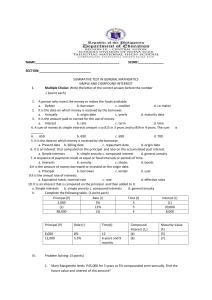

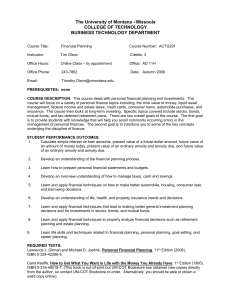

Finance Exam 1 Questions

advertisement

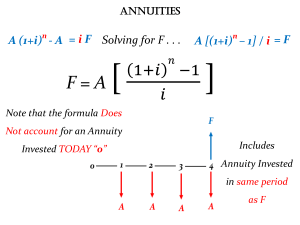

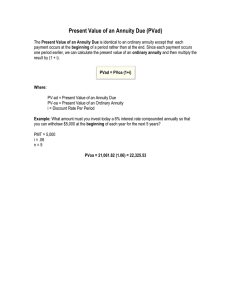

Exam 1 CFIN 3 Scott Besley Chapters 1-2-4 Chapter 1 1. What are the three principal forms of business organization? What are the advantages and disadvantages of each? 2. Drawing on your background in accounting, can you think of any accounting procedure differences that might make it difficult to compare the relative performance of different firms? 3. Compared to purely domestic firms, what are some factors that make financial decision making more complicated for firms that operate in foreign countries? Chapter 2 4. How might (a) seasonal factors and (b) different growth rates distort a comparative ratio analysis? Give some examples. How might these problems be alleviated? 5. Explain the difference between net income, or accounting profit, and net cash flow. Why do these numbers generally differ? 6. Indicate on the following pages the effects of the transactions listed in the following table on total current assets, current ratio, and net income. Chapter 4 7. What is an opportunity cost rate? How is this rate used in time value analysis, and where is it shown on a cash flow time line? Is the opportunity rate a single number that is used in all situations? 8. If a firm’s earnings per share grew from $1 to $2 over a 10-year period, the total growth would be 100 percent, but the annual growth rate would be less than 10 percent. True? Explain. Under what conditions would the annual growth rate actually be 10% a year? 9. Give a verbal definition of the term present value, and illustrate it using a cash flow time line with data from an example you construct. As a part of your answer, explain why present values are dependent on interest rates. 10. To find the present value of an uneven series of cash flows, you must find the PVs of the individual cash flows and then sum them. Annuity procedures can never be of use, even if some of the cash flows constitute an annuity (for example, $100 each for years 3, 4, 5, and 6) because the entire series is not an annuity. Is this statement true? Explain. 11. Suppose you are evaluating two investments, both of which require you to pay $5,500 today. Investment A will pay you $7,020 in five years, whereas Investment B will pay you $8,126 in eight years. a. Based only on the return you would earn from each investment, which is better? b. Can you think of any factors other than the expected return that might be important to consider when choosing between the two investment alternatives? 12. What is an amortized loan? What is an amortization schedule and how is it used?