STATE UNIVERSITY OF APPLIED SCIENCES IN KONIN Course

advertisement

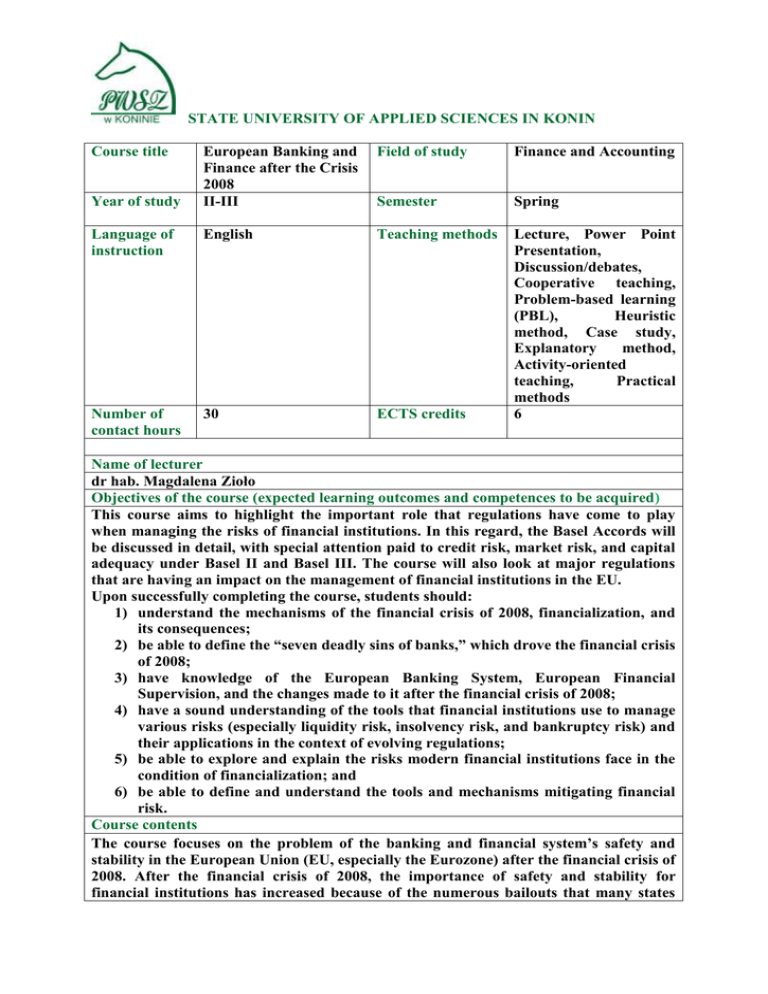

STATE UNIVERSITY OF APPLIED SCIENCES IN KONIN Course title European Banking and Finance after the Crisis 2008 II-III Field of study Finance and Accounting Semester Spring Language of instruction English Teaching methods Number of contact hours 30 ECTS credits Lecture, Power Point Presentation, Discussion/debates, Cooperative teaching, Problem-based learning (PBL), Heuristic method, Case study, Explanatory method, Activity-oriented teaching, Practical methods 6 Year of study Name of lecturer dr hab. Magdalena Zioło Objectives of the course (expected learning outcomes and competences to be acquired) This course aims to highlight the important role that regulations have come to play when managing the risks of financial institutions. In this regard, the Basel Accords will be discussed in detail, with special attention paid to credit risk, market risk, and capital adequacy under Basel II and Basel III. The course will also look at major regulations that are having an impact on the management of financial institutions in the EU. Upon successfully completing the course, students should: 1) understand the mechanisms of the financial crisis of 2008, financialization, and its consequences; 2) be able to define the “seven deadly sins of banks,” which drove the financial crisis of 2008; 3) have knowledge of the European Banking System, European Financial Supervision, and the changes made to it after the financial crisis of 2008; 4) have a sound understanding of the tools that financial institutions use to manage various risks (especially liquidity risk, insolvency risk, and bankruptcy risk) and their applications in the context of evolving regulations; 5) be able to explore and explain the risks modern financial institutions face in the condition of financialization; and 6) be able to define and understand the tools and mechanisms mitigating financial risk. Course contents The course focuses on the problem of the banking and financial system’s safety and stability in the European Union (EU, especially the Eurozone) after the financial crisis of 2008. After the financial crisis of 2008, the importance of safety and stability for financial institutions has increased because of the numerous bailouts that many states STATE UNIVERSITY OF APPLIED SCIENCES IN KONIN across the globe have encountered. Since 2008 banks have been at the heart of discussions about efficient regulations and ways of mitigating insolvency and bankruptcy risk. The European Union is still suffering from the consequences of insufficient supervision under the old financial system and its institutions. In response to the financial crisis, many new institutional measures, mechanisms, and instruments have been adopted. After the financial crisis of 2008, the main questions have been: what is the role of banks in the economy today and has the banking profession become distorted? Many banks preferred to speculate rather than finance households and companies in the past, which is obvious after analyzing the pre-crisis main indicators, such as loans and financial assets as a proportion of total assets. Taking into consideration the bailouts and the way banks have been managed so far, the vital part of the discussion is concentrated on: the problem of state aid (subsidies and financial aid for banks and other institutions from the state budget), wage divergence in the banking and financial sector (greed), and the activity of banks in so-called tax havens. All of these factors are crucial facets of the old banking and financial system and were responsible for its malfunction. Taking new steps toward making reforms will improve the system and enhance the efficiency of risk management, supervision, and control of financial institutions across Europe. Many improvements and regulations have already been implemented while some are still in progress (e.g., the European Banking Union). Regulatory responses to the financial crisis after 2011 have focused on the new concept of the European System of Financial Supervision (ESFS), which has operated for three years so far. There are also other mechanisms and solutions such as Basel III (CRD/CRR package), the European Banking Union, and the European Stability Mechanism (ESM) and safety net. There are also concepts worth mentioning that are not strictly connected to banking and financial sector regulations but are important for the stability of the public finance system of a European Union member state (especially those belonging to the Eurozone). Some examples are the Stability and Growth Pact, the Six Pack, the Two Pack, and the European Semester. The general goal of the course is to discuss the key factors responsible for the financial crisis of 2008, to point out the main changes and challenges in banking and financial sector regulations before and after the crisis, and finally, to present and consider the new regulations and solutions proposed in response to the financial crisis of 2008. Assessment methods Power point presentation, Test Recommended readings Bini Smaghi, Lorenzo (2013). Money and Banking in Times of Crisis. In: Balling, Morten, Ernest Gnan and Patricia Jackson (eds.). States, Banks and the Financing of the Economy: Monetary Policy and Regulatory Perspectives. SUERF studies 2013/3, pp. 31-42. Calomiris, Charles W. und Robert E. Litan (2000). Financial Regulation in a Global Marketplace. In: Litan, Robert E. and Anthony M. Santomero (eds.). BrookingsWharton Papers on Financial Services 2000. Washington, D.C., pp. 283-323. Coeuré, Benoît (2013). The Single Resolution Mechanism: Why it is needed. Speech at the ICMA Annual General Meeting and Conference 2013, Copenhagen, 23 May 2013. Council of the European Union (2013). Council agrees position on bank resolution. Council Press Release 11228/13 of 27 June 2013. STATE UNIVERSITY OF APPLIED SCIENCES IN KONIN Speyer, Bernhard (2011). Financial supervision in the EU – incremental progress, success not ensured. Deutsche Bank Research. EU Monitor 84. Frankfurt/Main. Beck, Thorsten (editor), Banking Union for Europe: Risks and Challenges, VoxEU Ebook, Center for European Policy Research, October 15, 2012 Others regarding to lecturers recommendation