Chapter 9 - Tripod.com

advertisement

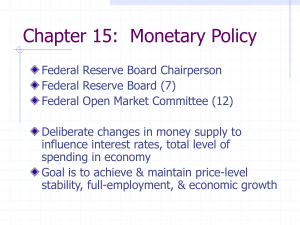

Chapter 9 Money Creation and the Money Supply Determinants and Process Multiple Deposit Creation and the Money Supply Process Four Players Central Bank (FED) Banks Depositors Borrowers Federal Reserve Balance Sheet Assets – increase in assets increases the Monetary Base • • • • • • Securities – Treasuries Discount loans to banks Gold and Special Drawing Rights certificates Coins Cash items in process (float) Physical Plant and others Liabilities - – increase in liabilities decreases the Monetary Base • • • • • Federal Reserve Notes outstanding – currency in circulation Printed by the FED Reserves of banks Required By the reserve requirement (10%) No interest paid Excess U.S. Treasury Deposits Foreign and other deposits Deferred-availability cash items (in process) – float Monetary Base: (bills + treasury currency + coins) + Reserves MB = C + R Control of the MB Open Market Operations • • • • The most direct method the Fed uses to change the monetary base is open market operations, which is buying or selling U.S. government securities. In an open market purchase the Fed buys government securities. An open market purchase increases either bank reserves or currency in circulation; therefore it increases the monetary base, which is the sum of reserves plus currency (B = C + R). Purchase – buy bonds from the banks, gives them more money to loan Increases the monetary base The Fed can reduce the monetary base by an open market sale of government securities. Sale – sells bonds to the banks, takes money away from them Decreases the monetary base Discount loans at the discount rate trough the discount window • • • Loan increases the monetary base Recalling a loan decreases the monetary base When the Fed lends to depository institutions, the loans are called discount loans and the interest rate on the loans is called the discount rate Deposit Creation Deposit Creation Start with $10,000 and a rr = 10% Bank A…… Simple Deposit Multiplier • Change in Deposits(D) = 1/rr x Change in Reserves (R) rr = Reserve Requirements The Money Multiplier One way the Fed manages the nation’s money supply is by controlling the monetary base, which is comprised of all currency in circulation and reserves held by banks. Calculation M = m x MB • • • C/D = currency-deposit ratio • • R = Reserves RR = Required Reserves RR = rr x D • ER = Excess Reserves R = RR + ER • • C = Currency D = Checkable Deposits ER/D is the Excess Reserve Ratio • M = Money Supply = C + D m is the money multiplier MB = Monetary Base = R + C rr = reserve requirement (ratio) R = (rr x D) + ER MB = R + C = (rr x D) + ER + C Since ER =ER/D x D and C = C/D x D MB = (rr x D) + (ER/D x D) + (C/D x D) D = (1/(rr + ER/D + C/D x D) x MB M = D + C = D + (C/D x D) = (1 + C/D) x D M = ((1 + C/D)/(rr + ER/D + C/D)) x MB m = (1 + C/D)/(rr + ER/D + C/D) Numbers rr = .10 C = $400b D = $800 ER = $.8b MS = $1200b m= MB = 480 Factors that Determine the Money Supply Reserve Requirement (Ratio): rr up, m and MS down C/D: up, then m and MS down ER/D: up, then m and MS down Changes: The money multiplier = ____ What if the FED increases the MB by 20 what will the MS be? MS = What will the change in the MB be if the Fed wants the MS to equal 1400? MB = Tools Open Market Operations – the purchasing and selling of government securities to commercial banks and/or the public Open market operations, the purchases and sales of securities in financial markets by the Fed, are the dominant means by which the Fed changes the monetary base. • • • The Fed began to use open market purchases as a policy tool during the 1920s. The lack of intervention by the Fed during the bank crisis of the early 1930s led Congress to establish the Federal Open Market Committee (FOMC) to guide open market operations. Open market purchases are viewed as expansionary and open market sales are viewed as contractionary. The FOMC meets eight times a year and issues a general directive stating its overall objectives for monetary aggregates and interest rates. • • • • • The Federal Reserve System’s account manager is responsible for carrying out open market operations that fulfill the FOMC’s objectives. The Open Market Trading Desk, a group of traders at the Federal Reserve Bank of New York, trades government securities over the counter electronically with primary dealers. The account manager can conduct open market operations through outright purchases and sales of Treasury securities or by using Federal Reserve repurchase agreements (analogous to commercial bank repos). For open market sales, the trading desk often engages in matched sale-purchase transactions (or reverse repos) in which the Fed sells securities to dealers who agree to sell them back to the Fed in the near future. Open market operations intended to change monetary policy are known as dynamic transactions, while those aimed at offsetting fluctuations in the base are called defensive transactions. Open market operations have several benefits that other policy tools lack: control, flexibility, and ease of implementation. To discern the Fed’s intentions, Fed watchers read carefully the directives issued by the Fed. Most used • • Types • • Sandy Krieger, Head of Domestic Open Market Operations New York District Bank • • • Dynamic – designed to change the level of MB and R Defensive – designed to offset other things that may change the level of MB and R A day at the Trading Desk • To buy bonds the FED offers a higher price which lowers interest rates To sell bonds the FED offers a lower price which raises interest rates Traded electronically with primary dealers selected by the FED Through banks or the nonbank public Dealers make offers to the FED Advantages • • • • Complete control – not subject to the actions of others (banks) Flexible and precise Easily reversed No administrative delays Discount Policy – loans to member banks Discount policy, which includes setting the discount rate and terms of discount lending, is the oldest of the Federal Reserve’s principal tools for regulating the money supply. The Fed influences the volume of discount loans by setting their price (the discount rate) and by setting their terms. • • • • An increase in the discount rate reduces the volume of discount loans and exerts upward pressure on other interest rates. The Fed uses the discount window to make one of three types of loans: adjustment credit, seasonal credit, and extended credit. Primary credit is available to health banks and may be used to for any purpose. Secondary credit is intended for banks not eligible for primary credit and may not be used to expand a bank’s assets. Temporary, short-term seasonal credit loans satisfy seasonal liquidity requirements of smaller depository institutions. Although the Fed allows banks to borrow from the discount window, it discourages banks from heavy use of discount loans. Discount policy offers the Fed certain advantages that the other policy tools do not have. The discount window provides the most direct way for the Fed to act as a lender of last resort to the banking system Discount rate changes – mostly ceremonial Used in a potential financial crisis (Crisis intervention) • • • • • • 1970 1974 1980 1984 Stock market crash of 10/87 911 0n 9/11/01 Quantity of loans • • • • • Types Primary Credit loan – to most sound banks Secondary Credit loans – to riskier banks Seasonal Credit loans – banks in vacation or agricultural areas Cost of borrowing from the FED Interest rate costs Concerns raised about the health of the bank Refusal to get a loan if you go to many times Moral suasion – rules for discount window operations FED is the lender of the last resort To avert a financial crisis Announcement effect – FED announces what it is thinking about doing… the market reacts Problem: banks don’t have to borrow or they may borrow more than expected Control is not 100% Reserve Requirement – Percentage of deposits that must be held in the FED Reserve requirements stem from the Fed’s mandate that banks hold a certain fraction of their deposits in cash or deposits with the Fed. • The Board of Governors sets reserve requirements within congressional limits, under authority granted by Congress in the Banking Act of 1935. • In 1980, the Depository Institutions Deregulation and Monetary Control Act established uniform reserve requirements for all depository institutions. The Fed changes reserve requirements much more rarely than it conducts open market operations. Every two weeks, the Fed monitors compliance with its reserve requirements by checking a bank’s daily balance. Ranges from 8% to 20% • 1937 – 20% • 1958 – 13% • 1980 – 12% • 1992 – 10% Now • 3% on the first $49.3 million • 10% above $49.3 million Advantage • It effects all banks equally Disadvantage • It is not precise • Changes would have to be .001% which is not practical Tool Action MB Money Supply Open Market Operations Buy Bonds Increases Increases Sell bonds Decreases Decreases Raise Rates Decreases Decreases Lower Rates Increases Increases Raise None Lowers Lower None Raises Discount Window Reserve Requirement Goals – some conflict Major High Employment • Economic Growth – 2 ½ % to 3.5% • Natural Rate of Unemployment – 6% Acceptable Frictional – between jobs Structural – mismatch of jobs and skills Seasonal Unacceptable Cyclical – due to business cycles Pollution increases Price Stability – 4.5% Minor Interest Rate Stability Financial market stability Foreign market stability Problems in Achieving Monetary Policy Goals A policy that is intended to achieve one monetary policy goal may have an adverse effect on another policy goal. The Fed’s tools don’t always allow it to achieve its monetary policy goals directly. The Fed also faces timing difficulties in using its monetary policy tools. The source of numerical objectives for unemployment and inflation General guidelines for numerical objectives are found in the Employment Act of 1946 and the Humphrey-Hawkins Full Employment and Balanced Growth Act of 1978. Full employment is believed to be about 4.0 to 4.5 percent measured unemployment in the mid 2000s. The goal for inflation depends upon recent experience and the political and historical environment. Price stability does not necessarily mean zero inflation but rather low inflation such as in the 1 to 2 percent range. Sustainable growth is thought to be in the 2.5 to 3.0 percent range. Targets Operating Reserve aggregates • • • • Reserves Nonborrowed reserves Monetary base Nonborrowed base Federal Funds Rate Intermediate Monetary aggregates • • • M1 M2 M3 Short and long term interest rates Criteria for choosing a target • • • Measurability Controllable Have a predictive effect on goals History – FED has switched its targets many times only recently to the Federal Funds Rate Teens – Discount rate 20’s – Open market operations Prior to the Great depression – Raised the discount rate to reduce credit Late 30’s – Reserve requirements. Money was no longer backed by gold or silver 40’s – Open market operations 50’s and 60’s – interest rates and money market conditions Fed’s independence established 70’s – M1 and M2 through the Federal Funds Rate Early 80’s – discount rate and Nonborrowed reserves Late 80’s – interest rates through discount rates and discount loans 90’s and today – Federal Funds rate 9/11/01: Fed averted a financial crisis by lowering the discount rate so that banks could borrow money to meet financial obligations Greenspan was out of the country. Vice Chairman Roger W. Ferguson was in charge 2003 – raised the discount rate above the federal funds rate to discourage banks from borrowing from the FED Check Clearing Act will allow paper reproductions of checks Taylor Rule Federal Funds Rate = 2.5 + Inflation + ½(Inflation Gap) + ½(GDP Gap) Daniel Rule FFR = 13.98 – 2.61(Unemployment Rate) + .01 (CPI) 93% accuracy