381 Principal payoff per period v03

advertisement

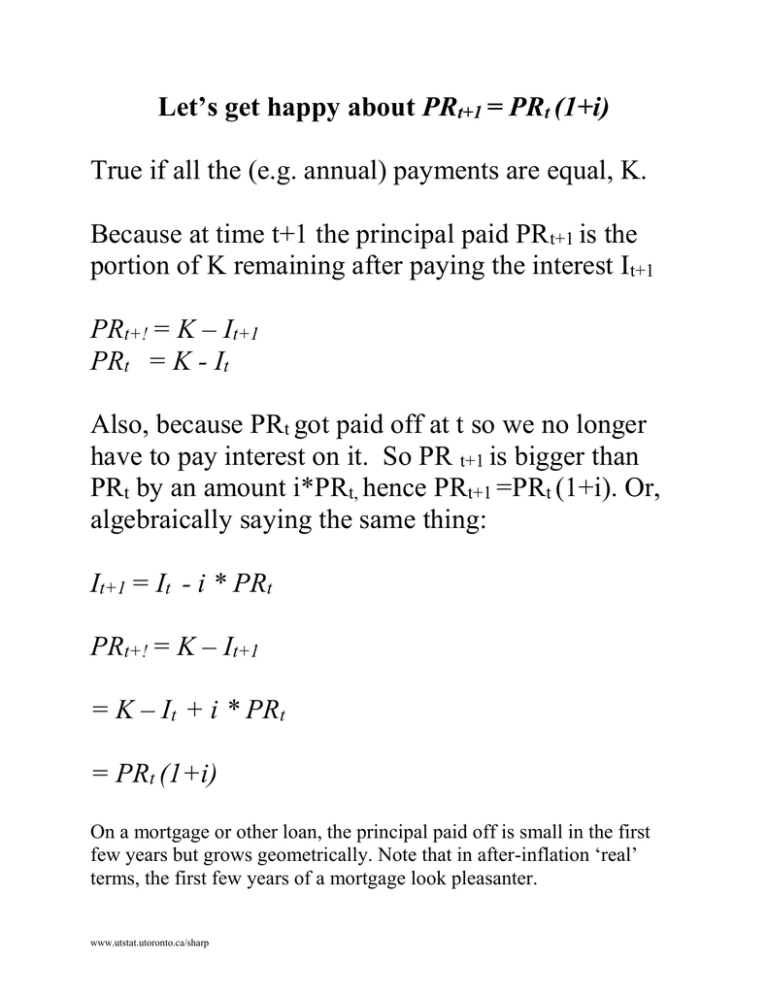

Let’s get happy about PRt+1 = PRt (1+i) True if all the (e.g. annual) payments are equal, K. Because at time t+1 the principal paid PRt+1 is the portion of K remaining after paying the interest It+1 PRt+! = K – It+1 PRt = K - It Also, because PRt got paid off at t so we no longer have to pay interest on it. So PR t+1 is bigger than PRt by an amount i*PRt, hence PRt+1 =PRt (1+i). Or, algebraically saying the same thing: It+1 = It - i * PRt PRt+! = K – It+1 = K – It + i * PRt = PRt (1+i) On a mortgage or other loan, the principal paid off is small in the first few years but grows geometrically. Note that in after-inflation ‘real’ terms, the first few years of a mortgage look pleasanter. www.utstat.utoronto.ca/sharp Level repayments K of a loan of L Recall the usual formula for level repayments K of a loan of L is: L=K a n Recall the big deal formula for principal repaid as part of the t+1 th level payment: PRt+1 = PRt (1+i) In the first payment K at time 1, the amount of interest must be: I1 = i * L www.utstat.utoronto.ca/sharp Last payment K, at time t=n In the last payment K, at time t=n, we must pay off the last bit of principal, OBn-1 = PRn , plus interest on it In = i* OBn-1 = i* PRn. So the remainder of the last payment is principal: OBn-1 = PRn = K – In = K - i* PRn. Hence PRn = K/(1+i) www.utstat.utoronto.ca/sharp PRn = K/(1+i) PRt+1 = PRt (1+i) or PRt = PRt+1 /(1+i) Combine the above two formulas and we have ourselves the formulas to put together an amortization schedule for a loan: PRt = K /(1+i) n-t+1 =K v n-t+1 It = K - PRt = K(1- v n-t+1) www.utstat.utoronto.ca/sharp Amortization Schedule: Zero Interest Let’s amortize a $20,000 loan to buy a car, 4 years at zero interest, K=5000=20,000/a4 Time Time t Principal t payment outstanding at t+ 0 -20,000 20,000 1 5,000 15,000 2 5,000 10,000 3 5,000 5,000 4 5,000 0 www.utstat.utoronto.ca/sharp Interest Principal portion portion of K of K 0 0 0 0 5,000 5,000 5,000 5,000 Amortization Schedule: Non-Zero Interest Let’s amortize a $20,000 loan to buy a car, 4 years at 10% interest, K=20,000/a 0.10 4 =6,309.42 Ti me t 0 1 Time t payment 2 6,309.42 3 6,309.42 4 6,309.42 -20,000 6,309.42 www.utstat.utoronto.ca/sharp Principal outstanding at t+ 20,000 =20,0004309.42 =15690.58 (Ka3 =6309.42 *2.4869 =15690.58) =15690.584740.36 =10950.22 10950.225214.40 =5735.82 5735.825735.82 =0 Interest portion Principal of K portion of K 0 0 =0.10*20,000 6309.42=2,000 2000 =4309.42 =0.10*15690.58 =6309.42=1,569.06 1569.06 =4740.36 0.10*10950.22 =6309.42+1,095.02 1095.02 =5214.40 0.10*5735.82 6309.42=573.58 573.58 =5735.82 Time t 0 1 2 3 4 Payment Prin outstanding -20000 20,000 6309.416 15,691 6309.416 10,950 6309.416 5,736 6309.416 0.00000000 Interest rate I= Annuity 4: www.utstat.utoronto.ca/sharp 0.1 3.169865446 Interest portion 0 2000 1569.058 1095.023 573.5833 Princ Portion 0 4309.416 4740.358 5214.393 5735.833 Q of Class Above loan just after 1st payment is renegotiated to be extended to 1+6 years. The interest rate used is the new market rate of 8% but the balance of the old loan uses the initial 10%. Calculate the new annual payment OB1 =15,691 (at 10%) Knew= 15,691 / a6 (at 8%) = 15,691/4.62287 = 3,394.20 www.utstat.utoronto.ca/sharp