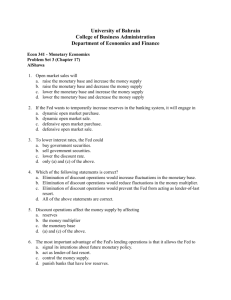

Macroeconomics

Chapter 15: Monetary Policy

Federal Reserve Board Chairperson

Federal Reserve Board (7)

Federal Open Market Committee (12)

Deliberate changes in money supply to influence interest rates, total level of spending in economy

Goal is to achieve & maintain price-level stability, full-employment, & economic growth

Tools of Monetary Policy

Open-market operations

Reserve ratio

Discount rate

Open-Market Operations

Bond markets are open to buyers & sellers of corporate & government bonds (securities)

Fed’s Open-market operations consist of buying bonds from or selling bonds to commercial banks & general public

The most important instrument for influencing the money supply

Reserve Ratio

Raising the reserve ratio increases amount of required reserves banks must keep reduces money supply

Forces banks to reduce amount of checkable deposits

Lowering reserve ratio decreases amount of required reserves banks must keep increases money supply

Transforms required reserves into excess reserves, enhancing ability of banks to create new money by lending

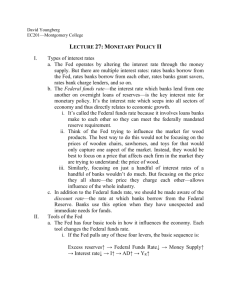

Discount Rate

Fed is “lender of last resort”

Short-term loans to commercial banks in need in its district (12)

Discount Rate: Interest rate Fed charges to commercial banks

Borrowing from Federal Reserve Banks by commercial banks increases reserves of commercial banks & enhances their ability to extend credit

Lowering discount rate increases money supply

Increasing discount rate decreases money supply

Easy Money Policy

Aka Expansionary Monetary Policy

To combat recession & unemployment,

Fed decides to increase money supply.

How:

Buy securities

Lower reserve ratio

Lower discount rate

Tight Money Policy

Aka Restrictive Monetary Policy

To reduce spending & control inflation,

Fed wants to reduce aggregate demand by contracting supply of money

How:

Sell securities

Increase reserve ratio

Raise discount rate

Effectiveness of Monetary

Policy

Strengths:

Speed & Flexibility (v. Fiscal Policy)

Isolation from Political Pressure (14 year terms)

Shortcomings & Problems

Less control due to changes banking practices

(bank reform & electronic transactions)

Changes in velocity

Velocity of money: number of times per year average dollar is spent on goods & services

Cyclical asymmetry: less reliable in pushing economy from recession

Targeting the Federal Funds

Rate

Focus of Fed’s monetary policy to stabilize the economy

Interest rates in general rise & fall w/ Federal

Funds rate

Prime interest rate: rate banks charge their most creditworthy customers, parallels FFR

By changing the FFR, Fed is changing economy’s overall interest rates

Fed announces changes in monetary policy by announcing changes for target FFR

Monetary Policy &

International Economy

Net Export Effect

Expansionary monetary policy (lower FFR) decreases foreign demand for dollars, increases net exports & dollar depreciates

Restrictive monetary policy (higher FFR) increases foreign demand for dollars, decreases net exports & dollar appreciates