MASTER SYLLABUS School of Business Administration, Sonoma

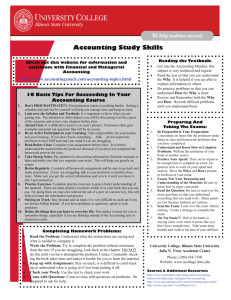

advertisement

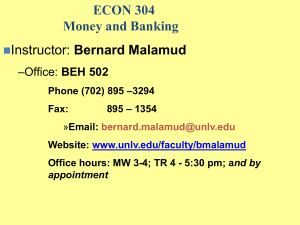

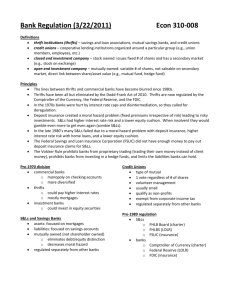

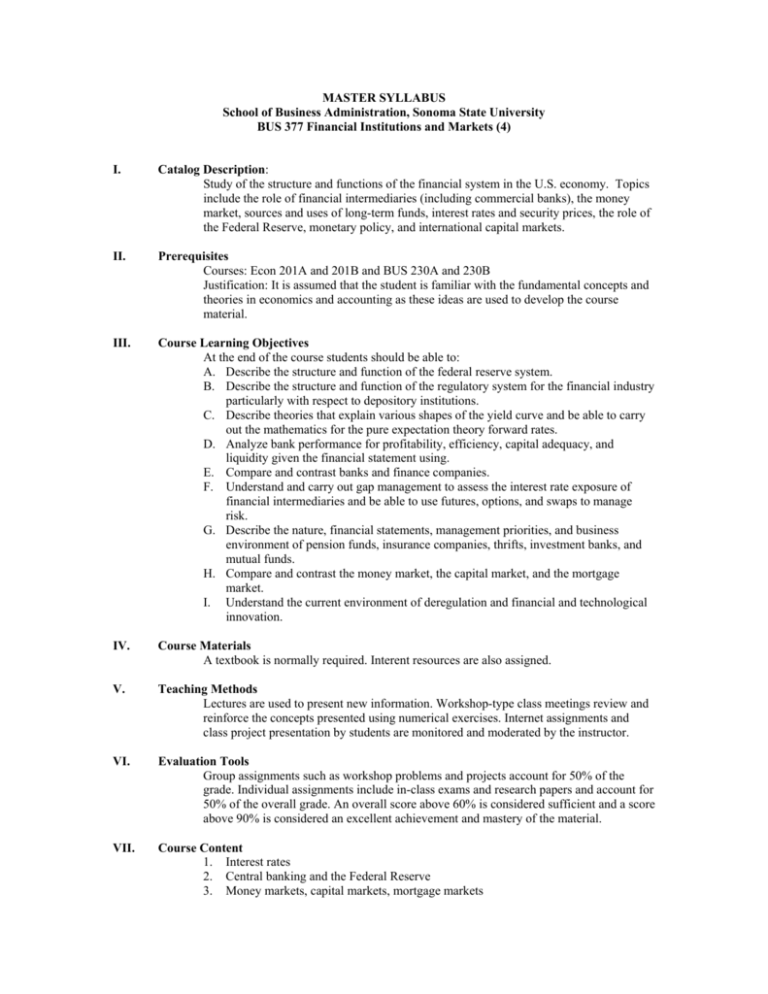

MASTER SYLLABUS School of Business Administration, Sonoma State University BUS 377 Financial Institutions and Markets (4) I. Catalog Description: Study of the structure and functions of the financial system in the U.S. economy. Topics include the role of financial intermediaries (including commercial banks), the money market, sources and uses of long-term funds, interest rates and security prices, the role of the Federal Reserve, monetary policy, and international capital markets. II. Prerequisites Courses: Econ 201A and 201B and BUS 230A and 230B Justification: It is assumed that the student is familiar with the fundamental concepts and theories in economics and accounting as these ideas are used to develop the course material. III. Course Learning Objectives At the end of the course students should be able to: A. Describe the structure and function of the federal reserve system. B. Describe the structure and function of the regulatory system for the financial industry particularly with respect to depository institutions. C. Describe theories that explain various shapes of the yield curve and be able to carry out the mathematics for the pure expectation theory forward rates. D. Analyze bank performance for profitability, efficiency, capital adequacy, and liquidity given the financial statement using. E. Compare and contrast banks and finance companies. F. Understand and carry out gap management to assess the interest rate exposure of financial intermediaries and be able to use futures, options, and swaps to manage risk. G. Describe the nature, financial statements, management priorities, and business environment of pension funds, insurance companies, thrifts, investment banks, and mutual funds. H. Compare and contrast the money market, the capital market, and the mortgage market. I. Understand the current environment of deregulation and financial and technological innovation. IV. Course Materials A textbook is normally required. Interent resources are also assigned. V. Teaching Methods Lectures are used to present new information. Workshop-type class meetings review and reinforce the concepts presented using numerical exercises. Internet assignments and class project presentation by students are monitored and moderated by the instructor. VI. Evaluation Tools Group assignments such as workshop problems and projects account for 50% of the grade. Individual assignments include in-class exams and research papers and account for 50% of the overall grade. An overall score above 60% is considered sufficient and a score above 90% is considered an excellent achievement and mastery of the material. VII. Course Content 1. Interest rates 2. Central banking and the Federal Reserve 3. Money markets, capital markets, mortgage markets 4. 5. 6. 7. 8. 9. 10. 11. VIII. Commercial banking and bank management Risk management in financial institutions Bank regulation Thrifts Insurance companies Finance companies Investment banks Pension funds and mutual funds Interdesciplinary Content 1. Topics that require graded work other than exams (and percent of course hours). a. International/global issues 5% b. Regulatory issues 15% c. Technology issues 5% 2. Topics that do not require graded work other than exams (and percent of course hours) a. Political issues 0% b. Social issues 0% c. Demographic Diversity 0%