Accounting Presentation

advertisement

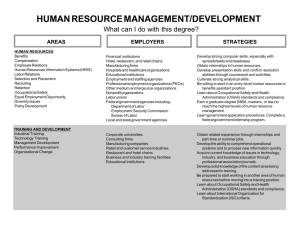

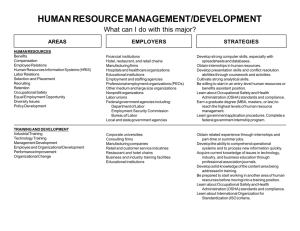

Accounting Presentation By: Brandon Miller, Katie Ketelsen, Kira Selser, Stephen Newman, Margaret Larson, & Patrick Hewitt Introduction What is accounting? Accounting is a dynamic field at the heart of every business. Modern accountants are problem-solvers and business advisors and frequently move to the top executive levels. The University of Iowa Accounting Program is designed to provide the diverse business background you’ll need to succeed in the fields of public accounting, private industry, government, and consulting. Graduation Requirements BBA degree requires a minimum of 120 semester hours of credit, of which at least 48 s.h. must be in the college of business and at least 60 must be nonbusiness courses Residence in the College of Business (Usually after sophomore year) Must have a 2.00 GPA on the total body of course work taken Course Requirements General Education Requirement (22-26 s.h.) Prerequisite Courses for Admission to College of Business (22 s.h.) Business Core Courses (24 s.h.) Accounting Major Course Requirement (28 s.h.) Electives (20-24 s.h.) Accounting Major Courses Income Measurement and Asset Valuation Introduction to Taxation Accounting for Management Analysis and Control Valuation of Financial Claimes Auditing Business Law Professional Seminar Series Accounting Information Systems Advanced Tax Topics Accounting for Multi-segment Enterprises Government and Not-for-Profit Accounting 150 Hour CPA Law By state law, all persons sitting for the Uniform CPA Examination must have a minimum of 150 semester hours of college credit. The purpose of this is that candidates must not only have the accounting and businessrelated education, but also a broader, general education in today’s highly technical, complex business environment. Requirements to Sit for the Exam 150 hours of college credit Resident of Iowa Be of good moral character and reputation Have a baccalaureate or higher degree from a college or university that is recognized by the Iowa Accountancy Examining Board and completed at least 24 semester hours in accounting courses CPA Examination Did You Know? You can start to take the CPA exam before you complete your 150 hour education requirement if you are in the process of completing your last semester of college. Accounting Graduate Programs Doctor of Philosophy Joint Accounting and Law Program Master of Accountancy Doctor of Philosophy Earn a Ph. D. in Business Administration Students could take this path after majoring in accounting if the wished to teach accounting at the university level in the future. Joint Accounting and Law Program Earn a M.Ac. degree and a J.D degree Enrolled in both the Graduate College and College of Law Up to 12 semester hours may be applied as electives to each program Master of Accounting Program (M. Ac.) The M.Ac. program is most commonly used to satisfy the CPA certification requirement. M. Ac. is a 1 year program Must choose one of the following tracks to specialize in: Financial & Auditing, Management Information Systems, Managerial Accounting, or Tax Financial & Auditing Specialization The environment in which both internal and external auditors operate is becoming increasingly complex. This complexity manifests itself in four ways. First, advances in technology are changing the way business is conducted; electronic commerce is replacing paper-based transactions. Second, markets are no longer limited by national boundaries. Firms must now be competitive on a global scale. Third, management information systems are becoming increasingly sophisticated in response to the revolution in commerce. Fourth, the explosion in the popularity and complexity of financial instruments and derivative securities has exposed auditors to new risks. Management Information Systems Specialization Both national and local employment trends are creating a new environment for UI students. Currently, professionals providing auditing and accounting services represent approximately half of the professionals in Big Five firms. The emphasis on consulting and other assurance services (for example, verifying the content of corporate websites) is expanding. Large public accounting firms are transforming themselves into professional services corporations. Managerial Accounting Specialization The accounting professional has become a part of the management team rather than a standalone information provider. The successful accountant must understand issues in functional areas such as marketing and production and keep current with changes in management philosophy. With the emergence of an empowered workforce and leaner organizations, the accountant’s role has changed as decisions are driven deeper into the organization. The modern accountant increasingly resembles a coach or an educator who helps employees use information for making better decisions. Tax Specialization The demand for tax specialists remains high. Firms in public accounting and in industry seek to hire graduates who have specialized in tax. Because businesses often face complex and contradictory tax, regulatory, and business issues, the activities performed by entry-level tax specialists require an in-depth understanding of not only current and emerging tax issues, but also business issues. The required tax track courses provide a basic understanding of tax as it is practiced today. More importantly, tax track graduates will have sufficient background to do the research necessary to find and communicate tax solutions in whatever tax environment Congress creates. Accounting Career Options The University of Iowa's Accounting Department offers students a wide range of options not only for their education and their degree program but also for their internships and their future careers. An accounting degree from the University of Iowa will provide you with the skills you need to assume a position in public accounting, consulting, private industry or government. This degree is also a good foundation for law school or for entrepreneurial careers. Accounting Internships An internship gives a student a chance to see whether or not a certain company's focus fits with their career goals. It also allows employers to evaluate the students compatibility with their company. Many companies often choose to hire their entry level employees from those that have completed internships with them. At Iowa, you have a wide variety of possibilities for internships. They can be done in the spring or summer or you can take one during your senior year for 6 semester hours. Internships are available in or out of state and can be found in public accounting firms, private industries or government. Accounting Internships (Cont.) Last year, some students that had taken internships in Chicago came back with starting offers of $50,000 and signing bonuses of $5000. The job market for accountants in Iowa has been expanding as the demand for employees far exceeds the supply of qualified individuals. This means that there are an unbelievable amount of opportunities out there for recent graduates with an accounting degree. Large public accounting firms hire almost 70% of University of Iowa accounting graduates. Others find positions in the insurance, financial, investment, manufacturing, government and nonprofit sectors. Of the 110 undergraduates in the class of 2000, 2/3 have found jobs in the field. The median starting salary for these graduates was $42,000 and many had signing bonuses of $2000-$5000 (graph on next slide.) It is also expected that the new 5 year requirement to sit for the CPA exam will decrease the number of CPA-ready grads because fewer people will qualify to sit for the exam. This in turn will drive up salaries. Public Accounting Firms Hiring 1999-2000 Accounting Graduates Arthur Andersen, LLP PriceWaterhouseCoopers McGladrey & Pullen Ernst & Young KPMG, LPP Clifton Gunderson & Co. DeLoitte & Touche, LPP *Not all companies are listed Industrial, Financial, Gov’t, ect. Firms Hiring 1999-2000 Accounting Graduates Blue Cross/Blue Shield The Boeing Company Rockwell Collins Amoco State Farm Insurance GE Capital Wellmark JC Penny Allied Group McCleod USA Deere & Co. Pella Corporation John Hancock Financial MCI WorldCom *Not all companies are listed