Chapter 7: Federal Income Taxes

advertisement

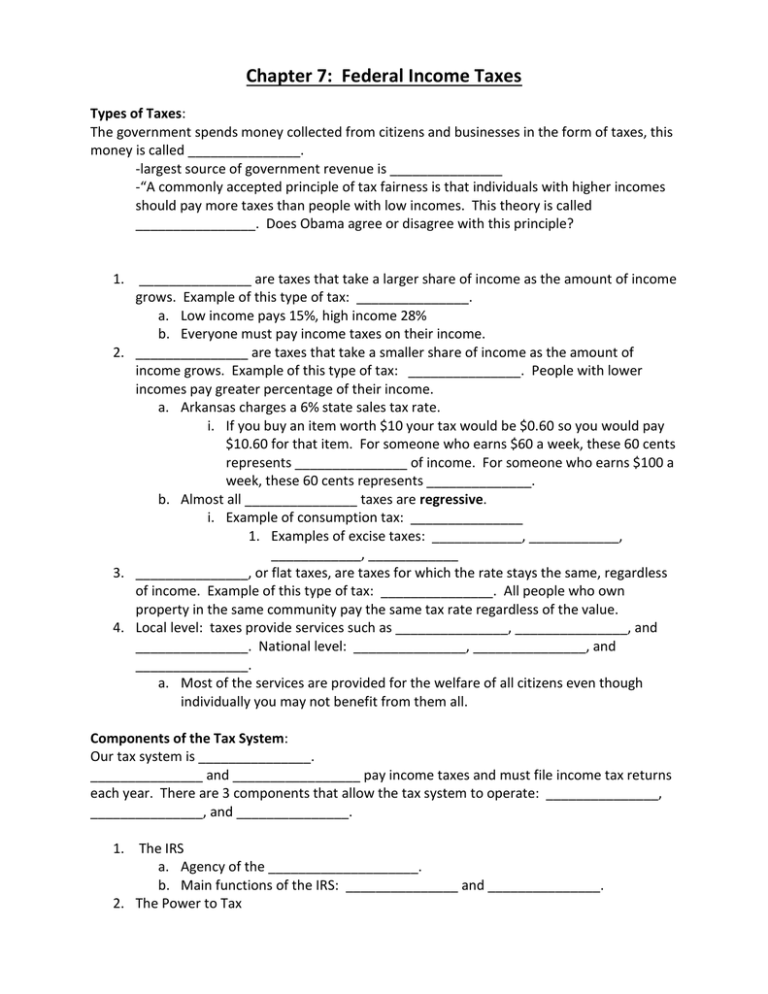

Chapter 7: Federal Income Taxes Types of Taxes: The government spends money collected from citizens and businesses in the form of taxes, this money is called _______________. -largest source of government revenue is _______________ -“A commonly accepted principle of tax fairness is that individuals with higher incomes should pay more taxes than people with low incomes. This theory is called ________________. Does Obama agree or disagree with this principle? 1. _______________ are taxes that take a larger share of income as the amount of income grows. Example of this type of tax: _______________. a. Low income pays 15%, high income 28% b. Everyone must pay income taxes on their income. 2. _______________ are taxes that take a smaller share of income as the amount of income grows. Example of this type of tax: _______________. People with lower incomes pay greater percentage of their income. a. Arkansas charges a 6% state sales tax rate. i. If you buy an item worth $10 your tax would be $0.60 so you would pay $10.60 for that item. For someone who earns $60 a week, these 60 cents represents _______________ of income. For someone who earns $100 a week, these 60 cents represents ______________. b. Almost all _______________ taxes are regressive. i. Example of consumption tax: _______________ 1. Examples of excise taxes: ____________, ____________, ____________, ____________ 3. _______________, or flat taxes, are taxes for which the rate stays the same, regardless of income. Example of this type of tax: _______________. All people who own property in the same community pay the same tax rate regardless of the value. 4. Local level: taxes provide services such as _______________, _______________, and _______________. National level: _______________, _______________, and _______________. a. Most of the services are provided for the welfare of all citizens even though individually you may not benefit from them all. Components of the Tax System: Our tax system is _______________. _______________ and _________________ pay income taxes and must file income tax returns each year. There are 3 components that allow the tax system to operate: _______________, _______________, and _______________. 1. The IRS a. Agency of the ____________________. b. Main functions of the IRS: _______________ and _______________. 2. The Power to Tax a. Power to levy taxes rests with _______________. b. The _______________ provides that “all bills for raising revenue shall originate in the House of Representatives.” 3. Paying Your Fair Share a. Income tax system is _______________. Tax rates increase as taxable income increases. i. Tax rates apply to income ranges, or _______________. 1. ________________ tax brackets 2. Lowest bracket is taxed __________. 3. Highest bracket is taxed __________. ii. When the government spends more than it receives in revenue, it has a _______________. It has to then borrow money to pay its expenses. iii. Income tax system is based on ____________________, which means that all citizens are expected to prepare and file income tax returns. 1. Due date for taxes each year: ______________. 2. Responsibility for filing and paying taxes falls upon _______________. 3. Failure to file/pay can result in _______________, ________________, and ________________. a. Willful failure to pay taxes is ________________. b. Who is this man? What did he do? 4. An IRS Audit a. _______________ is an examination of the tax return. Definitions of Terms: 1. 5 choices of Filing Status: a. Single person b. Married person filing a joint return c. Married person filing a separate return d. Head of Household e. Qualifying widower 2. Exemptions a.