Building Your Money with Interest

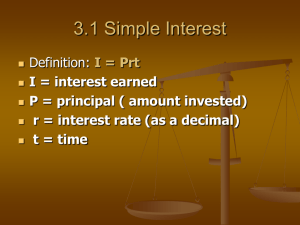

advertisement

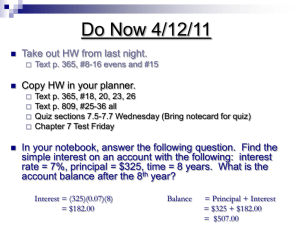

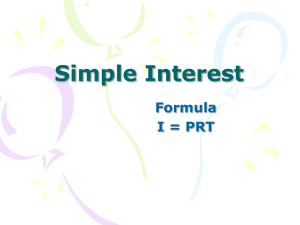

Mr. Stasa – Willoughby-Eastlake City Schools © If you put $100 under your mattress for one year, how much will you have? $100 Will the $100 you have today be able to buy the same value of goods a year from now? Current U.S. Rate of Inflation 1.7% Inflation is the rise in the cost of goods and services over time Inflation decreases the spending power of each dollar you have “A Hershey’s bar in 1955 could have been purchased with a nickel” “The price of a Hershey bar has increased 13% from 2008-2010” Principal is the original (initial) amount of money that is invested or borrowed. Banks and credit unions pay customers interest for the use of money that is deposited in an account The customers’ money on deposit is used by the bank to give out loans Those who pay back interest on borrowed loans is greater than the interest the bank pays for the use of customer’s money Banks are able to pay depositors interest and still make a profit. 1. Simple interest 2. Compound interest I = prt I = interest p = principal r = interest rate (as a decimal) t = number of year Mark has $500 in his savings account that pays 4% simple interest. How much total money will he have in his account after THREE years? I = prt PRINCIPAL 500 X RATE X TIME = INTEREST 3 $60 X 0.04 X = Total after three years: PRINCIPAL 500 + INTEREST + 60 = TOTAL MONEY $560 = Sarah has $1,000 in her savings account that pays 2% simple interest. How much total money will she have in her account after FIVE years? I = prt PRINCIPAL 1,000 X RATE X TIME = INTEREST 5 $100 X 0.02 X = Total after three years: PRINCIPAL 1,000 + INTEREST + 100 = TOTAL MONEY $1,100 = With simple interest, only the original principal is used to compute annual interest Compound interest is money earned on principal plus previously earned interest. http://www.youtube.com/watch?v=0t74Kxc9OJk The sooner you invest your money, the more time it has to grow! The rule of 72 has two functions: 1. Calculate the number of years needed to double your investment 2. Calculate the interest rate required to double your investment 72 #1 = Years Needed to Double Investment Interest Rate 72 #2 Years Needed to Double Investment = Interest Rate Required 72 Interest Rate = Years Needed to Double Investment Your grandparents give you $200 for your birthday. You want to invest it to help save for a down payment on a car. If you put the $200 in an account that earns 6% interest per year, how long will it take to double into $400? 72 / 6% interest = 12 years 72 Years Needed to Double Investment = Interest Rate Required What if you were very anxious to buy your new car and don’t want to wait too long for your money to double. Instead, you want your $200 to double in 4 year. What will the interest rate need to be? 72 / 4 years = 18% interest