AL-MADINAH INTERNATIONAL UNIVERSITY FRAMEWORK OF

advertisement

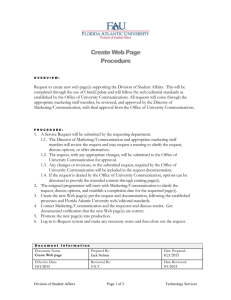

AL-MADINAH INTERNATIONAL UNIVERSITY FRAMEWORK OF ACCOUNTING, FINANCIAL POLICY AND GOVERNANCE OF THE UNIVERSITY The Directors of the Company Al-Madinah International (Malaysia) Sdn Bhd which own Al-Madinah International University are responsible for the preparation and fair presentation of the financial statements in accordance with the Companies Act 1965. Within the framework of this requirement, the University adopts specific financial policies and control procedures which are consistent with the established financial and control principles as contained in this manual. The principles and objectives are aligned towards these policies not only in relation to the requirements under the Companies Act but also to protect the best interest of the Company, the University and its stakeholders. Financial controls and procedures herein stipulated will assist to ensure all financial statements and reports are made under adequate control environment and represent financial operations that are based on established financial control principles. In the absence of these policies and procedures, or failures to implement such policies and procedures, or failures by responsible persons to comply with their provisions may result in financial losses and liabilities to be incurred and suffered by the University. Financial Affairs Division has been delegated with roles and responsibilities to enforce these policies and procedures and to update such policies and procedures as necessary and applicable within the framework of the above principles and objectives. The Board of Directors of the Al-Madinah International Sdn Bhd which is the holding company for the University shall adopt, uphold and undertake to comply with the principles of best practices of good governance. The policy implies responsibility upon the University to achieve best practice of business, operations and financial integrity in all its activities. This should include a commitment to follow the highest standards of corporate governance and the implementation of proper and appropriate systems of management control throughout the University. The objectives of the guideline and its supplementary procedure relating to internal control systems and standards is to encompass all procedures and guidelines in term of principles and concepts which are to be applied and implemented in those procedures. System of Management Control is an overall system 1|Page of control concepts and principles for the purpose of providing in general term the environments under which the University shall operate. The detailed requirements are found in individual policies and procedures relating to specific environment. Apart from individual procedures, the primary objective of System of Management Control in the context of Financial Affairs Division is to complement the critical Delegation of Authority Guidelines and Authority Limits together with other financial, accounting and control procedures. Other divisions need to review their requirements and to incorporate control principles and concepts specific to their needs as appropriate. CONTROL PRINCIPLES ON WHICH POLICIES ARE BASED The following principles are applied in the Guideline and shall be observed in the implementation and exercising of individual authority: Principles of Control 1. Review 2. Approval 3. Timely 4. Faithful representation 5. Consistency 6. Documentation Applications of the Principles of Control 1. Segregation of Duties 2. Supervision 3. Check and Balance 4. Detective measure 5. Corrective measure 6. Risk assessment 7. Delegation 2|Page FOUNDATIONAL FRAMEWORK OF UNIVERSITY AS AN ORGANIZATION Corporate Governance: Development and Application of the principles and benched-marked best practices of corporate governance. The policy of the Al-Madinah International (M) Sdn Bhd and AlMadinah International University to achieve best practice in its standards of business integrity in all its business. This includes the commitment to follow the highest standards of corporate governance throughout the University’s organizational structure. All areas of activities of the University that involve major decisions are as follows where each type of transaction, the final approval requirements are to be specified in delegation of authority or equivalent guides usually with monetary , volume , or other authority limits which must be consistent with University corporate Guidelines: 1. Establishment of policy and organization 2. Appointment and Administration of officers and personnel 3. Adoption of capital and related budget items 4. Purchase, sales, exchange and pricing of products and services 5. Contracting, leasing and purchasing of materials and services 6. Disbursements 7. Sale, assignments, pledging and dispositions of assets 8. Transaction of banking, credit, loans, guarantees, indemnities and financing arrangements 9. Initiation and resolution of claims 10. Commencement and settling of litigation In the above context, those organizations or specific officials whose evaluation is required, consultation is advises or endorsement required are to be specified for each type of action or transaction. Positions that can further delegate authority are to be limited and such re-delegation of authority are to be limited to appropriate management personnel with the endorsement of designated personnel or committee. The Financial Affairs Division or Controller has the responsibility of interpreting the delegation of authority. 3|Page No employee can be granted authority to approve his own expenditure, his own travel or business related expense or reimbursement. The authority is limited to expenditures and other transactions made within one’s areas of responsibilities for which stewardship exists. Where committees are formed and are tasked to achieve certain objectives, decisions reached must be documented via minutes of the meeting together with or without the rationale for such decisions. All correspondence with outside third-parties, including government agencies or external auditors, which contain financial and or operational information or statistics require endorsement or approval from senior management of the University. Professionalism and Competence and rational decision-making is maintained. Risk Policies and Management: Assessing, identifying, evaluating and reviewing the internal control and risk management activities in accordance with the Board of Directors and the University’s Risk Management Policy. Risk Management Policy need to be developed that seeks to ensure that adequate financial resources are available for the operation and development of University’s activities and plan. The University receives and reviews regular reports from the management of its faculties, key operating statistics, legal and regulatory matters. Each Division and faculty submits annual plan and budget. The results of the business and implementation of the plan are reported monthly and variances are analyzed against budget and deliberated on in a timely basis. Forecasts are revised on a need basis taking into account changes in internal and or external factors. The University manages funds, operating cash flows and availability of funding as to ensure that all refinancing, repayments are met. The University raises committed funding from financial institutions and prudently balances its portfolio with some short term funding so as to achieve overall cost effective. Role of Malaysian Accounting Standard Board (MASB) in the implementation of accounting and financial policy Companies Act 1965: The Directors of the company which owns the University are responsible for the maintenance of accounting records of the Company/ University and the preparation of annual financial 4|Page statements in accordance with applicable MASB approved accounting standards in Malaysia which gives a true and fair view. In preparing the financial statements, the directors are required to : Select suitable accounting policies and apply them consistently based on recommendations from Financial Affairs Division. Make judgements and estimates that are reasonable and prudent Prepare the financial statements on an –going concern basis unless it is inappropriate to presume that the Company will continue in business Management Control Policy It is the policy of the University to require that all its operations have in-built internal control mechanism for check and balance and standards of operations and benched marked against best practices . The Board of Directors has overall responsibility for the University’s systems of internal control and for reviewing its effectiveness whilst the role of management is to implement the Board policies on risks and the control of risks. All dealings and businesses conducted by the University must be apolitical. Therefore any arrangements or relationships with any political parties are not allowed. To protect the best interest of The University, it must continue to be an educational institution of higher learning and independent and has no political opinion or affiliation and to remain neutral throughout its dealing with external third parties, groups or authorities. The overall objectives are also to ensure all policies and procedures are in compliance with local legal requirements. All procedures require TMC endorsement before implementation with the exception of financial policies and procedures which may be implemented concurrently while being communicated or reviewed with TMC. Financial procedures as issued and updated by Financial Affairs Division are critical to protect the financial assets and conserve controls and to minimize financial liabilities of the University. Therefore such procedures whether they are in formalized or interim form shall be implemented immediately without delay. 5|Page The Rector in his capacity as the chief officer of the University is empowered by the University’s constitution to execute and administer all aspects of the University operations. The Internal Control Systems and Standards under the Financial Affairs Division in accordance with the authorized University’s organization chart, functional role and responsibility is delegated the task of ensuring critical and significant areas of internal control are in place. In view of the importance of this department and the policies, guidelines or procedures that the department issues to TMC for review and endorsement, it is also critical that fundamental control procedures be implemented concurrently while such procedures are being reviewed or deliberated by TMC. Such procedures so implemented prior to formal endorsement by TMC shall be effective subject always to the fact that certain parts or all parts of the provisions of the procedures can be amended or withdrawn at any time as TMC deems fit and appropriate. Any exceptions to procedures must be properly documented. For record purposes the statement should provide a brief note on the background, the unique situation and the reason/s or the rationale for exception decision. Internal Control Department shall compile all exception statistics and issue Financial Exceptions Report to University’s Management twice a year in July and January. All exceptions are subject to audit review. The system of internal control is designed to manage rather than eliminate the risks of failure to achieve business objectives. In pursuing these objectives, internal controls can only provide reasonable and not absolute assurance against material misstatement or loss The Board of Directors of the Al-Madinah International Sdn Bhd which is the holding company for the University shall adopt, uphold and undertake to comply with the principles of best practices of good governance. The policy implies responsibility upon the University to achieve best practice of business, operations and financial integrity in all its activities. This should include a commitment to follow the highest standards of corporate governance and the implementation of proper and appropriate systems of management control throughout the University. System of Management Control is an overall system of control concepts and principles for the purpose of providing in general term the environments under which the University shall operate. The detailed requirements are found in individual policies and procedures relating to specific environment. System of Management Control complements the critical Delegation of Authority Guidelines and Authority Limits 6|Page and other financial, accounting and control procedures. Divisions need to review their requirements and to incorporate control principles and concepts specific to their needs as appropriate. All the elements of control concepts and principles must be present in all critical procedures which impact on the implementation of critical financial and operational procedures. Control concepts and control principles are defined in terms of accountability of all actions, review, authorization and approval of transactions, supervision, segregation of duties, delegation duties, preventive and detective control, check and balance, reporting, timeliness, accuracy, adequate supporting details for transactions, compliance with legal requirements, planning and budgeting, stewardship, conflict of interest etc. Delegation of Authority Policy Unless otherwise provided by applicable legislation, the election of the Board of Directors of the holding company of the University, Al-Madinah International (Malaysia) Sdn Bhd initiates the delegation of the authority process. It is the policy of the University to establish a clear hierarchical level of authority as frame of reference for individuals with duties and responsibilities. The Board of Directors delegates authority to officers and employees who are responsible for taking actions, signing documents and approving transactions affecting the operations and affairs of the University. The objective of the Delegation of Authority Guideline and Authority Limit is to provide a formal framework and a hierarchy of authority delegation assigned to the incumbent of a position stipulated in the approved official organization charts. It provides a guideline and a reference on the structure and levels of delegated authority and the limit of this authority for specific operational transactions in the running of the University by the specified incumbents. The structure of these authorities is defined in this guideline. Each authority shall be in accordance with the Scope of Authority and Responsibility. As provided for by the University’s Constitution, the Rector is the Chief Executive of the University. He shall exercise the power in the administration of the University. This power shall include the power to delegate tasks, responsibilities and prescribed authorities to the persons he appointed or assigned. In 7|Page exercising this power the Rector may use his discretion whether to exercise the authority directly or through his delegated assignees of his management team or committee such as TMC. The incumbent defined in the authority delegation shall only exercise the authority delegated within his or her primary domain of responsibility i.e. Division, Department, Unit or Center. The incumbent is not authorized to exercise this authority outside his or her domain unless explicitly provided for in the ADF. There shall not be crossed divisional authority unless approved by original initiating division. The authority delegated to an incumbent cannot be re-delegated or further assigned to another person without approval from the original approver. Once the primary delegation of an incumbent is cancelled all secondary delegations are automatically cancelled by virtue of the fact that all secondary delegations were approved by the incumbent unless provided otherwise by the appropriate conditions of cancellation. Monetary limits and the associated approval delegation limits are classified according to risk categories. Generally the monetary limits, or equivalent amount thereof in other than Malaysian currency, are similarly defined according to the Contract and Procurement Procedure. By default the decision under intermediate and high risks classifications require the authority of Rector and or TMC. There are exceptions to this general classification depending on situations being considered. In such cases upper limits are appropriately specified. In exercising the authority assigned, the incumbent shall discharge the authority in full professional conduct with clear conscience of responsibility, accountability and transparency of his or her action in the best interest of the University. Third-party Contract and Procurement Policy Generally services or purchases done through any third parties for the account of the University must be executed in writing. This is to protect the best interest of the University and its stakeholders. All purchases or expenditure require justifications. The higher the value of expenditure and or for longer duration the more detailed requirements of the rationale and justifications to support and justify the expenditure. Policy is implemented through competitive bidding, bid evaluation, award recommendation and the issue of contractual document such as purchase order, service order or contract that incorporate standard protection clauses. Customized contract documents may be developed to cater for certain situations. All non-standard contracts and service orders should be sent to Financial Affairs Division for 8|Page review prior to signing and execution. Issue of all purchase order / service Order and contractual agreements shall be in accordance with contract document serial control number. Contractual agreements shall comply with local laws and regulations. Due to legal requirement contract documents are to be stamped where appropriate especially if operating Divisions determine that there are potential risk and liability exposure arising from such contract performance by third-party vendors or other contract parties. Exceptions to the above principles are normally allowed for (i) very low risk and low value items or services, or (ii) where it can be established the existence of sole source provider, or where goods or services are proprietary in nature such as they are held under patent, trademark or copyright, or (iii) in situation where it can be established that there is an exceptional urgency or emergency with regard to procurement of such purchases or services, or (iv) in situation where it can be established in the best interest of the University for a certain procurement or contract be directly negotiated. All exception cases above require either Financial Affairs Division approval or Top Management Committee’s approval depending on the nature of the procurement or contracting, the associated risk and the amount to be committed. Exceptions are also provided for certain centres to allow for special circumstances and situations where strict application of this procedure may not be possible. Under such circumstances a case by case review is to be considered and notes or remarks recorded as appropriate on the relevant documents. All planned procurements and contracting activities by Divisions shall be governed by the existing approved budget and the availability of funds as determined by Financial Affairs Division, and relevant provisions of Delegation of Authority Guideline and Authority Limit. The objective prescribes a range of appropriate methods and purpose under various situations of risk category and the value involved for purchasing and procurement, including where appropriate, a competitive bidding and contracting procedure. The best interest of the University is served by observing the following principles: The requirement for competitive bidding process that ensures transparency, impartiality, fairness and minimizing conflict of interest in the procurement and contracting process. The requirement and necessity for obtaining the best possible value in term of cost and quality of purchases and or services. The requirement for ensuring minimum exposures by the University to all forms of liabilities and litigations. 9|Page Purchasing, tendering and contracting are activities that can potentially be implemented in various uncontrolled ways and means and using different practices and standards creating unnecessary exposures to complaints, liabilities including litigations. This policy and procedure provides a streamlined framework that is consistent with the above principles. Policy regarding core responsibility and professional conduct Contract and Procurement processes entails responsible and professional conduct on the part of personnel assigned to transact business on behalf of the University and to protect the best interest of the University. This entails responsibility to ensure that the University obtains the best value and most favorable terms in the procurements and purchases of goods and services. The processes must ensure they minimize potential exposures and liabilities that may arise in the course of performance by vendors or contractors to deliver materials or services ordered by the University. Transparency All processes are to be documented. This is to ensure transparency of review and decision processes involved in all purchasing activities. All documents must be properly maintained to allow and facilitate internal assessment by Financial Affairs Division, who is the custodian of these documents, as well as to permit independent third-party audit by external auditors. Conflict of Interest and Ethics At all time, personnel assigned to conduct business on behalf of the University must exercise highest ethical standard and take care to ensure that there is no conflict of interest between the personnel and the potential suppliers or contractors. They must not be perceived to have any vested interest in the dealings or the outcome of the negotiating process. In the situation where possible conflict of interest may arise, the personnel must disclose the fact to Financial Affairs Division for review and decision with the University’s Top Management Committee. Non-disclosure is a serious breach of this policy and procedure. Staff who are directly or indirectly involved in procurement will have to ensure that they are not, or are not perceived to be in a conflict of interest with any supplier or contractor. Those staff who have, or may be perceived to have, a vested interest in the outcome of a purchase should disclose any conflict to their supervisor or will consult Financial Affairs Division and or TMC for decision whether they should exclude themselves from any role in the purchase. 10 | P a g e The best value for University goods and services must be sought. There will be a documented process for all purchases which allows for transparency of decisions and review of purchases. The conduct of procurement is subject to periodical audit by the University and by external bodies. Prohibited Practices Multiple or split orders or split billing which collectively amount to a substantial amount that can supersede or circumvent existing procedure is strictly prohibited Operating Divisions are expected to forecast their estimated needs for given services and goods and to plan accordingly to avoid the above. Should repeat orders be required this fact should be reviewed with Financial Affairs Division for review on case by case basis. Purchase of goods and services from relatives or friends must be disclosed in writing to Financial Affairs Division and or TMC for determination whether such purchases can proceed. FINANCIAL AND ACCOUNTING CONTROL IN GENERAL The University has a responsibility to account for and report the financial results to its Council and for various government agencies. To meet these responsibilities, the University is to establish policy and procedures regarding: Record and properly describe all financial transactions Report data in a uniform manner following the general accepted accounting principles (MASB). Chart of accounts. This includes a list of controlling accounts with account codes which are to be maintained in the official books of accounts. As required to meet the needs of the University, the Chart of accounts is to be amplified by the use of sub-accounts underlying the controlling accounts. If it is necessary to reflect transaction accounts not covered in the chart of accounts, Financial Affairs Division of the University is to develop and include the new accounts as part of Chart of accounts. Many transactions are recorded in sub-ledgers and sub-systems with some detail or summary information recorded in the general ledger. Sub-systems are often used for recording entries relating to students receipts, cash receipts, payroll, disbursements, assets and employee receivables. When operating in an environment with sub-systems: input, processing and output controls are to conform to certain format. 11 | P a g e Sub-systems balances are to be reconciled to general ledger balances on a timely basis in order to recognize and correct discrepancies that may occur between the two systems. Reconciliations are to be reviewed and approved by Head of Financial Affairs Division. Journal Vouchers are a medium for recording accounting entries: Financial Affairs Division is to establish review and approval requirements for each type of entry. Higher of review and approval are required for unusual transactions, write-offs, write-down and other adjustments and accruals. Supporting documents properly approved are to be attached to the journal vouchers or reference made to where they are filed. Correcting entries are to include a cross reference to the entry being corrected. Procedures are to be established to ensure that all packs related to a months business are adequately processed and included in the financial records related to the month. Independent verification procedures are to be established to ensure integrity of journal entries. The purpose of each transaction is to be clearly stated. Where computer programs are used to automatically transfer entries between accounts, controls are to be in place to ensure that only properly authorized transfers are made Adjustments, whether computer generated or manually recorded by journal entries are to be: Sufficiently documented to include source, purpose and accountability and reviewed and approved by a supervisory level in accounting. Procedures are to be established in accounting review, approval and control of accruals and related related reversing entries. Month-end accounting cut-off procedures are to be established to ensure accurate and uniform monthly recording and reporting of purchases, sales, deliveries, inventories, cash and other items. Such procedures affect both sub-systems and journal vouchers. Accounting source documents are to be cancelled after processing to preclude their possible re-use Banking transactions arise from activities and relations established with third-party financial institutions, normally commercial banks, trust companies etc. In addition to providing depository for cash and other negotiable instruments, these institutions normally provided wide-range of financial and security services which aid in optimizing cash positions in receiving, disbursing, transferring and borrowing of funds. 12 | P a g e The opening and closing of accounts with banks or other depositories is to be supported by individual board resolutions. An acceptable alternative would be a general banking resolution delegating this authority to certain authorized offices of the University. The authorized officers are normally, Financial controller, Director of Financial Affairs Division or alternatively other high level and senior offices of the University as appropriate. When using this alternative, the control objective is to be achieved by use of a general board resolution requiring the signatures of two officers on the bank notification letter when opening or closing a bank account or changing authorized signatures. A record of the opening of bank accounts and subsequent changes in the instructions or status is to be maintained. The opening and closing of bank accounts by authorized officers is to be ratified by the University’s Board or To Management Committee at least annually. At the time an account is opened copy of the Board resolution is to be provided to the financial institution. Banks are to be notified promptly of decisions to close accounts. All banks accounts are to be approved and recorded in the University books of accounts. Access to cash funds on deposits is controlled by specifying in the board resolution or in the instruction to the banks, the following appropriate signatories authorized to draw on the account, any other limitations deemed necessary, such as restricted endorsement or maximum check limits. Dual signatories requirements on checks and other disbursement instruments above a specified limit are to be established to allow for additional review and approval of large disbursement. Cash Control It is the policy of the University to maintain a constant and healthy financial strength and its sustainability over both short-term and long-term period. It is the foundation on which the University can continue to operate and develop its resources to attain its objectives and aspirations. Monitoring expenditure and funding level to meet the University’s financial commitment and responsibility to ensure reconciliation between bank accounts and financial account in accordance to Cash and Banking Operations Procedure and Delegation of Authority Guideline. The role is to ensure there are sufficient funds at any time especially in the savings or current accounts. Assets Control This is relating to policy governing the protection and proper accounting for the University’s assets from the beginning when these assets are first acquired. This is vital as all materials, equipment acquired are critical and valuable tools and assets to the University. 13 | P a g e This establishes policy and responsibility for characterization of expenditure into capitalized development project and expensed project, monitoring the expenditure related to work-in-progress, and its conversion to asset accounts upon completion for each project as applicable. Policy regarding periodical physical verification of development project and asset accounts of the balance sheet in accordance with existing procedure.The objective of this policy is to ensure that all transaction activities relating to the acquisition of assets are handled in according to the guidelines and responsibilities. The objective also covers whole range of project management activities which have financial implication. This is to ensure clear assignment of responsibility of relevant Departments and Units to ensure that their development, access and usage are adequately controlled. Receivables Control The policy regarding account receivable in conjunction and in support of cash and banking in facilitating and maximizing the revenue inflow from paying students who will ultimately form a major fund contributor towards revenue generation by the University. In order to implement the above policy, it is the objective is to be primarily responsible for all income receivable from payments by students, payment of staff loan and other debtors of the University. It implements credit control and status analysis to ensure payments due to the University are made timely and credit terms or discounts are applied correctly in accordance with existing procedure. To ensure correct student billings there based on the accurate and complete student registration data and record on the amount to be billed. With the setting up of the Foundation, it is the policy of the University regarding the requirements and the provision of students’ scholarship and or financial assistance are handled by the Foundation. Since the Foundation is registered as separate body and its operations are independent from the University, students may also apply scholarship or sponsorship from other sponsors such as PTPTN, Mara etc if they meet the minimum qualifications of these bodies. The policy establish a formal mechanism to streamline the processing of approved student scholarship and/or other financial assistance to the students of the University. Deserving students who are studying or who are accepted for enrollment into the University can apply with, or be given either a scholarship, or a form of financial assistance or both through the Foundation or other sponsorship institutions. General Accounting Control 14 | P a g e The policy requires that all financial statements of the University must be prepared according to accepted accounting standards of Malaysia. This entails responsibility for the full set of chart of accounts of the main financial system and subsystems in compliance with the accounting standards. It periodically assesses to ensure all accounts are aligned to all operations of the University as it evolves.The objective is to ensure that the related responsibilities and functions is consistent with the requirements of the above policy. It periodically assesses to ensure all accounts are aligned to all operations of the University as it evolves. Payment Control It is the policy of the University to provide for a systematic process with adequate system of control, proper check and balance and consistent policy in executing payment activities on behalf of the University and to protect its financial interest. All payments for the account of the University are to be processed within stipulated time if they can be readily checked, compared and verified to supporting documents. In order to facilitate these activities, it is the responsibility of submitters of invoices, bills, claims and various request for payments to ensure that all documentation supporting their invoices, bills and claim forms are original, complete, correct, accurate and timely. In addition all payments are shall be in accordance with all regulatory requirements. Financial Affairs Division’s primary accountability is to protect financial policy and interest of the University and the Division is tasked to ensure these requirements are complied by all parties. Budgeting Control It is the policy of the University to inculcate planning activities as part of primary responsibilities of top management personnel. It is also the requirement of the University Constitution to ensure that the University plan and budget all its operations. For long-term development of the University it is vital that the University develops its strategic plan. The policy requires implementation of stewardship execution of the plan and budgets for reporting to the Management and works in tandem with system of Management by Objectives (MBO) such as KPI and Score Card related specifically to financial components. 15 | P a g e The policy regarding budgetary plan is to ensure that operations and development activities are conducted in orderly, proactive and controlled manner. Budgets will ensure that there is sufficient funding available for execution and implementation of approved plan and spending. It provides control mechanism for the accounting and stewardship of income and expenditure of the University. Reporting controls of books of accounts The policy is to ensure financial analysis and reporting is carried out professionally based on accurate and complete financial reports. It is important that this policy is implemented so that the University can utilize financial reports for important decision making. The Financial Analysis and Reporting is responsible for quantitative analysis of all financial accounts in term of factors that relate to the operations of all Divisions of the University in accordance with Financial Analysis and Reporting Procedure. The result of the analysis is translated to various report formats for periodical distribution and preparation for presentation to Management. The objective is to ensure all financial analysis and reporting activities play an important role to support the University Management especially to provide financial advice and to facilitate its decision making. This advice is based on the financial reports which track progress of budgets in relation to actual expenditure and to provide factors affecting the budget and actual spending. AUDIT To act as an independent body within the University to oversee all matters pertaining to both internal and external audit as well as ad hoc investigations of the affairs of the University. The primary responsibility of the Committee is to ensure all critical operations have adequate control features and mechanism to prevent and detect unauthorized actions which may have significant financial and/or legal implications and exposures. In addition to addressing issues regarding internal and external audits reports, the Committee shall also have powers to direct the formation of a separate investigating body when required or when circumstances arise. The audit Committee is supported by an independent internal audit function. The Committee must be aware of the fact that an independent internal audit function is essential to assist in the obtaining the assurance it requires regarding the effectiveness of the system of internal control. The main role of the internal audit function is to review the effectiveness of the system of the internal control and this is performed with impartiality, proficiency and due professional care. During the year, the internal audit 16 | P a g e function has carried out the more pertinent audit activities stated in the internal audit program which have been approved by the Audit Committee. 17 | P a g e