LUISS - Fall 2014 (QTEM)

advertisement

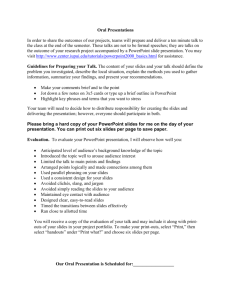

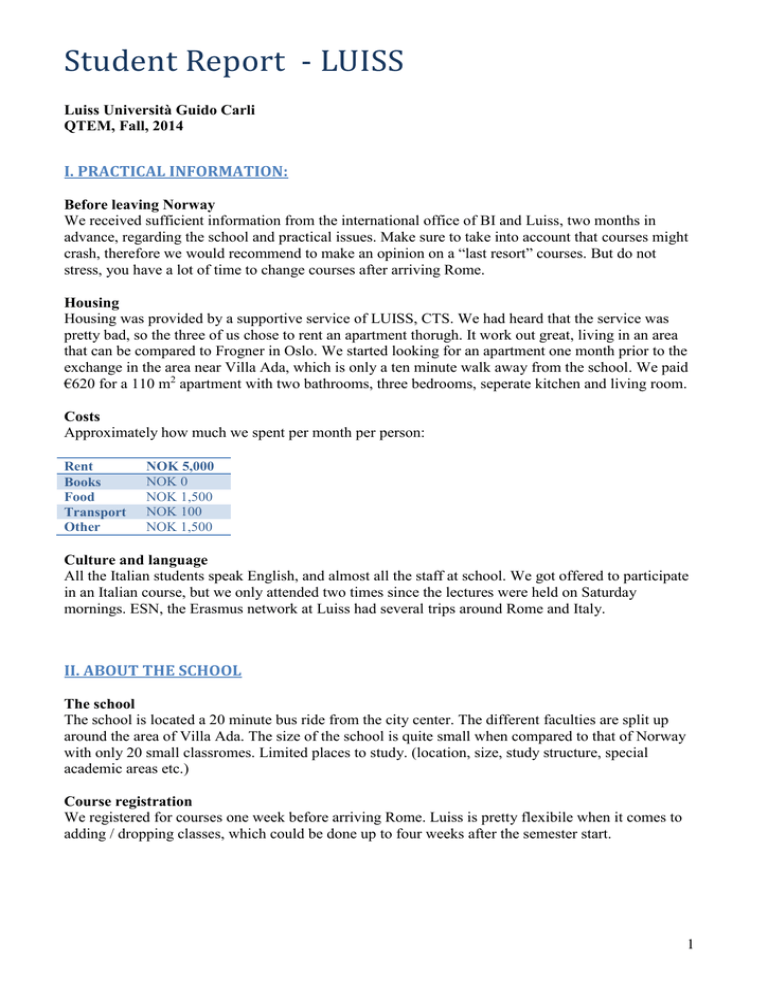

Student Report - LUISS Luiss Università Guido Carli QTEM, Fall, 2014 I. PRACTICAL INFORMATION: Before leaving Norway We received sufficient information from the international office of BI and Luiss, two months in advance, regarding the school and practical issues. Make sure to take into account that courses might crash, therefore we would recommend to make an opinion on a “last resort” courses. But do not stress, you have a lot of time to change courses after arriving Rome. Housing Housing was provided by a supportive service of LUISS, CTS. We had heard that the service was pretty bad, so the three of us chose to rent an apartment thorugh. It work out great, living in an area that can be compared to Frogner in Oslo. We started looking for an apartment one month prior to the exchange in the area near Villa Ada, which is only a ten minute walk away from the school. We paid €620 for a 110 m2 apartment with two bathrooms, three bedrooms, seperate kitchen and living room. Costs Approximately how much we spent per month per person: Rent Books Food Transport Other NOK 5,000 NOK 0 NOK 1,500 NOK 100 NOK 1,500 Culture and language All the Italian students speak English, and almost all the staff at school. We got offered to participate in an Italian course, but we only attended two times since the lectures were held on Saturday mornings. ESN, the Erasmus network at Luiss had several trips around Rome and Italy. II. ABOUT THE SCHOOL The school The school is located a 20 minute bus ride from the city center. The different faculties are split up around the area of Villa Ada. The size of the school is quite small when compared to that of Norway with only 20 small classromes. Limited places to study. (location, size, study structure, special academic areas etc.) Course registration We registered for courses one week before arriving Rome. Luiss is pretty flexibile when it comes to adding / dropping classes, which could be done up to four weeks after the semester start. 1 Academic calendar Arrival date: First day of the semester: Last day of classes: Examination period: September 10th September 12th December 5th Decembert 8th – 22nd Arrival We arrived two days before the orientation day. Unfortunaltey we were too late to buy tickets for the introduction buddy program, since a lot of the bachelor students had started one week earlier so they were sold out. Anyways we could still join for some of the activities. The International Office The international office is always helpful. We felt that the IO prioritized QTEM-students. The international office is only open three days a week at certain times. Social activities One of us played football with other ESN students. Otherwise one could participate in one of the many ESN activities, such as; a trip to Napoli, Piza, and many others. The Italian students are very social in and outside of the class room. III. ACADEMICS In the classroom The teching style is much more practical when compared to that of BI. All the courses had case studies, except for emerging markets. Also, almost all the professors are practioners, such as in “Asset Management” and “M&A” where they are asset managers and investment bankers. The level is a bit higher than bachelor courses at BI, but the workload is not high. Only mandatory case studies in “performance measurement”. Course materials Asset Management Book (6 chapters) and powerpoint slides. M&A and Investment Banking Only powerpoint. Emerging Markets Book (5 chapters) and powerpoint slides. Advanced Corporate Finance Book and powerpoint slides Fixed Income Powerpoint slides Financial Market Law Different homepages, powerpoint slides and a book. Real Estate Finance Book and powerpoint slides Performance Measurement and Financial Reporting Only powerpoint slides. Exams All the exams were based on the course materials reviewed in class. 2 Library and technology We did not try out the library since people said it was quite small, and it was a 30 minute walk away from the campus. Limited places to study. Four computer rooms with only one printer in each of them, so be prepared to wait when you want to do some printing. Description of courses Course Emerging Markets Master/ Bachelor Master Performan ce measureme nt and Financial Reporting Asset Manageme nt M&A and Investment Banking Fixed Income Master Financial Market Law Master Financial and Credit Derivatives Exam form 1 hour written final (100%) 2 cases (30%) and 2 hours written (70%) Prerequisite s None Basic accounting Oral exam – 10 minutes (100%) Oral exam – 10 minutes (100%) 1 hour midterm (20%), project (40%), and 2 hours final (40%) Two 1 hour midterms (50%) and 10 minutes oral exam (50%) Basic finance Master 1 hour midterm (50%) and 1 hour final (505) Basic derivatives Advanced Corporate Finance Master 1 hour written final Basic finance Real Estate Finance Master Oral (100%) Finance Master Master Master None Comments The professor is a bit boring, he talks and talks and talks. Concepts are easy to follow, but a bit challenging math. The main professor is good, but the two others are a bit difficult to understand. My favorite professor and course. Theoretical foundations with a lot of practical case studies. Good professors from the practitional field. Theoretical and practical. Good to know excel and basic statistics / macroeco. Good course, with several guest lecturers. The professor is very dedicated and works in the field of fixed income. It has a practical approach with focus on fully understanding basic concepts and trading strategies. None The main professor is a bit boring and bad at communicating the subject. The course is very theoretical, where we go thorugh directives, regulations, and regulatory environment in Europe. High workload, given the midterms. Interesting course, it is quite theoretical. The professor is very good at explaining the concepts and he uses examples to illustrate them. Covers a wide range of topics and includes an introduction to Matlab. The professor is knowledgable and funny. The course is as mch about derivatives as it is about corporate finance. Light workload. Interesting course and there is a lot of guest lecturers. There are two main professors, both working in the field of real estate, one in the area of finance and the other an engineer. It has a very practical approach and includes a location visit to a real estate development. 3