________________ $__________________ $ 388 $__________________ $ 388 $ 388 th Due by the 20 day of the month following the end of the reporting period. Mail To: County of Henrico, Lockbox #4733, P O Box 90791, Henrico, VA 23228-0791 For, example, *sales of items without a meal OR non-food items AND deductions for returned checks. 25 Examples DELINQUENT FILING AND PAYMENT EXAMPLE COUNTY OF HENRICO, VIRGINIA DEPARTMENT OF FINANCE (804) 501-7354 or (804) 501-7329 Collections for the Period Ending: June 2014 Account Number Name & Address 1. Gross Sales 2. Non- Taxable Sales and Other Deductions 3. Taxable Sales (Line 1 less Line 2) 4. Food and Beverage Tax (Line 3 X 4%) 5. Seller’s Commission (Line 4 X 3%) $ 12,000 $ (2,000)* $ 10,000 $ 400.00 $__________________ (only if the return is filed and the tax paid in full by the due date) I declare that the forgoing statements are true, full and correct to the best of my knowledge. _John Doe______________ Signature _Accountant____________ Title FOOD AND BEVERAGE TAX _____8/21/14___ Date _XXX-XXXX____ Phone 6. Subtotal (Line 4 less Line 5) 7. Penalty for Late Filing (Line 6 X 10%) 8. Penalty for Late Payment [(Lines 6 + 7) X 10%] 9. Sum of Lines 6, 7, and 8 10. Interest if Late (Line 9 X a daily rate of .0274%) 11. Total Due (Line 9 + Line 10) 12. Amount Paid $ 400.00 $_________40.00____ $_________44.00____ $ 484.00 $________ __3.98____ $ 487.98 $ 487.98 th Due by the 20 day of the month following the end of the reporting period. Mail To: County of Henrico, Lockbox #4733, P O Box 90791, Henrico, VA 23228-0791 For, example, *sales of items without a meal OR non-food items AND deductions for returned checks. 26 Record Retention and Audit • Each business collecting the meals tax is required to keep and preserve for five years records showing gross sales of all food and beverages, the amount charged to the purchaser for each such purchase, the date of the purchase, the taxes collected on the purchase, and the amount of tax required to be collected. • Our office has the right to examine these records at reasonable times and to make copies of any or all parts of the records. 27 Going Out of Business When a business that was required to collect or pay the food and beverage tax ceases operations, any tax collected but not yet remitted shall become immediately due and payable, and such business shall immediately make a report and pay the tax due. 28 MEALS TAX Contact Information: Susan Layne Steve Klos (804) 501-7354 lay@co.henrico.va.us (804) 501-7329 klo11@co.henrico.va.us www.co.henrico.va.us/finance/meals-tax-information Questions? 29