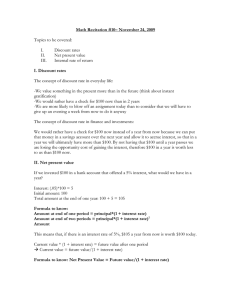

here

advertisement

Q1 • • • The discount rate for the value of the option is the expected return on the stock: E(s) =r=0.02+3(0.1-0.02)=0.26 The call option has a positive value if (up, up) occurs. This happens with probability: Pr(up,up)=0.6^2=0.36 The present value of the option is: PV=0.36[50(1.15^2)-55]/(1.262)=2.52 Q2 • The present value of the cost for r=EAIR=(1.005)^12-1=0.061678 is: PV=80/(1+r)21+80/(1+r)22+80/(1+r)23+80/(1+r)24 +90/(1+r)24+90/(1+r)25+90/(1+r)26+90/(1+r)27 =161.84 • The present value of the deposits for the same discount rate: PV=100/(1+r)2+x/(1+r)10 • Set the present value of the cost equal to the value of the deposits and solve of x 161.84=88.19+x/(1+r)10 X=133,052 Q3 • Calculate the present value of the cash value of dividends for each year and add them together: PV1/2=5.5/1.161/2 + PV3/2 =5.5(1.15)/1.163/2 + PV5/2=5.5(1.15)2/1.165/2 + PV7/2 =5.5(1.15)3/1.167/2 PV9/2=5.5(1.15)4/1.169/2 + PV11/2=5.5(1.15)5/1.1611/2 + PV13/2=5.5(1.15)5/(0.16*1.1611/2) =60.55 Q4 • You can find the covariance of the portfolio by multiplying the correlation by the standard deviations of both stocks: Cov(x,y)=0.04*0.12*0.18=0.000864 • Then use the formula for the portfolio variance and take the square root to find the portfolio’s standard deviation: Varp=0.82*0.122+2*0.8*0.2*0.000864+0.22*0.182=0.010788 Std=(0.010788)1/2=0.10387 Q5 • Use the weighted cost of capital equation from Modigliani and Miller (1958) proposition II: RS R0 B ( R0 RB ) S RS=0.12+0.4/0.6(0.12-0.3)=0.18 Q6 • Use the condition that IRR is the discount rate (r) that would make the projects NPV=0. Then solve for r using the quadratic formula. 1.Let x=1+r NPV=0 -500-600/x+1500/x2=0 5x2+6x-15=0 2. Using the quadratic formula x is either x1= 1.233 x2=-2.34 3.Ignore any negative rates of return r=x1-1=0.23 Q7 • The yield on a bond is the discount rate (r) that would make the NPV of the bond equal to zero. Use that condition and solve for r using the quadratic formula. 1.Let x=1+r NPV=0 1320/x2+120/x+120-800=0 17x2-3x-33=0 2. Using the quadratic formula x is either x1= 1.484 x2=-1.307 3.Ignore any negative rates of return 4.Currently r is the 6 month discount rate. Transform it to an effective annual interest rate: EAIR=(x1)2-1=0.203 = 20.3%