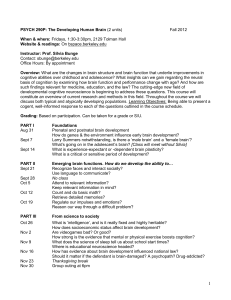

Bryan School of Business and Economics

advertisement

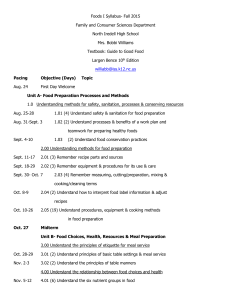

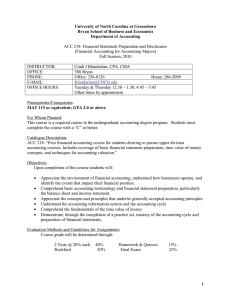

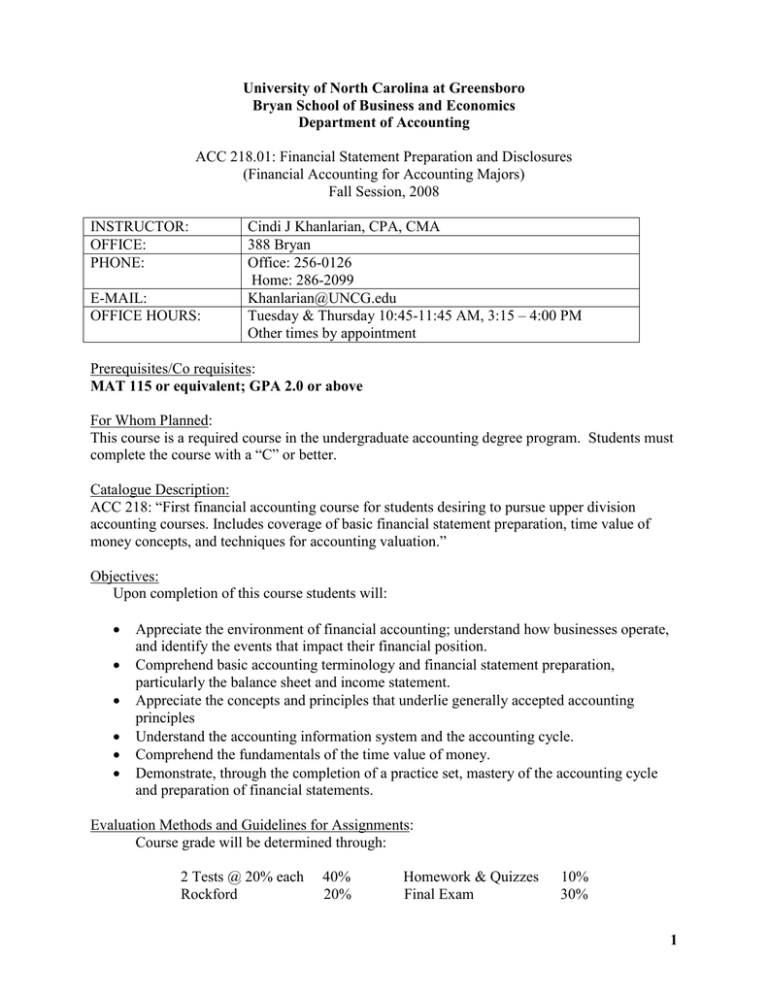

University of North Carolina at Greensboro Bryan School of Business and Economics Department of Accounting ACC 218.01: Financial Statement Preparation and Disclosures (Financial Accounting for Accounting Majors) Fall Session, 2008 INSTRUCTOR: OFFICE: PHONE: E-MAIL: OFFICE HOURS: Cindi J Khanlarian, CPA, CMA 388 Bryan Office: 256-0126 Home: 286-2099 Khanlarian@UNCG.edu Tuesday & Thursday 10:45-11:45 AM, 3:15 – 4:00 PM Other times by appointment Prerequisites/Co requisites: MAT 115 or equivalent; GPA 2.0 or above For Whom Planned: This course is a required course in the undergraduate accounting degree program. Students must complete the course with a “C” or better. Catalogue Description: ACC 218: “First financial accounting course for students desiring to pursue upper division accounting courses. Includes coverage of basic financial statement preparation, time value of money concepts, and techniques for accounting valuation.” Objectives: Upon completion of this course students will: Appreciate the environment of financial accounting; understand how businesses operate, and identify the events that impact their financial position. Comprehend basic accounting terminology and financial statement preparation, particularly the balance sheet and income statement. Appreciate the concepts and principles that underlie generally accepted accounting principles Understand the accounting information system and the accounting cycle. Comprehend the fundamentals of the time value of money. Demonstrate, through the completion of a practice set, mastery of the accounting cycle and preparation of financial statements. Evaluation Methods and Guidelines for Assignments: Course grade will be determined through: 2 Tests @ 20% each Rockford 40% 20% Homework & Quizzes Final Exam 10% 30% 1 Grading Scale: A+ = 98-100 A = 93-97 A- = 90-92 B+ = 88-89 B = 83-87 B- = 80-82 C+ = 78-79 C = 73-77 C- = 70-72 D+ = 68-69 D = 63-67 D- = 60-62 F = 59 and below Graduate students: any average below 70 = F All grades will be posted on Blackboard. It is your responsibility to make sure they are recorded correctly. Please contact me immediately if there is an error. Required Texts/Readings/References: Intermediate Accounting, Twelfth Edition Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield Rockford Corporation: An Accounting Practice Set to Accompany Intermediate Accounting Twelfth Edition, Kieso, Weygandt, Warfield and prepared by Larry Falcetto, Wiley 2007. Honor Code: Students are expected to know and abide by the Honor Code in all matters pertaining to this course. Please do not get into trouble by violating the Honor Code. If you find yourself behind or in a difficult situation, please come to see me. Do not be tempted to cheat. When in doubt about whether or not something violates the code, ask me. http://academicintegrity.uncg.edu/violation/ Student Conduct: Students are expected to know and abide by the Student Code of Conduct. Students who behave in an unprofessional manner will be dismissed from the class. “An academic community of integrity upholds accountability and depends upon action in the face of wrongdoing. Every member of an academic community—student, group/organization, faculty member, and staff—is responsible for upholding the integrity of the community.” http://studentconduct.uncg.edu/policy/code/ www.uncg.edu/bae/faculty_student_guidelines.pdf Student Disabilities - ( http://ods.dept.uncg.edu/services/_ ) Any request for special accommodations must come through that office with the appropriate paperwork. Attendance policy: while there is no required attendance policy, be aware that people who come to class generally perform better on tests than people who do not come to class. Prompt and regular class attendance is necessary to master the material in ACC 218. Financial Accounting is not an overly difficult subject, but it does require students to prepare for class in advance, study regularly, and resolve any problems or difficulties in understanding the material promptly. Should you feel that you are lost, please seek help immediately. It is difficult to discover knowledge the day before an exam. Make-up Exam Policy: Make-up tests will be prepared for students with documentation. Quizzes cannot be made up. 2 Makeup policy for other assignments: Homework is due on the due date. No late homework is allowed. No late submissions will be accepted. This class will abide by the University’s policy during inclement weather as it is posted on the website or by calling 334-5000. Other Comments: 1. I believe that your education is your primary responsibility. It is your job to prepare for and attend class. 2. This course is a critically important portion of the accounting curriculum at UNCG. It is also very time intensive. You may find it necessary to read the textbook material more than once to fully absorb it. 3. Please note that the chapter assignments and practice sets may only represent the minimum amount of work necessary to gain an understanding of the material covered in this course. 4. There are no opportunities for “extra credit” in this course. 5. Please bring your calculator to all classes. You may not borrow or share calculators during quizzes, tests or exams. Topical Outline: Week Aug. 26 Aug. 28 Sept. 2 Sept. 4 Sept. 9 Sept. 11 TOPIC COVERAGE Chapter 3: The Accounting Information System Define accounting and the accounting information system Learn the 5 elements and the accounting equation (page 35) Learn how to identify, measure and communicate economic events Learn the formulas to prepare the 4 basic financial statements Income Statement Statement of Equity Balance Sheet Statement of Cash Flows Debits and Credits Journals and ledgers Accounting Transaction Cycles Worksheet Adjusting entries In class practice sets Chapter 1 Parties involved in standard setting Generally accepted accounting principles Issues in financial reporting 3 Sept. 16 Sept. 18 Sept. 23 Sept. 25 Sept. 30 Oct. 7 Oct. 9 Oct. 14 Oct. 16 Oct. 23 Oct. 28 Oct. 30 Nov. 4 Nov. 6 Nov. 11 Nov. 13 Nov. 18 Nov. 18 Nov. 20 Nov. 25 Dec. 2 Dec. 4 Dec. 9 Exam Chapter 2 Conceptual Framework Basic objectives of financial reporting Fundamental concepts--Qualitative characteristics Recognition and measurement concepts Review Exam 1 Chapter 4 Income statement preparation and related information Format of the income statement Reporting irregular items Special reporting issues Periodic COGS: pp. 370-372 Terms and discounts: p. 320 Payroll Chapter 5 Balance Sheet preparation Recording Stock purchases: p. 483 & 729-732 and Treasury stock: p. 733-737 Lower of cost or market: Recording dividends declared: p. 742-743 Recording purchase of long-term assets: p. 473 Depreciation: sum of years’ digits, units of production, straight-line, double declining balance: p. 525-528 Gain or loss on disposal: p. 485-488 Bad Debts: p. 323-326 Note receivable: p. 326-331 Exam 2 Chapter 6 Accounting and the time value of money Basic time value concepts Single-sum problems Annuities Rockford Set Due Basic Principles of Accounting page 38 International issues (Chapter 1) Ethics in Accounting Review Reading Day Dec. 11 @ 8AM Dec. 11 @ noon Dec. 12 @ 3:30 PM 4