RWJ06 - BYU Marriott School

advertisement

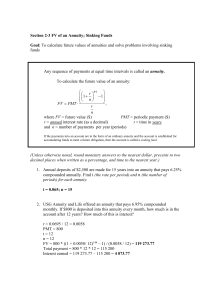

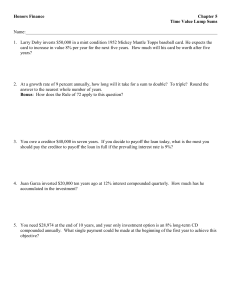

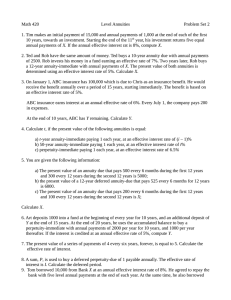

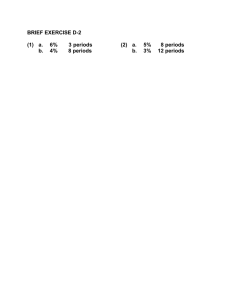

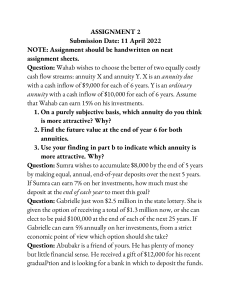

DISCOUNTED CASH FLOW VALUATION R OSS, WESTERFIELD, & J ORDAN C HAPTER 6 FUTURE VALUE OF TWO PAYMENTS You initially deposit $100 in an account and make an additional deposit during the next period. If the interest rate is 8%, what is the ending balance in the account after 2 years? SAVING UP REVISITED You think you will be able to deposit $4000 at the end of each of the next three years in a bank account now paying 8% interest. You currently have $7000 in the account. How much will you have in three years? In four years? TWO METHODS You make $2000 payments for five years. If the interest rate is 10%, what is the ending balance in your account? SAVING UP AGAIN If you deposit $100 in one year, $200 in two years, and $300 in three years, how much will you have in three years? How much of this is interest? How much will you have in five years if you don't add additional amounts? Assume a 7 percent interest rate throughout. HOW MUCH I? You are offered an investment that will pay you $200 in one year, $400 the next year, $600 the next year, and $800 at the end of the fourth year. You can earn 12% on very similar investments. What is the most you should pay for this one? HOW MUCH II? You are offered an investment that will make three $5000 payments. The first payment will occur four years from today. The second will occur in five years, and the third will follow in six years. If you can earn 11% what is the most this investment is worth today? What is the future value of the cash flows? Number of Periods ANNUITY TABLE 1 2 3 4 5 6 7 8 9 10 5% 0.9524 1.8594 2.7232 3.5460 4.3295 5.0757 5.7864 6.4632 7.1078 7.7217 Interest Rate 10% 15% 0.9091 0.8696 1.7355 1.6257 2.4869 2.2832 3.1699 2.8550 3.7908 3.3522 4.3553 3.7845 4.8684 4.1604 5.3349 4.4873 5.7590 4.7716 6.1446 5.0188 20% 0.8333 1.5278 2.1065 2.5887 2.9906 3.3255 3.6046 3.8372 4.0310 4.1925 FINDING A PAYMENT • What is the annuity payment of the present value is $100,000, the interest rate is 18%, and there are five periods? CREDIT CARD You ran a little short on your spring break vacation, so you put $1000 on your credit card. You can afford only the minimum payment of $20 per month. The interest rate on the credit card is 1.5% per month. How long will you need to pay off the $1000? FINDING THE RATE An insurance company offers to pay you $1000 per year for 10 years if you pay $6710 up front. What rate is implicit in this 10 year annuity? LOTTERY The Tri-State Megabucks lottery in Maine, Vermont, and New Hampshire offers you a choice of how to take your winnings (most lotteries do this). In a recent drawing, participants were offered the option of receiving a lump sum payment of $250,000 or an annuity of $500,000 to be received in equal installments over a 25 year period.