Chapter 1 An Introduction to Money and the

ECON 304

Money and Banking

Instructor: Bernard Malamud

–Office: BEH 502

Phone (702) 895 –3294

Fax: 895 – 1354

» Email: bernard.malamud@unlv.edu

Website: www.unlv.edu/faculty/bmalamud

Office hours: MW 3-4; TR 4 - 5:30 pm; and by appointment

Money, Banking, and Financial Markets

• The role of money and monetary policy in the economy

TRUST

• How financial markets such as bond, stock and foreign exchange markets work

TRUST

• How financial institutions such as banks and insurance companies work

TRUST

Course Objectives

• Roles played by banks and other intermediaries

• Determination of asset prices in financial markets

• How financial institutions operate

– Asymmetric information

• Adverse selection/Moral hazard/Principal – Agent Problems

– Innovations

– Regulation

• The conduct and impacts of monetary policy.

– How policies can promote macroeconomic stability

• Understand and explain the roots, responses and consequences of the subprime-triggered financial crisis.

Text

• Frederic S. Mishkin, The Economics of Money, Banking and Financial

Markets, 9 th edition. Earlier editions work

Supplemental Books and Articles:

• Frank Partnoy. Infectious Greed: How Deceit and Risk Corrupted the Financial Market,

Times Books, 2003.

• Gillian Tett, Fool’s Gold: How the Bold Dream of a Small Tribe at J.P. Morgan Was

Corrupted by Wall Street Greed and Unleashed a Catastrophe, Free Press, 2009.

• David Wessel, In Fed We Trust: Ben Bernanke’s War on the Great Panic, Random House,

2009.

• Michael Lewis, The Big Short: Inside the Doomsday Machine. W.W. Norton, 2010

• Andrew Ross Sorkin, Too Big to Fail. Viking, 2009

• Simon Johnson and James Kwak, 13 Bankers : The Wall Street Takeover and the Next

Financial Meltdown. Random House, 2010

• Raghuram G. Rajan, Fault Lines: How Hidden Fractures Still Threaten the World Economy.

Princeton, 2010.

• Liaquat Ahamed, Lords of Finance: The Bankers Who Broke the World. Penguin, 2009.

• Articles in Journal of Economic Perspectives (JEP) and Federal Reserve System publications cited in this outline and as added as the semester proceeds. These can be accessed from the JEP and Federal Reserve Bank websites.

• A security (financial instrument) is a claim on the issuer’s future income or assets

• A bond is a debt security that promises to make specified payments over time

– An interest rate is the cost of borrowing or the price paid for the rental of funds

• Common stock represents a share of ownership in a corporation

– A share of stock is a claim on the earnings and assets of the corporation

Interest Rates on Selected Bonds, 1950–2008

Sources: Federal Reserve Bulletin; www.federalreserve.gov/releases/H15/data.htm.

Banking and Financial Institutions

• Financial Intermediaries—institutions that borrow funds from people who have saved and make loans to other people and businesses

• Banks—accept deposits and make loans

• Other Financial Institutions—insurance companies, finance companies, pension funds, mutual funds and investment banks

• Financial Innovation

– The information age and e-finance

– Derivatives … bubbles and crisis

– Securitization … bubbles and crisis

Money and Business Cycles

• Recessions (unemployment) and booms (inflation) affect all of us

• Monetary Theory ties changes in the money supply to changes in aggregate economic activity and the price level

Money Growth (M2 Annual Rate) and Interest Rates

(Long-Term U.S. Treasury Bonds), 1950–2008

Sources: Federal Reserve Bulletin, p. A4, Table 1.10; www.federalreserve.gov/releases/h6/hist/h6hist1.txt.

Money and Inflation

• The aggregate price level is an average price of goods and services in an economy

• A continual rise in the price level (inflation) affects all economic players

Monetary and Fiscal Policies

• Monetary policy is the management of the money supply and interest rates

– Conducted by the Federal Reserve Bank (Fed)

• Fiscal policy is government spending and taxation

– Any deficit must be financed by borrowing … government borrowing affects interest rates

Bernanke’s Focus

• PREVENT DEPRESSION

• Inflation Targeting in tranquil times

– Adjust “real” rate of interest with eye on preannounced target rate of inflation

– Wiggle room for other objectives/emergencies

– Transparency and accountability

• Other Governors: www.federalreserve.gov/bios

– Oppose Deflation

• Great Depression and clogged credit channel

Core Principles of Money and Banking

• Time has Value

Interest rate

• Risk Requires Compensation

• Financial decisions are based on

Information and TRUST

• Markets set prices and allocate resources

• Stability reduces risk and spurs enterprise

• Uncertainty Fear Enterprise

Where to Find the Numbers

• http://research.stlouisfed.org/fred2/

• www.federalreserve.gov/releases/

• www.economist.com

• www.ft.com

• www.nytimes.com

• www.bea.doc.gov

• http://www.gpoaccess.gov/eop/

Function of Financial Markets

• Channel funds from economic players that have saved surplus funds to those that have a shortage of funds

• Promotes economic efficiency by producing an efficient allocation of capital

– increases production

• Improves consumer well-being

– allows them to time purchases better

Structure of Financial Markets

• Debt and Equity Markets

• Primary and Secondary Markets

– Investment Banks underwrite securities in primary markets

– Brokers and dealers work in secondary markets

• Exchanges and Over-the-Counter (OTC) Markets

• Money and Capital Markets

– Money markets deal in short-term debt instruments

– Capital markets deal in longer-term debt and equity instruments

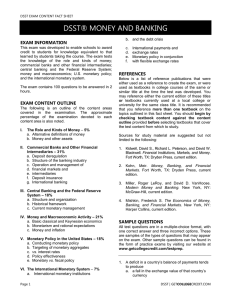

Principal Money Market Instruments

Principal Capital Market Instruments

Internationalization of Financial Markets

• Foreign Bonds—sold in a foreign country and denominated in that country’s currency

• Eurobond—bond denominated in a currency other than that of the country in which it is sold

• Eurocurrencies—foreign currencies deposited in banks outside the home country

– Eurodollars—U.S. dollars deposited in foreign banks outside the U.S. or in foreign branches of U.S. banks

• World Stock Markets

Function of Financial Intermediaries: Indirect Finance

• Lower transaction costs

– Economies of scale

– Liquidity services

• Reduce Risk

– Risk Sharing (Asset Transformation)

– Diversification

• Asymmetric Information

– Adverse Selection (before the transaction)—more likely to select risky borrower

– Moral Hazard (after the transaction)—less likely borrower will repay loan

Principal Financial Intermediaries and Value of Their Assets

Regulation of the Financial System

• To increase the information available to investors:

– Reduce adverse selection and moral hazard problems

– Reduce insider trading

• To ensure the soundness of financial intermediaries:

– Restrictions on entry

– Disclosure

– Restrictions on Assets and Activities

– Deposit Insurance

– Limits on Competition

– Restrictions on Interest Rates