Giesting Financial Weekly Update WEEKLY QUOTE "First say to

WEEKLY QUOTE

"First say to yourself what you would be; and then do what you have to do."

- Epictetus

Giesting Financial Weekly Update

November 30, 2015

A MESSAGE FROM MARK…

‘Tis the season – for so many opportunities and temptations. With that in mind, Kiplinger has put together a great list of things to do – and not do – to protect your wallet this holiday season.

http://www.kiplinger.com/slideshow/credit/T065-S001-13-ways-towaste-money-during-the-holidays/index.html?rss_source=rss

WEEKLY TIP

Taking money out of your retirement account with the goal of using it to pay for your child's college expenses is a bad idea. Student loans do burden a young adult, but you could end up delaying your retirement because of this move.

WEEKLY RIDDLE

In what year did

Christmas and New

Year's Day happen in the same year?

Last week's riddle:

You cannot see me. I am inside everyone. I only emerge in anger. The

CONSUMER CONFIDENCE TRENDS DOWN

November saw the Conference Board consumer confidence index plummet. It dropped 8.7 points from its revised October mark of 99.1 to 90.4; economists polled by Briefing.com assumed it would rise slightly to 99.6. The CB attributed

November's poor reading (the lowest since September 2014) to declining expectations of job and wage growth in the next few months. November's final

University of Michigan consumer sentiment index also declined to 91.3 from its preliminary reading of 93.1.

1,2

CONSUMER SPENDING NUDGES UP

Personal spending improved just 0.1% in October, but the Commerce Department's latest report also revealed that personal incomes rose by 0.4% last month. In news related to consumer spending, October saw a 3.0% gain in capital goods orders

(0.5% minus transportation orders), and the Bureau of Economic Analysis put Q3

GDP at 2.1% in its second estimate, 0.6% higher than in its first.

1

A LEAP FOR NEW HOME SALES IN OCTOBER

New home buying increased 10.7% last month according to the Census Bureau, resulting in a 4.9% annualized gain. Resales declined 3.4% in October, the National

Association of Realtors noted, citing declining inventory as a major factor.

3

AN ADVANCE FOR THE BIG THREE

The Nasdaq led the way among the major U.S. equity indices last week, rising 1.06% to a November 27 close of 5,127.53. Next was the Dow, gaining 0.37% in the shortened trading week to settle at 17,798.49 Friday. The S&P 500 eked out an

0.04% advance from Monday through Friday to close the week at 2,090.11.

4

shorter I am, the hotter

I am. What am I?

Last week's answer:

A temper.

THIS WEEK: NAR's October pending home sales index appears Monday. Tuesday sees the release of the November ISM manufacturing PMI and Q3 earnings from Bob

Evans. Wednesday, Federal Reserve chair Janet Yellen speaks on the outlook for the economy in Washington, D.C.; the Fed releases a new Beige Book, a new ADP employment change report comes out, and Wall Street also considers earnings from

Aeropostale and American Eagle Outfitters. Thursday, Janet Yellen testifies on the economic outlook in the Senate; October's Challenger job-cut report, November's

ISM services PMI, a new initial claims report and earnings from Barnes & Noble,

Dollar General, Express, Five Below, Kroger, Land's End, Sears Holdings and Toro also arrive. The Labor Department's November jobs report arrives Friday, plus earnings from Big Lots! and Hovnanian.

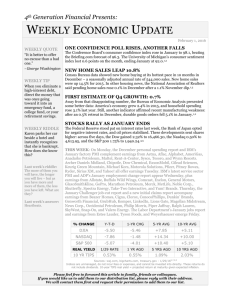

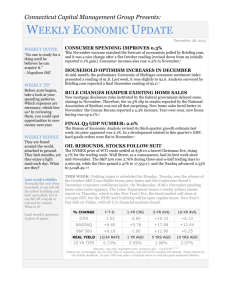

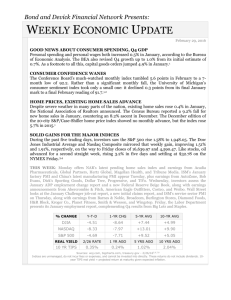

% CHANGE Y-T-D 1-YR CHG 5-YR AVG 10-YR AVG

DJIA

NASDAQ

-0.14

+8.27

-0.17

+7.01

+12.09

+20.46

+6.34

+12.90

S&P 500 +1.52

+1.09

+15.15

+6.62

REAL YIELD 11/27 RATE 1 YR AGO 5 YRS AGO 10 YRS AGO

10 YR TIPS 0.62% 0.39% 0.75% 2.04%

Sources: wsj.com, bigcharts.com, treasury.gov - 11/27/15

5,6,7,8,9

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

Please feel forward this article to family, friends or colleagues – referrals are truly appreciated!

If you would like us to add them to our distribution list, please reply with their address.

We will contact them first and request their permission to add them to our list.

DISCLAIMER: This e-mail and any files transmitted with it are private, confidential and solely for the use of the intended recipient. It may contain material that is legally privileged, proprietary or subject to copyright belonging to the sender or its related parties, and it may be subject to protection under federal or state law. If you are not the intended recipient, you are notified that any use, distribution or copying of the message is strictly prohibited and may subject you to criminal or civil penalties. If you received this transmission in error, please contact the sender immediately by replying to this e-mail and delete the material from any computer. Please do not leave trade instructions via email as we cannot honor them.

DISCLOSURE: Giesting Financial is not owned or controlled by the cfd Companies. Adviser not licensed in all States. Advisory Services are provided through Creative Financial Designs, Inc., a Registered Investment Adviser, and Securities are Offered through cfd Investments, Inc., a Registered

Broker/Dealer, Member FINRA & SIPC, 2704 South Goyer Road, Kokomo, IN 46902 765.453.9600

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services.

If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment. The Dow Jones Industrial Average is a priceweighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard

& Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange

(the "NYSE") and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the

COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 briefing.com/investor/calendars/economic/2015/11/23-27 [11/27/15]

2 - usatoday.com/story/money/business/2015/11/24/consumer-confidence-job-market-economy/76306492/ [11/24/15]

3 - zacks.com/stock/news/199216/new-home-sales-rebound-in-october-housing-back-on-track [11/26/15]

4 markets.on.nytimes.com/research/markets/usmarkets/usmarkets.asp [11/27/15]

5 - markets.wsj.com/us [11/27/15]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=12%2F31%2F14&x=0&y=0 [11/27/15]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=11%2F28%2F14&x=0&y=0 [11/27/15]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F28%2F14&x=0&y=0 [11/27/15]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F28%2F14&x=0&y=0 [11/27/15]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F26%2F10&x=0&y=0 [11/27/15]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F26%2F10&x=0&y=0 [11/27/15]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=11%2F28%2F05&x=0&y=0 [11/27/15]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F28%2F05&x=0&y=0 [11/27/15]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F28%2F05&x=0&y=0 [11/27/15]

7 - finance.yahoo.com/q/hp?s=^DJI&a=10&b=26&c=2010&d=10&e=26&f=2010&g=d

8 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [11/27/15]

9 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [11/27/15]