To view this press release as a file

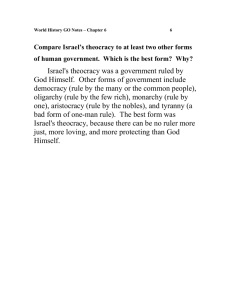

advertisement

BANK OF ISRAEL Office of the Spokesperson and Economic Information October 28, 2015 Press Release The Bank of Israel updates the calculation of weights in the nominal effective exchange rate The Bank of Israel calculates and publishes the nominal effective exchange rate index on a daily basis, similar to other central banks. This index is comprised of a weighted average of a number of exchange rates, reflecting the relative importance of each currency in Israel’s foreign trade. The weights in the existing index were last updated in 2009. Since then, there have been changes in the composition of Israel’s foreign trade. Therefore, the Bank of Israel has examined revising the weights in the index in order for it most precisely represent the nominal effective exchange rate. In addition to the changes in the breakdown of trade in goods, the revised index is also based on data on the geographic breakdown of trade in business services, which were not available at the time the weights in the existing index were calculated. The weight of these services have grown constantly, reaching about one-quarter of Israel’s foreign trade. The weights in the new index are calculated on the basis of the bilateral flow of trade of goods and services, while adjusting for third party competition—which is expressed in Israeli exports competing with manufacturers from a large number of countries in each market to which they are exported, and not just with domestic manufacturers in that country. The new index includes 33 countries and 26 currencies (the difference being the result of the fact that 8 European countries included in the index use the same currency—the euro), compared to the existing index that included 38 countries and 28 currencies. The update of the weights led to an increase in the weight of the US dollar as a result of the inclusion of trade in services, about half of which takes place with the US, and an increase in the weight of the Chinese yuan as a result of increased trade with China. In parallel, there was a decline in the weight of the eurozone countries. In total, the effect of the changes on the index itself is not large, and the new index indicates a similar picture to that described by the development of the old index. As a result of the strengthening of the dollar worldwide in the past year, the revised index indicates an exchange rate that is slightly depreciated compared to the old index. However, even according to the new index, the level of the exchange rate is the most appreciated in a long time. Bank of Israel - update of exchange rate components Oct. 28th, 2015 Page1 Of2 Table: Revision of the weights of the major currencies in the effective exchange rate (percent) Old weight New weight Euro 32.6 26.4 US dollar 24.8 26.4 Yuan 5.7 10.2 Pound sterling 5.2 6.0 Turkish lira 3.9 4.6 Other currencies1 27.8 26.4 Figure: The Nominal Effective Exchange Rate - Levels* (Index, January 1, 2010 = 100) * Daily data, January 1, 2010 – October 26, 2015. 1 The complete weight chart appears here. Click here for the full document. Bank of Israel - update of exchange rate components Oct. 28th, 2015 Page2 Of2