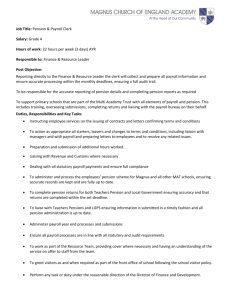

Payroll Service - Leicestershire & Rutland Association of Local

advertisement

Does calculating and processing your payroll tie up staff that could be spending their time more productively? Can you be sure that your payroll and pension returns are processed on time and that the online filing is submitted? Are you able to assess each employee, at each payroll runtime, as to whether they need to be 'auto enrolled' into your pension scheme and if so, enroll them, and calculate their contributions? Do you receive clear reports detailed by departments/services? Administering your payroll can be a time-consuming and complicated process. With HMRC real time information (RTI) and the introduction of Auto Enrolment, the penalties for non-compliance are now even higher. It has never been more important to get it right first time. By outsourcing your payroll, we remove the headache of worrying about covering sickness or holidays, and your Tax Year End Processing will be carried out for you. We will ensure relevant staff are auto enrolled; produce the necessary auto enrolment communications for employees, correct contributions reported directly to your chosen pension provider and provide audit trail facilities as required by The Pension Regulator for compliance evidence. Clear pay slips are provided for each employee together with monthly reports and the cost is probably less than you might expect. The monthly cost is just £25 for up to four employees or £6.50 per person for five or more employees*. * Initial implementation fees are applicable as per our price list Let Accounting Solutions be your Payroll Solution. Payroll Price List We offer a payroll processing service for monthly or quarterly payrolls for Councils. Payrolls with up to 50 employees as follows: Initial set up cost Once only implementation fee £30.00 1 - 50 Employees Once only implementation fee per employee £10.00 Monthly Payroll Provision Fee including calculating and deducting Pension and Union contributions 1-4 Employees in the Tax Year Monthly minimum charge per payroll £25.00 5 - 50 Employees in the Tax Year Price per person on payroll £6.50 Tax Year End Charged as one additional pay run ● Councils with over 50 employees are subject to separate negotiation. Additional Charges and Optional Services ● ● ● ● ● ● ● ● Masterfile Changes Payroll re-runs Dealing with HMRC on clients behalf Checking pay scales, calculating salaries Other unspecified work as requested Postage of letters if email address not supplied If required to create a bespoke report for the Pension Providers monthly return P9/P11D's if requested £5.00 Half payroll fee £25.00 per hour £25.00 per hour £25.00 per hour £0.60 per letter £99.00 Once only Subject to quote All fees correct up to the financial year ending April 5th 2017. Prices subject to VAT at Standard Rate Reports: Payslips; Salary analysis including net pay and amount to pay to HMRC; Payroll History and other reports available on request. To ensure you remain compliant with regards to Auto Enrolment, we will: ● ● ● ● ● ● ● Assess the employees at payroll run time to see if they need to be enrolled into a pension scheme Categorise the employees (Eligible Job holder, Non Eligible Job holder, Entitled worker) Enrol employees into your designated fund and setup contributions during the payroll run Defer employees based on the company setting Flag Qualifying Earnings and Pensionable Pay Keep employee records for 7 years Produce the required report that needs to be delivered to the designated pension provider ● ● ● Produce relevant automatic enrolment communications for employees Provide 24/7 access for employees to view/print/save their letter/payslips on a securely protected online portal Provide audit trail facilities required by the TPR for compliance evidence Unit 1, Uffcott Farm, Uffcott, Swindon, Wiltshire, SN4 9NB Tel: 01793 739110 Fax: 01793 731550 Web: www.dckbeavers.co.uk DCK Beavers Limited, Registered office as above. Registered in England No. 3832919